Economist and former deputy governor, Reserve Bank of India

Contrarian Commentator

Hemindra Kishen Hazari, is a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594, BSE Entitlement No. 5036) with over 30 years’ experience in the Indian capital markets. He has specialized in banking, macro-economy and corporate financial analysis.

Early in his career he was fortunate to have been mentored by N.L. Hingorani, a close friend of his father, R.K. Hazari in corporate strategy and financial analysis.

He has worked with prominent foreign and domestic capital market firms such as UBS, Societe Generale, HSBC, ASK Raymond James and Karvy Stock Broking. In the course of his career he has interacted with senior executives of prominent Indian companies, foreign and domestic institutional investors and regulatory authorities. He has arranged non-deal roadshows of senior company executives to meet prominent institutional investors in Singapore, Hong Kong, London and in the USA.

In the 1990s, he publicly debated with India’s leading credit rating agencies on their debt rating of individual companies and highlighted deficiencies in their methodologies.

His research note of February 2000 highlighted that if the government continued with its then policy of appointing State Bank of India (SBI) chairman on the basis of seniority, SBI would have 8 chairmen in the following 4 years. Post the publication of the note and the subsequent media coverage the government changed its policy of appointing the SBI chairmen solely on seniority.

As an independent analyst he was one of the first to caution about the impending asset quality and corporate governance problems in Indian private sector banks and his critical analysis on some of the CEOs’ performance (Yes Bank and Axis Bank) finally led to the banking regulator refusing an extension to their tenures.

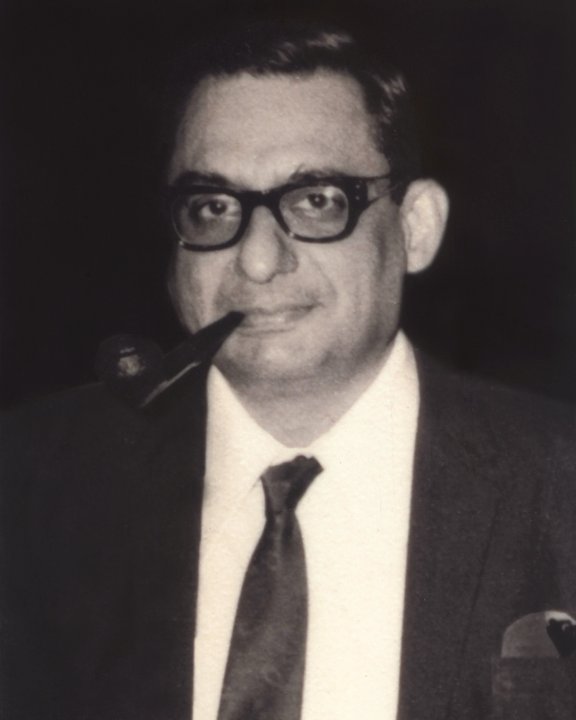

R.K Hazari (1932-1986)

N.L. Hingorani (1932-1995)

former director, National Institute of Bank Management

In a series of research notes commencing from May 2021, he highlighted the high staff attrition in some of the private banks and the consequent impact on operational and customer service. This issue was ignored by other analysts and the media. In end May 2023, the Reserve Bank of India for the first time publicly aired its concern on attrition.

In January 2024, he dissected a high-risk transaction undertaken by Axis Capital (100% subsidiary of Axis Bank) which exposed the merchant bank’s credit appraisal and risk management and the poor oversight by the bank. On September 19, 2024, SEBI in its interim order publicly acknowledged the report and debarred Axis Capital from undertaking any debt transactions.

The research reports are non-consensus and focus on in-depth analysis of the accounts and provides an insight on how board of directors actually function. The reports also deal with corporate governance and how to improve practices on transparency, accountability and risk management. The reports are based on information in the public domain and quantify and highlight pitfalls and attempt to predict how the management’s future strategy would unfold. There also have been instances where the board of directors appear to have taken remedial action post the release of the research report.

For his institutional clients he has arranged meetings with company executives and senior-level officials in regulatory organisations.

Subscribers to the research are institutional investors and companies (investor relations/risk management departments).