Axis-2009-to-2018-Case-Study-in-Mismanagement-and-Board-FailureDownload

Hemindra Hazari

Risk management is the control and nerve centre of a bank. The independence of control and vigilance functions like risk management and audit...

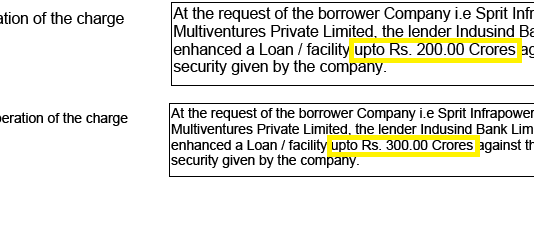

EXECUTIVE SUMMARY. Romesh Sobti, the CEO of Indusind Bank, was recently crowned ‘banker of the year’ by a fawning business media, despite reporting...

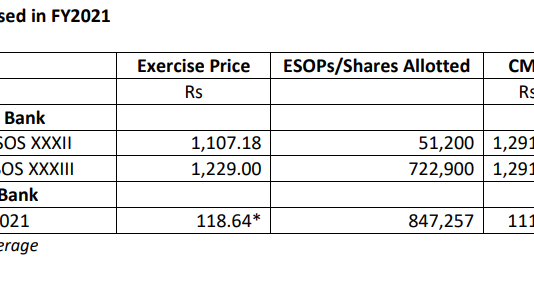

EXECUTIVE SUMMARY. When private bank stocks languish, or worse, spiral downwards, it is not just shareholders whose wealth erodes. Senior management executives, the elites...

EXECUTIVE SUMMARY. The Covid-19 outbreak and the resulting lockdown have caused widespread economic devastation, particularly in urban and commercially developed centres. Taking into account...

It is difficult to read the SEBI's scathing order and not wonder what on earth the NSE board was doing.

In Rudyard Kipling’s Jungle Book, Akela,...

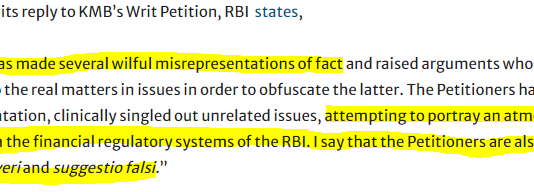

On December 14, 2020, Kotak Mahindra Bank (KMB) informed the exchanges that the Reserve Bank of India (RBI) had approved the appointment of Prakash...

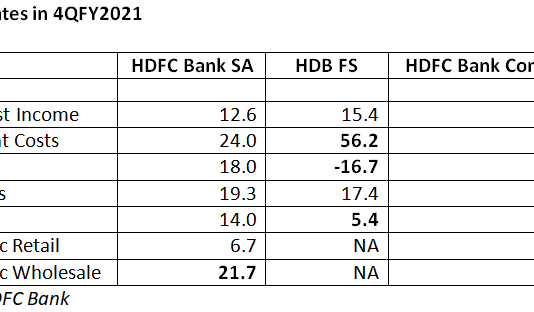

EXECUTIVE SUMMARY. There are two features worth noting in HDFC Bank’s 4QFY2021 results. The first is the continuing de-emphasis on retail loans. This was...

February 23, 2018 by rupeindia

— Hemindra Hazari writes:

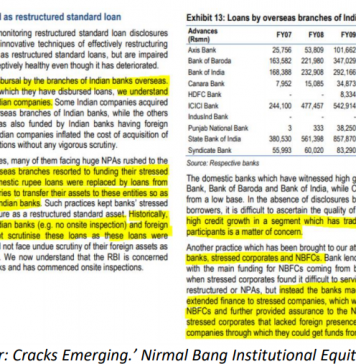

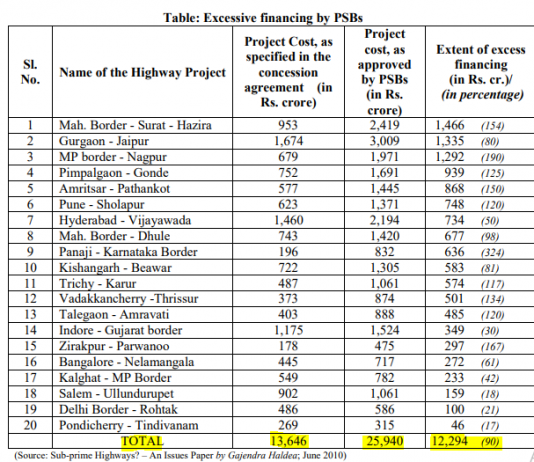

The Punjab National Bank (PNB) Nirav Modi scam has led to a clamour from certain quarters for the...

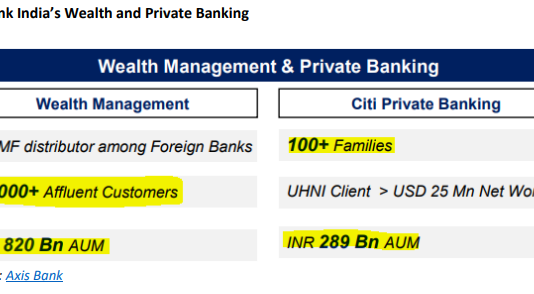

EXECUTIVE SUMMARY. Axis Bank’s acquisition of Citibank India’s consumer finance division has been applauded by the stock market, and the bank has outperformed Nifty-50...