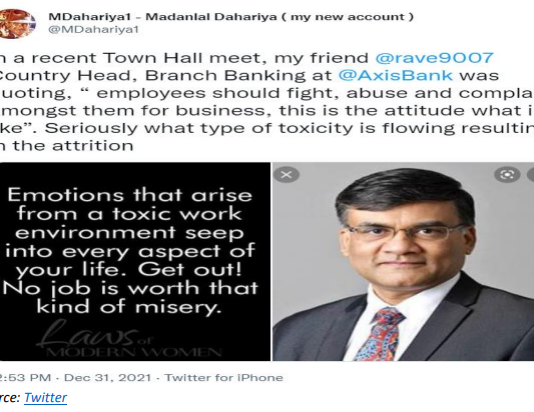

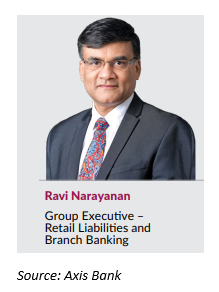

EXECUTIVE SUMMARY. The toxicity in Axis Bank’s work culture which this analyst has been highlighting (here and here) was recently confirmed by Ravi Narayanan,...

Ravi Narayanan, the 55-year old Group-Head in-charge of retail branches, retail liabilities and third party products abruptly resigned from Axis Bank on March 13,...

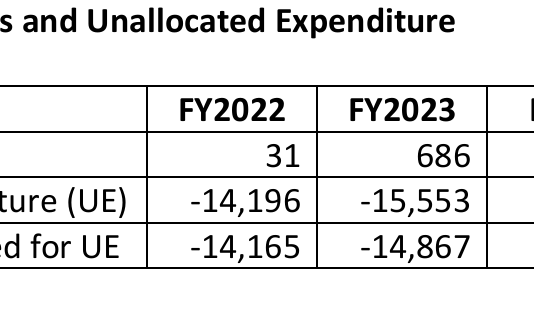

EXECUTIVE SUMMARY. Government banks have been derided for indulging in ‘phone banking’ (being instructed on the telephone by ruling party politicians and civil bureaucrats...

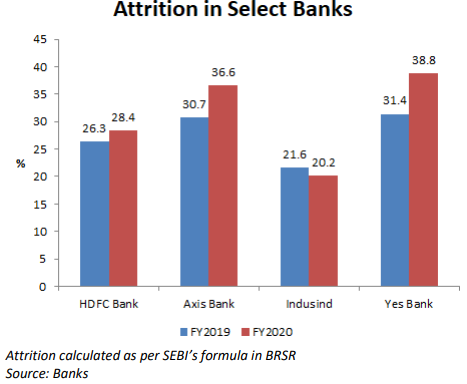

The abrupt resignation of Indusind Bank’s Chief Human Resources Officer (CHRO), Zubin Mody, on July 25, 2025 is another symptom of the internal churn...

In June 2024, Yes Bank sacked at least 500 junior staff, mainly in its retail division (as reported by The Economic Times on June...

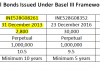

Privatisation is supposed to increase competition, usher in greater efficiencies, unleash animal spirits, and enrich stakeholders. IDBI Bank’s board of directors appear to have...

EXECUTIVE SUMMARY.

“hush money”: money paid to someone to prevent them from disclosing embarrassing or discreditable information – Concise Oxford English Dictionary

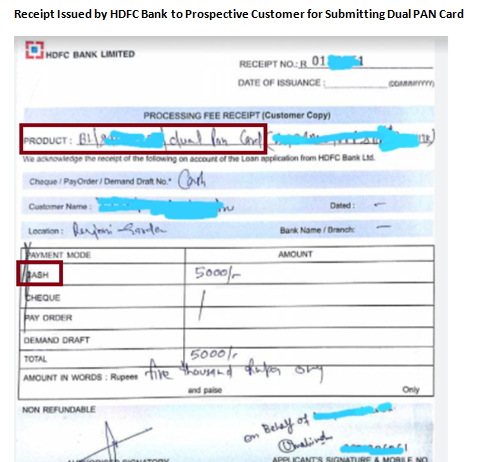

HDFC Bank, India’s...

EXECUTIVE SUMMARY. While Axis Bank has recovered from its corporate non-performing asset (NPA) crisis, it seems to be in the midst of a management...

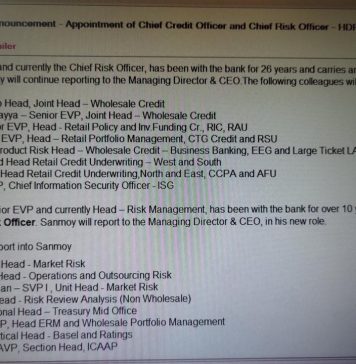

EXECUTIVE SUMMARY. Two long serving senior executives of HDFC Bank who headed important business verticals have abruptly quit the bank, reportedly under unusual circumstances....

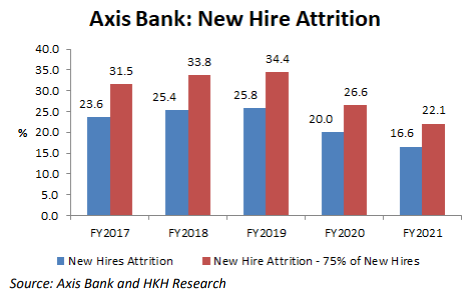

EXECUTIVE SUMMARY. A closer look at Axis Bank’s staff data reveals the alarming mortality rate of new hires in the bank, and provides a...