SBI’s massive restructuring of standard loans are finally coming home to roost with a vengeance.

Hemindra HazariBANKING13/FEB/2018

SBI’s headquarters in Mumbai. Credit: Reuters

On February 9, 2018, a sad day dawned in the history of Indian banking. The State Bank of India, the government’s premier bank and India’s most prestigious, reported that the Reserve Bank of India (RBI) had found that the bank had mis-reported its profits and non-performing assets (NPAs) for the year ended March 31, 2017.

The bank was found to have understated its gross NPAs by 21% and overstated its profits by 36%. It is a matter of shame that a bank tracing its roots to 1806 as the erstwhile Bank of Calcutta, and today accounting for around 20-22% of the banking industry’s assets, had to suffer such ignominy more than two centuries later.

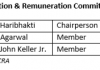

The RBI has a threshold limit for misreporting: if the central bank audit finds that the bank has understated NPAs by 15% or more and if the additional provisioning requirements assessed by RBI exceed 15% of the published net profits after tax is the bank forced to publicly report the divergence. This itself is a liberal threshold, as banks should have at best under 5% divergence. The RBI’s purpose of disclosing the divergence was to name and shame the bank. For any bank to report gross NPA divergence exceeding 15% reflects poorly on the chief executive officer (CEO), the chief financial officer (CFO), the head of the audit committee of the board and the auditor.

In this hall of shame, SBI has joined the ranks of market-fancied banks such as HDFC Bank, Yes Bank, Axis Bank, ICICI Bank and Indusind Bank. Sadly, thanks to the abysmally poor corporate governance standards of corporate India, not a single high-ranking individual has been fired or had the decency to resign, owning responsibility for such a serious transgression. Nor does the Securities and Exchange Board of India (SEBI) or the RBI believe in holding any senior executive to task for misinforming the public and distorting price discovery in the market.

In the media circus that constitutes business journalism, on January 25, 2018, a fortnight before SBI announced its results, Arundhati Bhattacharya, the former chairman, SBI and the individual responsible for FY’2017 accounts, was awarded the title of Business Standard Banker of the Year. The jury was headed by former economic affairs secretary C M Vasudev, and Anand Sinha, the former deputy governor, RBI, was one of its members.

This was by no means the only award the former chairman of SBI received. On December 5, 2017, she received the Financial Express Best Banker of the Year 2015-2016. Strangely, when SBI declared its FY’2017 results on May 19, 2017, it revealed massive losses at its former banking subsidiaries which required an immediate recapitalisation of SBI. Such issues, which are normally indicative of larger problems, did not deter the illustrious jury members from bestowing awards on a chairman who had presided over such losses. Apparently, in business media’s business model, getting independent and eminent individuals to hand out awards is highly lucrative. The juries of both media agencies, now have to explain to the public on how such awards stand up when the regulator detects significant fudging of the books. In future, it is best for media to avoid such farcical awards and stick to their profession of journalism and leave event management to event managers.

Divergence of gross NPAs in SBI reached Rs 23,239 crores in FY’2017. Around 50% of this was from two corporate accounts, Jindal Steel and Power (JSPL) and the Videocon concession in a joint offshore venture with BPCL and Petrobras. Many banks, including HDFC Bank and Axis Bank, suffered divergence on account of JSPL, and all banks in the consortium led by SBI claimed that JSPL was consistently servicing its dues within 90 days. However, Rajnish Kumar, the present SBI chairman who took charge on October 7, has accepted RBI’s finding and is not contesting the divergence.

Corporate NPAs have SBI in a vice-like grip. For three consecutive quarters, in standalone SBI, bad debt provisions exceed profit before provisions. This renders SBI’s considerable standalone quarterly operating profit, ranging from Rs 11,700 crores to Rs 14,600 crores, redundant, and it is only through exceptional income and write-backs that SBI was able to report net profits in the first and second quarters of FY2018. The huge depreciation on investments as a result of rising bond yields also contributed to SBI’s loss in the 3QFY2018. The continuous tidal waves of bad debt costs that are engulfing SBI are on account of the massive restructuring of standard loans that RBI permitted banks to indulge in so as not to report the accounts as non-performing earlier. It is these chickens that are finally coming home to roost with a vengeance.

Source: State Bank of India

In the third quarter of the present financial year, out of the total slippages to NPA of Rs 25,836 crores, corporate slippages accounted for Rs 21,823 crores, and 89% of the corporate slippages are from the restructured standard loans pool. What is indeed ominous is that at the end of the third quarter of the current financial year, standalone SBI has outstanding restructured standard loans of Rs 50,482 crores and net NPAs of Rs 102,370 crores, as against a 9 month operating profit (excluding exceptionals) of Rs 38,192 crores till December 31, 2017. Not only are a considerable component of the restructured loans likely to become NPA, requiring significant provisions, but the net NPAs, on account of ageing, will also require additional provisions. The corporate asset quality issue of SBI is likely to persist for some time.

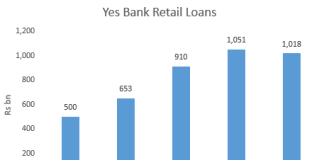

While the focus of the media and analysts is riveted towards corporate NPAs, nobody, it appears, is paying attention to the huge growth in retail loans in recent years. The fate of these loans is linked to the employment and income of the borrowers, which in turn depends on the economy.

The economy has yet to come out of its slump, and individual sectors (IT, telecom) are set to experience huge job losses irrespective of any economic upturn and on account of digitalization in banking even HDFC Bank is reducing its headcount. Employees in these sectors were prominent among retail borrowers. SBI’s gross NPAs in retail are only 1.3%; that figure has nowhere to go but up.

It is unlikely that the worst is over for SBI, as its chiefs have repeatedly insisted over the past several years.

Hemindra Hazari is an independent market analyst.