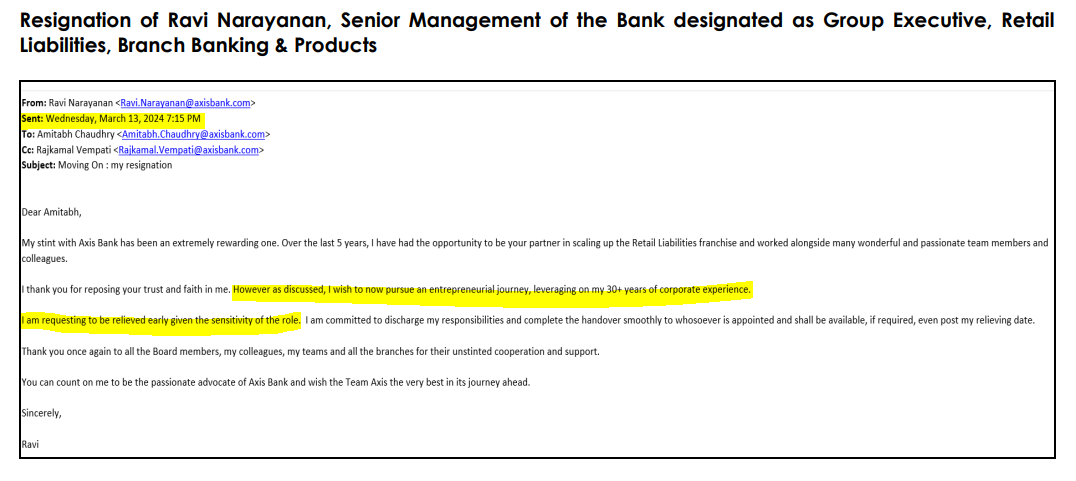

Ravi Narayanan, the 55-year old Group-Head in-charge of retail branches, retail liabilities and third party products abruptly resigned from Axis Bank on March 13, 2024 because he wished to pursue an “entrepreneurial journey”. He will be relieved on March 22, 2024, to conform to his wish for an early departure.

Source: Axis Bank

Narayanan’s sudden departure is unusual, as executives rarely leave high-paying corporate jobs to pursue entrepreneurship at the age of 55. In corporate India, it is also uncommon for executives to voluntarily depart in early March, as March 31 is the close of the financial year; anyone quitting before that date loses out on the annual bonus. Normally, when an executive resigns the individual loses out on the unvested stock options. Moreover, given Narayanan’s seniority (one level below a board position), it is remarkable that he is going to be relieved within 9 days of submitting his resignation. That means that the bank wanted him to exit at the earliest. Normally, to facilitate a smooth transition, senior executives serve a minimum of 1 month to hand over their responsibilities.

Ravi Narayanan’s Remuneration (excluding stock options) in Axis Bank

| Rs | Age | Date of Joining | FY2020 | FY2021 | FY2022 | FY2023 |

| Ravi Narayanan | 55 | 6 Feb. 2019 | 14,721,570 | 18,668,271 | 21,436,966 | 26,467,636 |

| Increase (%) | – | – | – | 26.8 | 14.8 | 23.5 |

| Av. Increase in Managerial Salary (%) | – | – | 9.8 | 0.7 | Nil | 8.9 |

| Median Increase for all Staff (%) | – | – | 8.9 | -3.3 | 6.2 | 7.6 |

| Designation | – | – | President | President | Group Executive | Group Executive |

Source: Axis Bank

Ravi Narayanan in FY2023 was the 8th highest paid executive in the bank. He joined Axis Bank from HDFC Bank on February 2019, soon after Amitabh Chaudhry took charge as the Chief Executive Officer (CEO) in January 2019. Narayanan is a controversial individual. On December 21, 2021 at a town hall meeting of staff at Axis Bank’s Ahmedabad branch, he reportedly said,

“Employees should fight, abuse and complain amongst them [sic] for business, this is the attitude what [sic] I like.”

Despite the negative publicity associated with Narayanan’s comment, and despite his crucial role in promoting a toxic work culture in the bank, the Axis Bank CEO and the board of directors not only retained his services, but promoted him in FY2022 from president to group executive. His salary increases during his tenure in the bank have been consistently higher than for the managers and the median for all staff in Axis Bank.

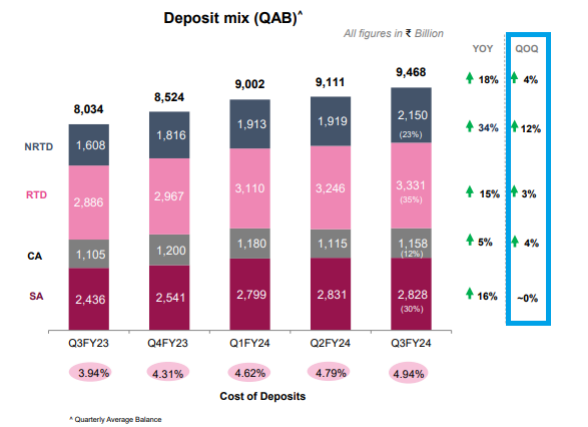

Narayanan’s abrupt resignation, despite the handsome rewards he was getting, was unexpected, given his seniority in the bank. A possible explanation for his sudden interest in pursuing entrepreneurship can be found in a Morning Context article which was published on March 12, 2024. The article highlighted that Axis Bank, like other banks, was having difficulty in raising retail deposits. Since its standalone loan to deposit ratio (LDR), at 93% in 3QFY2024, was higher than that of other banks, the banking regulator was pushing the bank to lower the LDR.

On the 3QFY2024 results call for analysts, probing questions were posed to the bank on its inability to increase retail deposits from a qoq perspective, and its recent dependence on non-retail term deposits.

Extract from 3QFY2024 Results Analysts Call

Source: Axis Bank

Source: Axis Bank

The lowering of Axis Bank’s future LDR would involve either slowing its loan growth (with the likely effect of a slump in the share price) or upping the pace of deposit growth, or a combination thereof. It is possible that the bank was planning for an aggressive retail deposit growth for the following quarters, which Narayanan may have found challenging.

There are lessons to be learnt for stakeholders if, following the need to raise retail deposits, Axis Bank was able to persuade Narayanan that his future was more promising in entrepreneurship. The board of Axis Bank was of the opinion that as long as a senior executive achieved results and targets, while promoting a toxic culture and exhorting staff to abuse one another, the individual would be rewarded by promotions and higher remuneration. But when the same senior executive finds it difficult to achieve further aggressive targets, a change in leadership was warranted.

It is possible that Narayanan may try his hand at entrepreneurship after his departure from Axis Bank, but the timing of his resignation, foregoing his annual bonus and unvested stock options, and the fact that he will be leaving within just 9 days of submitting his resignation, indicate the bank was possibly looking for a change, given the recent tardy growth in retail deposits.

Amitabh Chaudhry’s second term as CEO ends on December 31, 2024. If Axis Bank is unable to significantly reduce its LDR by then, regulatory pressure may also persuade the existing CEO to consider a journey in entrepreneurship.

____________________________________________________________

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). Please see SEBI disclosure here. Investment in securities market are subject to market risks. Read all the related documents before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendary. I own shares in Axis Bank. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

All rights reserved. No portion of this article may be reproduced in any form without permission from the author. For permissions contact: