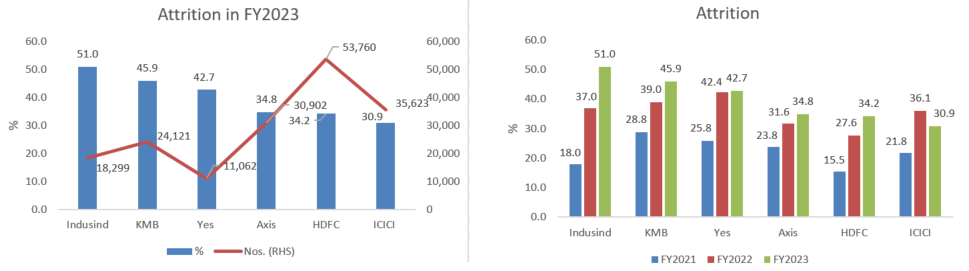

Private sector banks’ high and sharply rising attrition is in the spotlight, thanks to the mandatory disclosures in banks’ annual and business sustainability reports since FY2023. However, inter-bank comparison may not be an accurate indicator of the attrition in a particular bank, as some large banks use unlisted subsidiaries and associate companies to undertake back-office functions and sales for the bank; these banks do not disclose attrition data for subsidiaries. Hence it is problematic to compare the attrition data of such banks with the data of banks which directly employ all their staff engaged in banking activities.

Nevertheless, in the absence of public data on attrition in banks’ unlisted related companies, the attrition reported by a bank is the only indicator available to assess employee wellbeing, work culture, customer service and continuity in the bank.

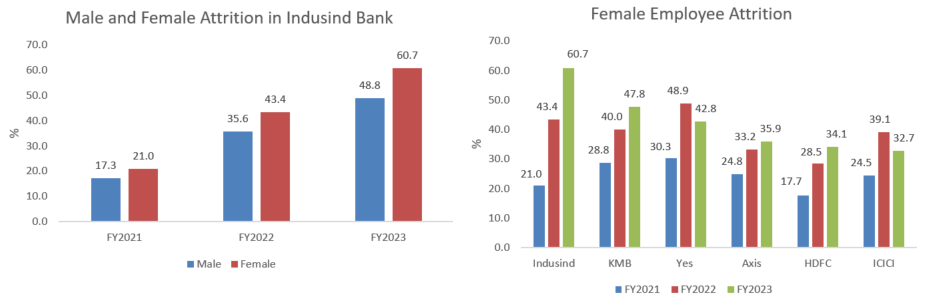

Source: Banks

Indusind Bank has a subsidiary, Bharat Financial Inclusion which is primarily engaged in microfinance and also offers other banking services such as merchant acquisition and remittances and employs over 36,000 staff. However, the attrition data pertains only to the standalone Indusind Bank. Following the precedents set by Axis Bank and Kotak Mahindra Bank, Indusind Bank’s FY2023 annual report conveniently omitted any discussion on the bank’s sharp rise in attrition, from 37% in FY2022 to an alarming 51% in FY2023. Indusind Bank’s reported attrition is the highest amongst the private sector banks, but the directors on the board evidently did not believe that the fact of more than half of the staff exiting to be relevant to discuss with shareholders in the annual report. Indeed, the word “attrition” is to be found only in 3 places in Indusind Bank’s annual report, and all those instances pertain to the mandatory actuarial calculation. There is no attempt by the board to educate shareholders on why attrition is rising, why it is the highest in the bank’s peer group and what remedial measures the management is taking to reduce attrition. As commercial banking in India is staff-intensive, and retail banking is even more staff-dependent, the silence of the board on such an important issue is worrying.

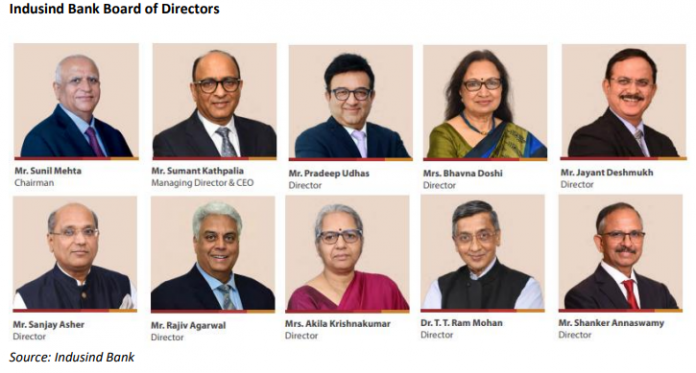

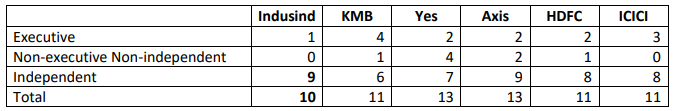

It is regrettable that the Indusind Bank board of directors chose to follow the examples of Axis Bank and Kotak Mahindra Bank, instead of the examples of HDFC Bank and Yes Bank, where the CEOs were willing to discuss the issue of attrition with shareholders in their annual report. What is most surprising in Indusind Bank is that this happened despite the fact that, in the 10-member board of directors, all directors apart from the CEO are independent directors. Independent directors on the board are there to defend the non-promoter interest, and not to merely rubber stamp decisions of the executive/promoter. In Indusind Bank, it appears that the independent directors are either completely ignorant of attrition, or went along with the bank management’s silence. This is puzzling, as independent directors completely dominate Indusind’s board, unlike the situation in peer bank boards. Despite this, they collectively chose to be silent on the important issue of attrition when even the then Reserve Bank of India (RBI) deputy governor had gone public in end May 2023.

Composition of Board of Directors in FY2023

Prior to FY2022, Indusind Bank use to voluntarily disclose granular data on attrition which included attrition in the various age buckets, in new hires and even voluntary attrition which ceased to be disclosed from FY2022 onwards when the overall bank attrition sharply deteriorated. The absence of the earlier voluntary disclosure does not bode well for transparency by the board of directors.

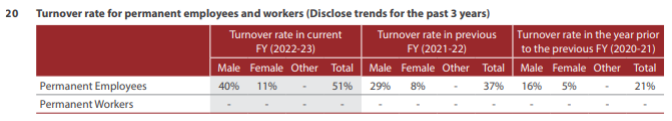

As per the Securities and Exchange Board of India’s (SEBI) mandatory disclosure, companies have to disclose male and female attrition separately. Strangely, the computation of male and female attrition rate by Indusind Bank does not conform with the capital market regulator’s prescribed formula.

Calculating the bank’s male and female attrition as per SEBI’s formula reveals that female attrition is extremely high, at 61%, in FY2023 in Indusind Bank. Female attrition is rising in most private sector banks, but there is no explanation in their annual reports to enlighten stakeholders.

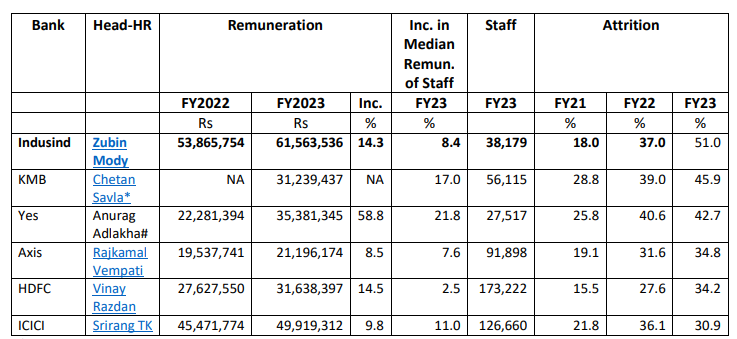

In analysing attrition, stakeholders need to hold the human resources department (HR) and the HR head accountable. The role of HR is crucial in organisations, and unfortunately, in some, HR is reduced to merely administration and pay roll management of the employees, and is not actively engaged in developing the business and work culture in the organisation. Comparing the HR-heads’ remuneration among prominent private sector banks, and the increase in remuneration in FY2023 based on performance for the period FY2022 as compared with FY2021, reveals some unusual aspects of Indusind Bank.

HR-Heads Remuneration in Prominent Private Sector Banks

NA Not Applicable

Source: Banks

Although Indusind Bank’s size of operations is significantly lower than HDFC Bank, ICICI Bank and Axis Bank, the bank’s HR head’s (who is also responsible for the over 36,000 employees in Bharat Financial Inclusion) remuneration is significantly higher. Not only is the relatively high remuneration to Indusind’s HR head a concern, but it increased by 14.3% in FY2023 to Rs 61.6 mn. The remuneration increase in FY2023 pertains to the performance in FY2022 as compared with FY2021.

All executives in performance-driven companies have Key Performance Indicators (KPI) which are given at the beginning of the year, and their performance is benchmarked vis-à-vis the KPIs. For HR and even for business leaders, one would imagine that lowering attrition would be a key KPI. While all the HR heads of prominent private sector banks got an increase in remuneration in FY2023, even as attrition increased from the Covid low in FY2021 to FY2022, the increase in attrition for Indusind Bank was huge. Interestingly, the Nomination and Remuneration Committee (NRC) in Indusind Bank rewarded the HR head with a 14.3% increase on a base which is much higher than industry levels. Meanwhile, the increase in the median of the bank’s total staff was only 8.4%.

In this particular case the role of the Indusind Bank’s NRC needs to be evaluated. Stakeholders need to know why the NRC has historically given the HR head a remuneration much higher than is given in much larger private sector banks. Is it that in general senior executives in Indusind Bank are given much higher remuneration (excluding ESOPs) than their larger peers, and if so, what is the rationale for the NRC to have done so? Is it that, as compared with their peers, the Indusind Bank HR head and/or the other senior executives are given much lower ESOPs, and therefore the higher remuneration is the justification? Moreover, what was the rationale for giving the HR head a higher percentage increase in remuneration than was given to the employees as a whole, when attrition jumped sharply between FY2021 and FY2022?

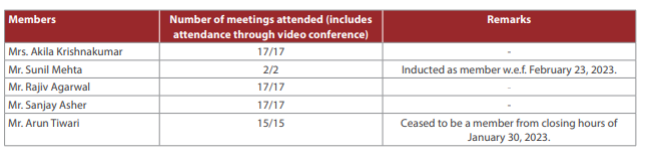

Nominations and Remuneration Committee of Indusind Bank in FY2023

Attrition should be the main responsibility of the HR department and its head, and a basis on which to evaluate their performance. A sharply rising attrition rate is an indicator of deficient HR policies in recruitment and training, and poor work culture. Attrition is harmful to the bank, as it leads to higher employee cost and poor customer service, and it poses a major operational risk. Ultimately, the CEO and the board are accountable for rising attrition.

It is possible that peer banks may turn out to have higher attrition rates, once we factor in the attrition in their subsidiaries/associates which engage in back-office/sales for them. But even if it were so, the sheer fact that, in Indusind Bank, the reported attrition is over 50% is a huge concern for stakeholders, which needs to be urgently addressed by the board of directors.

The complete neglect by the Indusind Bank board of directors to discuss attrition in the FY2023 annual report reflects poorly on its conduct. The bank’s NRC, an important sub-committee of the board, has historically approved remuneration to senior executives which appear excessive when compared with the salaries at much larger peers. Further, it generously approves increments, even as a critical KPI significantly deteriorates. This needs to be probed by the banking regulator.

Stakeholders, particularly in banks, need to demand high standards from independent directors, as they are responsible for monitoring the executive and managing the public’s unsecured deposits; and banks play a vital role in the economy. Independent directors need to be aware that their conduct too will be monitored, and any major shortfall will be publicly called out.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in all the banks mentioned in this report. HDFC Bank subscribes to this analyst’s research and a member of this analyst’s family is employed with HDFC Bank. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

www.hemindrahazari.com

All rights reserved. No portion of this article may be reproduced in any form without permission from the author. For permissions contact:

hkh@hemindrahazari.com