Hemindra Hazari

The government’s decision to appoint Urjit Patel, the current deputy governor of the Reserve Bank of India (RBI), to replace Raghuram Rajan as governor of the central bank was met with a chorus of approval by the media, and by captains of industry and financial capital who proclaimed...

If Chanda Kochhar had disclosed her husband's dealings and recused herself from the credit committee that sanctioned the Videocon loan, her personal integrity would not be under question right now.

Credit: Reuters

Hemindra HazariBANKING02/APR/2018

ICICI Bank chairman M.K. Sharma displayed utter contempt for the media and public by calling for a press conference,...

The display of such largesse should be a troubling signal for shareholders who worry about corporate governance.

Hemindra HazariBANKINGGOVERNMENT25/JUL/2017

Rewarding senior management during a particularly bad year should be a troubling signal for shareholders. Credit: Reuters

Mumbai: In a year when the net profit of Axis Bank – India’s third-largest private bank –...

By Hemindra Hazari

On January 11, 2019, the Reserve Bank of India (RBI) issued a press release informing the public that “by an order dated January 4, 2019 imposed a monetary penalty of Rs 30 million on Citibank N.A. India (the bank) for deficiencies in compliance with the RBI instructions on ‘Fit...

Hemindra Hazari 4 March 2017

Axis Bank has had a tough year. Just as it was slowly recovering from the demonetisation fiasco, wherein some of its officials were arrested for money laundering, its non-watch list corporate loans slipped into the non-performing category in the third quarter of FY’2017. In the last month, news...

The bank’s promoter-cum-CEO and its board of directors have not understood the letter and spirit of an important banking rule, but have instead sought to take it as a starting point for negotiation.

Uday Kotak. Credit: Reuters

Hemindra HazariBANKING17/AUG/2018

In an indictment of Kotak Mahindra Bank (KMB) and its promoter-CEO, Uday Kotak,...

A Kotak family entity, Infina Finance Private Ltd. (Infina), purchased electoral bonds totalling Rs 1.3 billion – which is more than twice the amount disclosed by the State Bank of India (SBI) to the Election Commission of India (ECI) during FY2019 to FY2022.

In FY2020, the company purchased Rs 760...

Claudius, in Hamlet, noted that “When sorrows come, they come not single spies but in battalions.”

He could well have been speaking about the woes of Yes Bank shareholders. The last few months, and in particular November, have been a punch in the gut to owners of the stock.

On November 14,...

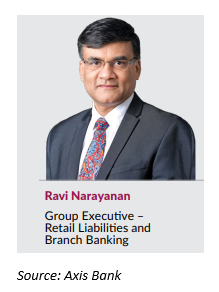

Ravi Narayanan, the 55-year old Group-Head in-charge of retail branches, retail liabilities and third party products abruptly resigned from Axis Bank on March 13, 2024 because he wished to pursue an “entrepreneurial journey”. He will be relieved on March 22, 2024, to conform to his wish for an early...

SBI's massive restructuring of standard loans are finally coming home to roost with a vengeance.

Hemindra HazariBANKING13/FEB/2018

SBI’s headquarters in Mumbai. Credit: Reuters

On February 9, 2018, a sad day dawned in the history of Indian banking. The State Bank of India, the government’s premier bank and India’s most prestigious, reported that...