The author acknowledges the contribution of Aspects of India’s Economy (RUPE) for this article

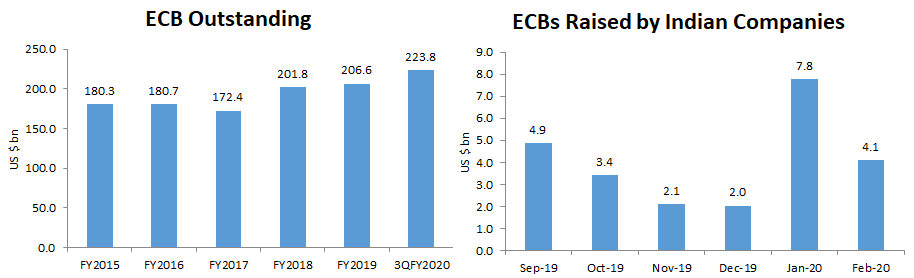

EXECUTIVE SUMMARY. There was a sharp rise in corporate India’s external commercial borrowings (ECB) during the past financial year. Outstanding ECBs for December 2019 rose $ 29 bn y-o-y, to $ 223 bn, or 40% of India’s external debt, a jump of more than 2 percentage points y-o-y. This appears to be on account of significant liberalisations by the Reserve Bank of India (RBI) in 2019, in a conscious effort to increase capital inflows. Among the liberalisations was a reduction in hedging requirements, which may now come to haunt the corporate borrowers and the RBI.

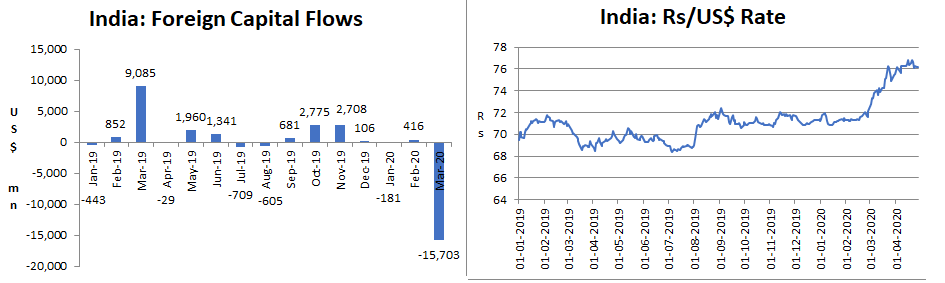

Even for companies which normally enjoy a natural hedge in the form of foreign exchange earnings, the severe hit to the global economy and trade may now nullify that natural hedge. On the back of a persisting crisis of non-performing loans in the corporate sector and a drastic reduction in corporate revenues due to the lockdown, a rupee depreciation could deal a blow to corporate ECB borrowers who have not hedged, or hedged inadequately.