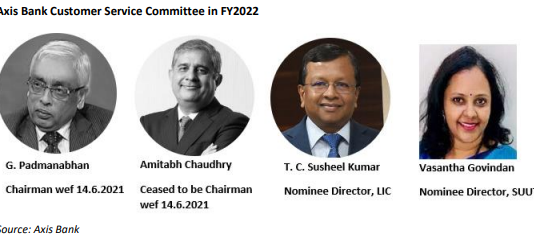

The gap between Axis Bank’s own portrayal of customer experience and the reality of customer complaints recalls Robert Louis Stevenson’s classic tale of Dr. Jekyll and Mr. Hyde.

Let us begin with Dr Jekyll. The bank claims, in its FY2022 Sustainability Report, that “we are committed to delivering the greatest...

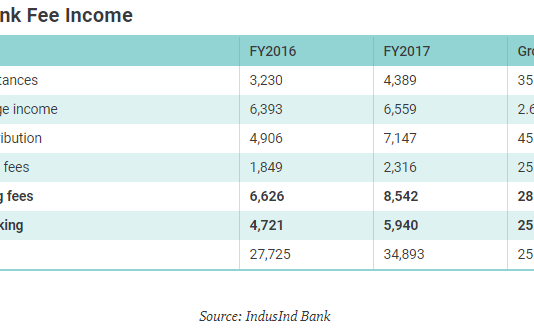

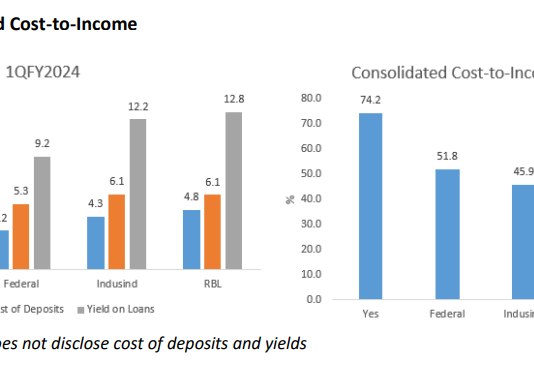

IndusInd Bank’s quarter ended March 31, 2017 (4QFY2017) was impacted by a “one-off” exposure to a company whose cement operations is in the process of being acquired by a top-rated company. While sell-side analysts regard it as a blip in the secular positive outlook on the bank, they are...

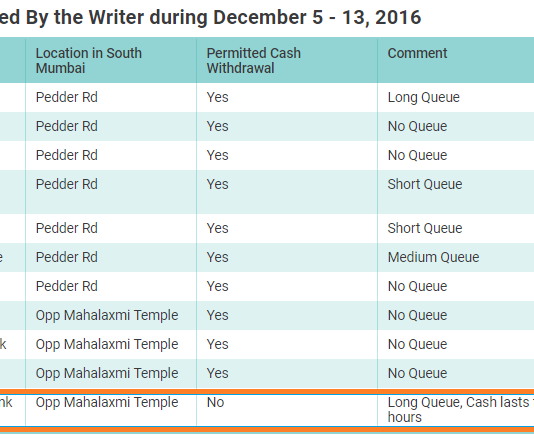

Customers of HDFC Bank, India’s most valuable and one of the most expensive banks in the world have been hard hit in the ongoing demonetisation saga in India. Depositors of HDFC Bank have been complaining about their inability to withdraw the Reserve Bank of India’s (RBI) stipulated cash withdrawal...

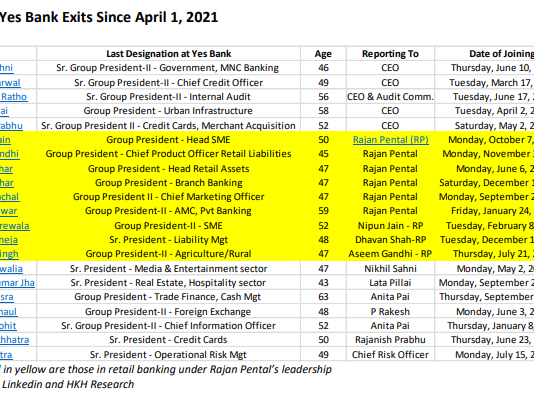

It has been 3½ years since the Reserve Bank of India imposed a moratorium on Yes Bank, superseded its board, and organised a financial bail-out by a State Bank of India (SBI)-led consortium, as well as a board and financial restructuring. While financial solvency and stability have been restored...

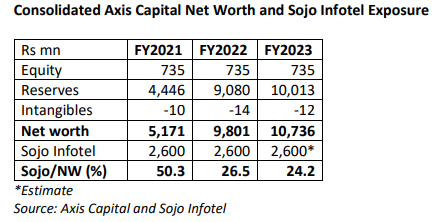

Axis Capital’s structured finance team is proud of its “unblemished track record of ‘No Default’ in any transaction with 100% investor money”. But the underwriting of Rs 2.6 bn of non-convertible debentures (NCD) of Sojo Infotel in March 2021 may result in its inaugural blemish on March 25, 2024,...

EXECUTIVE SUMMARY. Yes Bank is in the news for its non-performing assets, a legacy of erstwhile founder-CEO Rana Kapoor’s reckless lending being transferred to an Asset Reconstruction Company (ARC). If and when the deal is announced, the balance sheet and the bank will be absolved of the sins of...

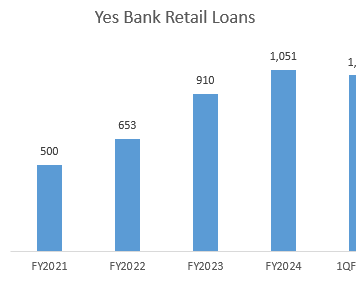

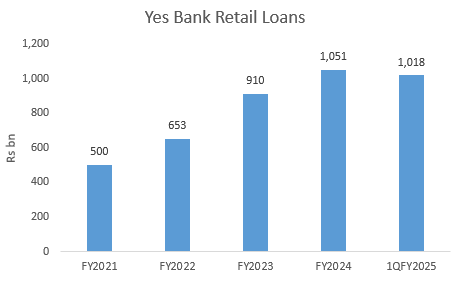

Yes Bank’s 1QFY2025 results which revealed the fall in outstanding retail loans as compared with March 31, 2024 and the sacking of at least 500 staff, with more forced exits expected in the near future (as reported by The Economic Times, dated June 25, 2024), is an admission that...

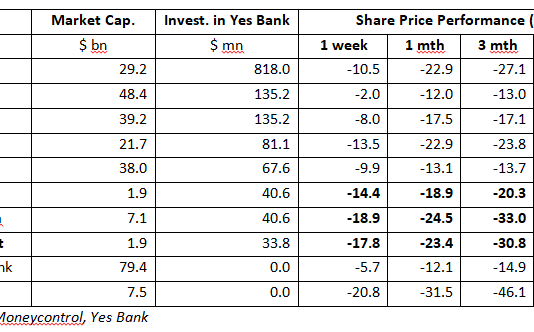

EXECUTIVE SUMMARY. In the SBI-led bail-out of Yes Bank assisted by private sector entities, HDFC Bank, the largest private sector bank, is notably absent, as is Indusind Bank. Stranger still, much smaller banks like Bandhan Bank, Federal Bank and IDFC First have decided to come to the rescue of...

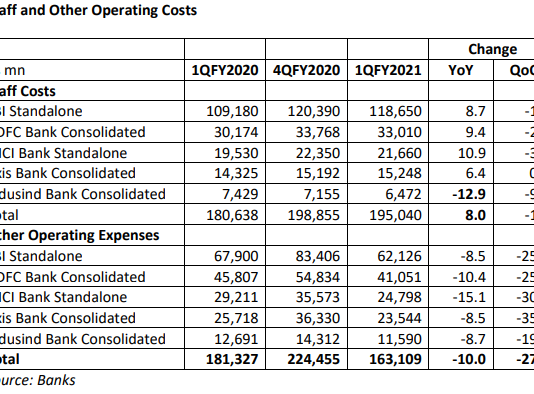

EXECUTIVE SUMMARY. The near-absence of a government stimulus to revive the Indian economy from the Covid-19 meltdown portends a severe and prolonged economic slowdown. This will squarely hit the banking industry with huge credit costs and low growth. In such a dismal scenario, the only lever available to the...

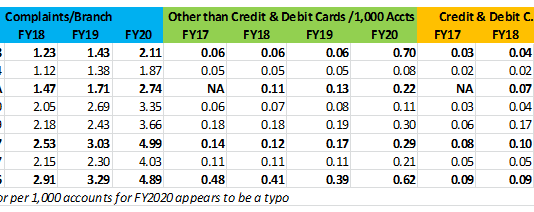

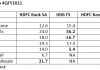

EXECUTIVE SUMMARY. The capital markets continue to reward private sector banks with rich valuations, benefitting shareholders. But larger stakeholders such as bank customers are registering a steep increase in complaints to the banks’ ombudsman. For the year July 1, 2019 to June 30, 2020, customer complaints (per branch and...