EXECUTIVE SUMMARY. The Indian prime minister’s announcement that India had destroyed a ‘low-earth orbit’ satellite with a missile, and thus joined an elite club, suggests that the ruling party is desperate to deflect the voters’ attention from the dire economic situation in India. This desperation points to a reality...

By Hemindra Hazari

Even on their best days, India’s financial newspapers are watchdogs that rarely bark. For the most part, they prefer not to place large companies under the scanner, let alone try and fix accountability on influential promoters and powerful chief executive officers.

On March 20, 2019, Business Standard (BS) announced that...

The language used in the writ petition filed by Kotak Mahindra Bank (KMB) in Bombay High Court against the banking regulator should have alarmed shareholders. They would be even more apprehensive if they read the language used by the Reserve Bank of India (RBI) in its reply. That a...

EXECUTIVE SUMMARY

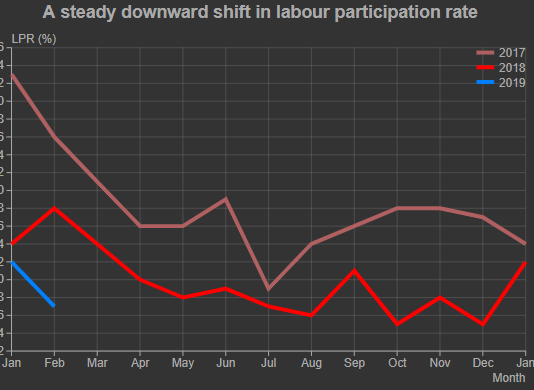

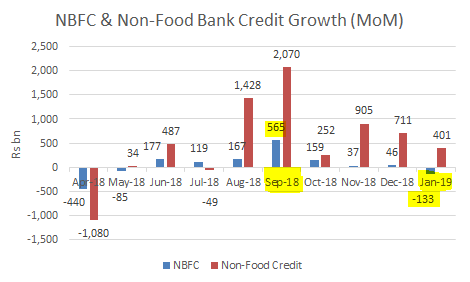

For the beleaguered non-bank finance company (NBFC) sector, banks are the single largest component of external funding. This source peaked at the end of September 2018, in the aftermath of the default of IL&FS, a private unlisted infrastructure developer and financer. However, in the beginning of the last...

EXECUTIVE SUMMARY

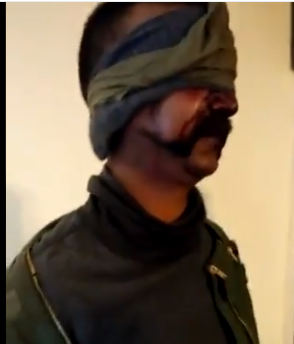

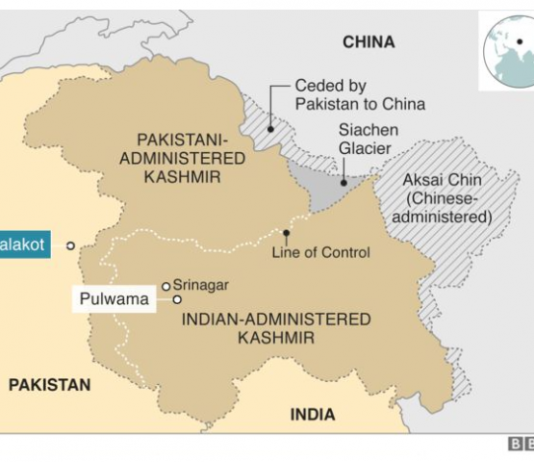

Post the downing of the Indian Air Force (IAF) MIG-21 by Pakistan over its territory and the capture and subsequent return of the pilot, the narrative which was strongly in favour of Narendra Modi and the ruling Bharatiya Janata Party (BJP) rapidly spiralled downwards. Whether the Pakistan Air...

EXECUTIVE SUMMARY

The air strikes launched by the Indian Air Force on Jaba Top in Balakot, in the Khyber Pakhtunkhwa province of Pakistan, have raised the stakes in the escalation of conflict between the two nuclear-armed neighbours in South Asia. The stock market reaction on the morning of February 26...

EXECUTIVE SUMMARY

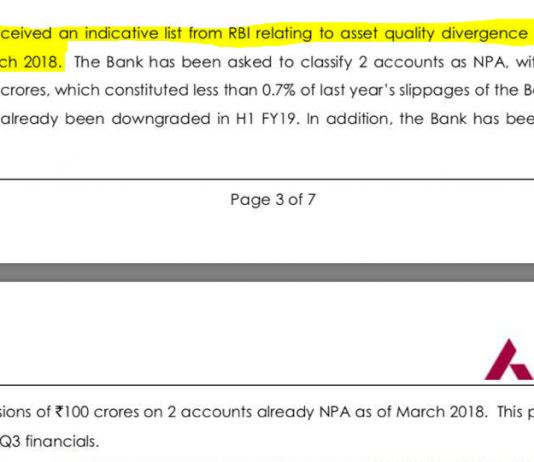

Yes Bank is in the cross hairs of the Reserve Bank of India (RBI), the banking regulator. On February 13, 2019, the bank issued a press release stating that the regulator’s risk assessment report (RAR) for the year ended March 31, 2018 revealed nil divergence, i.e. the bank’s...

EXECUTIVE SUMMARY

The ‘Interim Report of IL&FS and Its Subsidiaries’ dated November 30, 2018 by the Serious Fraud Investigation Office (SFIO), which was submitted by the Ministry of Corporate Affairs (MCA) to the National Company Law Tribunal (NCLT), not only reveals the shenanigans of IL&FS’s senior management but also puts the spotlight...

EXECUTIVE SUMMARY

The press statement issued by ICICI Bank based on the enquiry report headed by Justice (Retd.) Srikrishna to investigate the allegations against Chanda Kochhar appears deliberately confusing and convoluted. While it states that Chanda Kochhar was in violation of the bank’s Code of Conduct, on the more serious charge of...

EXECUTIVE SUMMARY

Yes Bank has appointed Ravneet Gill as the bank’s CEO, effective latest from March 1, 2019, for a 3-year term. The announcement led to a spurt in the bank’s share price, as the leadership issue was finally resolved. While investors rejoiced, it remains to be seen whether the...