One of the most shocking episodes in the history of Indian banking was revealed by The Wire.in in a recent exclusive: namely, that the Hinduja-promoted IndusInd Bank reported a meeting of its Asset Liability Committee (ALCO) dated 7 October 2024, when no such meeting took place. None other than Sumant Kathpalia, the then Chief Executive Officer (CEO) of the bank, signed the fraudulent minutes of the non-existent meeting. That a bank CEO would knowingly sign off on the minutes of a fraudulent ALCO meeting suggests that IndusInd Bank considered fraud at the highest executive level of the bank to be an acceptable practice.

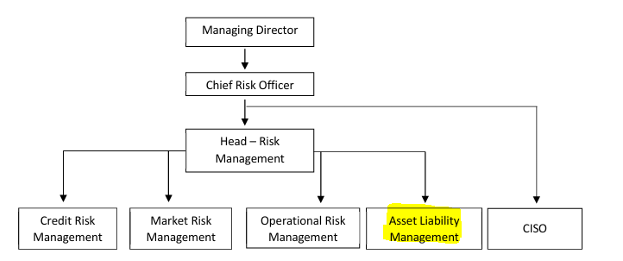

In all banks, the ALCO consists of the senior-most executives, and the meetings are chaired by the CEO or the Executive Director (Number 2 position). ALCO strategically manages the balance sheet, managing interest rate risk, liquidity and market risk with the objectives of profitability, financial stability and regulatory compliance. It must ensure that the balance sheet provides the necessary support to achieve the bank’s strategic goals. The ALCO is one of the most important committees of the senior executives in a bank.

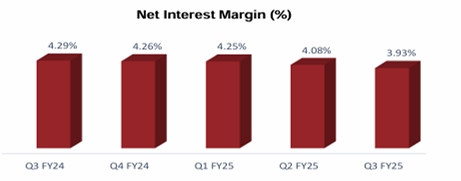

The purpose of the 7 October 2024 fraudulent ALCO meeting was to back-date a change in the accounting treatment of six derivative trades, so as to increase the net interest margin (NIM) while simultaneously reducing the other income. This change would be net profit neutral. It appears that the change in the accounting treatment of the six derivative trades could not be undertaken without an ALCO approval, hence the need to fraudulently back-date an ALCO meeting.

That the decision was back-dated is obvious from the Wire’s revelation of an email dated 30 January 2025, one day before the announcement of the 3QFY2025 results was sent by Amit Sareen Head Balance Sheet Management to Arun Khurana, deputy CEO, requesting the latter’s approval for the accounting change for the same six derivative trades.

The date of the email is important, as this change should have been done immediately after the 7 October 2024 meeting and prior to 31 December 2024, the closing date for the 3QFY2025 results. That the change in the accounting treatment was sought more than 3 months after the purported 7 October 2024 ALCO meeting, and nearly a month after the December 2024 quarter ends, indicates that the decision to change the accounting treatment was taken nearing the finalisation of 3QFY2025 results to manage the NIM.

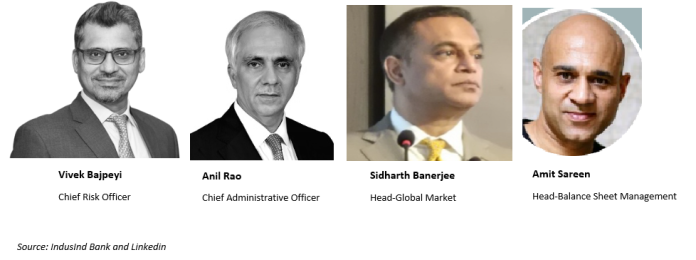

The draft minutes of ALCO meetings are circulated or discussed with all ALCO members for their approval, and there should be a formal documented process of the draft minutes being circulated seeking the approval of the attending members prior to the finalisation of the minutes. In banks the ALCO minutes are documented by the Asset Liability Management team under the Chief Risk Officer (CRO) and accordingly, minutes are first cleared by the CRO, before it is sent for clearance to other ALCO members. In IndusInd Bank’s case, Sumant Kathpalia should have signed these minutes after discussing with Arun Khurana the deputy CEO, Vivek Bajpeyi the CRO, and Sidharth Banerjee Head – Global Market Group with respect to any treasury matter. It is unlikely that Sumant Kathpalia and Arun Khurana, the then deputy CEO, were the only senior executives aware of the fraudulent 7 October 2024 ALCO meeting.

As per published disclosures, Grant Thornton was appointed as the forensic investigation team and it would be interesting to know, who drafted the minutes and how these minutes were ultimately signed by the CEO for the banking industry to understand and take measures to avoid such fraudulent practices. It is mandatory for banks to report Fraud Monitoring Returns (FMR) to the Reserve Bank of India (RBI) about various types and nature of fraud including forgery and negligence within 14 days of its identification.

Mid-level and certain senior executives have been charge-sheeted by IndusInd Bank in mid-2025 and subsequently suspended and terminated for being aware of the fraudulent 7 October 2024 meeting, but, interestingly, the following senior executives, who should have been aware of the meeting and the back-dating of the derivative trades, are not only holding onto their executive positions but have apparently not been charge-sheeted. Vivek Bajpeyi, (CRO), in the minutes of the 7 October 2024 meeting, is shown as being purportedly present via Microsoft teams, and had to have been aware as the ALCO is part of the risk management organisational structure and all important decisions in ALCO meetings are overseen by the CRO.

Sidharth Banerjee Head-Global Markets, who is purportedly shown as being physically present at the 7 October 2024 ALCO meeting, is responsible for the treasury including all the derivative trades in the bank, and the change in the accounting treatment for the 6 specified derivatives could not have been implemented without his approval and knowledge. He was recently promoted by the board of directors to Senior Executive Vice President, the highest executive grade after the CEO in the bank. While Anil Rao, Chief Administrative Officer (Operations) is not shown as being present in the 7 October 2024 ALCO meeting, the change in the accounting treatment is a back office function in treasury operations, hence his department would have had to implement the decision, which took place sometime on or after 30 January 2025, and before the announcement of the bank’s 3QFY2025 results on 31 January 2025.

The Wire article cited an email from Amit Sareen Head-Balance Sheet Management (not charge sheeted by the bank despite his involvement and continues to hold the post) to Arun Khurana dated 30 January 2025 seeking his approval to change the accounting treatment for the same 6 derivative trades. The fact that operations was implementing a decision taken purportedly after the 7 October 2024 meeting and well after the close of the September-December quarter on 31 December 2024 should have raised alarm bells in operations as the back office was effectively back dating the six derivative deals. No junior level operational individuals would take such a decision on their own, and Anil Rao had to have authorised or atleast been aware of the transaction. Pertinently, the IndusInd Bank board of directors were so impressed by Anil Rao that he was elevated to be part of the “Committee of Executives” on 30 April 2025, along with Soumitra Sen (who was purportedly shown as physically attending the 7 October 2024 meeting) to manage the day-to-day operations of the bank after the CEO and the Deputy CEO quit.

Banks follow the practice of effecting back-dated changes through Memoranda of Change (MOCs). Each change proposed through a MOC is formally recorded, supported by clear justification, and approved by an authorised official. These MOCs are subject to review by the statutory auditors and the Audit Committee of the Board (ACB) to ensure that the financial statements present a true and fair view.

The ACB undertakes a granular review of all MOCs, analysing their impact on the bank’s financial position, accuracy of corrections, and fair representation of results. Given these governance requirements and the ACB’s oversight responsibilities, the relevant MOCs would necessarily have been reviewed and approved by the ACB in its January 2025 meeting, when the committee was chaired by Bhavna Doshi. Till date there is no information in the public domain on how the ACB viewed these back-dated changes which manipulated the bank’s NIM in 3QFY2025.

What is unusual is that the fraudulent back-dating of accounting only resulted in an additional net interest income of Rs 153 crores and a corresponding reduction in the other income. The accounting change was net profit neutral. It appears that the bank was confronted with a net interest margin (NIM) decline in 3QFY2025 as compared with 2QFY2025, so it attempted to report a lower reduction. It may have been trying through other means as well, but was apparently successful only in doing this particular transaction, which inflated the NIM by around 10-12 basis points. It is interesting also to note that the six derivative trades were deliberately chosen so as to be net profit neutral on 31 December 2024, as otherwise auditors would highlight that an accounting change had resulted in a change in net profit, thereby defeating the entire purpose of the exercise. This also demonstrates how banks can surreptitiously, without auditors’ comments, manipulate the NIM within certain limits to hoodwink analysts who closely monitor this important indicator.

This analyst sent a questionnaire to IndusInd Bank enquiring which were the senior executives who finalised the minutes of the 7 October 2024 ALCO meeting, which individual drafted the fraudulent minutes, and why the board of directors had not taken action on these senior executives and instead taken strong disciplinary action on their juniors. IndusInd Bank response stated,

“Following the disclosures in March 2025, the Bank has thoroughly investigated all matters through independent reputed external consultants and internally, as required. After careful evaluation of the findings, the Bank has reported the accounting matters as fraud to the Reserve Bank of India and also filed complaints with law enforcement agencies as per regulatory obligations of the Bank, subsequently initiating the staff accountability process based on the findings. The Bank is fully cooperating with the agencies and continues to provide information and assistance, as requested. While the law enforcement agencies are investigating the matters based on the Bank’s complaints, it would not be appropriate for the Bank to respond to your report.”

Banking operations are always governed by the ‘Four Eyes Principle’ or the ‘Maker Checker’ approach which is that all transactions are cross–checked by another competent individual, the banker initiating a transaction or a change (the maker) is reviewed and authorised by another banker (the checker). In the case of the fraudulent ALCO meeting and the back-dating of the accounting change for the 6 derivative trades, the basic checks and balances system was completely compromised, as it had the blessing of the then CEO and Deputy CEO. This incident sadly demonstrates the culture of non-compliance and engaging in fraudulent activity by the highest executive leadership in the bank, which should sound the death knell for any bank.

It is bad enough that IndusInd Bank’s then CEO, its then deputy CEO, and senior executives were all aware and facilitated the back-dating of the accounting treatment and the fraudulent ALCO meeting. What is worse is that while the bank charge-sheeted, suspended and even terminated some of the junior executives for being aware of the fraudulent ALCO meeting, these identified senior executives remained unscathed. Indeed, Vivek Bajpeyi, Sidharth Banerjee, Anil Rao and Soumitra Sen are currently classified as senior management personnel in IndusInd Bank.

It is apparent from the bank’s response that it has completed its own investigation and filed complaints with the authorities, and the continued employment of these senior executives indicates that the blame has been directed to their juniors. It appears the board of directors were reluctant to charge-sheet executive one step below the CEO/Deputy CEO, as the entire executive leadership of the bank would stand exposed and stakeholders would question the absence of board oversight. This is the most damaging inference for depositors, shareholders and the regulator. When the senior-most executives in a bank knowingly engage in fraud and forgery and the board of directors declines to punish them, the regulator needs to hold individual non-executive directors accountable.

Mid-tier banks such as IndusInd struggle to raise genuine retail deposits, and are hence compelled to rely on wholesale deposits. However, institutions and corporates are extremely sensitive to regulatory and compliance issues in banks, non-bank finance companies, mutual funds and companies when placing their deposits. IndusInd Bank depositors should be extremely concerned about the fraud committed by the senior executive leadership and the selective response by the board of directors in the form of targeting junior executives. Even if capital adequacy or liquidity was not immediately impaired, the integrity of financial reporting, risk governance, and supervisory trust directly affect depositor confidence, which is a core regulatory concern. The RBI has clear statutory powers to supersede the Board if it concludes that the bank’s affairs are being conducted in a manner detrimental to depositor interests or public interest.

Fraudulent activity by senior executives going unpunished is unacceptable in banking as it poses a grave risk to depositors and the banking system. As the RBI as yet has not publicly demanded accountability from the bank’s board of directors, we might see equity investors and even depositors staying away from IndusInd Bank.

__________________________________________________________________

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). BSE Enlistment No. 5036. Please see SEBI disclosure here. Investment in securities market are subject to market risks. Read all the related documents before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendary. I own equity shares in IndusInd Bank. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.