The issue here is governance and that the bank's board of directors did not have formal oversight despite RBI suggesting to banks to have an IT Strategy Committee in its April 2011 circular, according to Hemindra Hazari, SEBI registered independent analyst.

"When smaller banks and even NBFCs had IT Strategy...

Kotak firm’s Rs 60 crore donation to BJP coincided with crucial RBI decisions on Kotak Mahindra Bank

In a piece published in The Wire a month later, Hemindra Hazari, an independent research analyst registered with the Securities and Exchange Board of India, called this “one of the more odd episodes in the history of banking regulation”.

“The settlement was more or less a win for the bank’s promoter, Uday Kotak and...

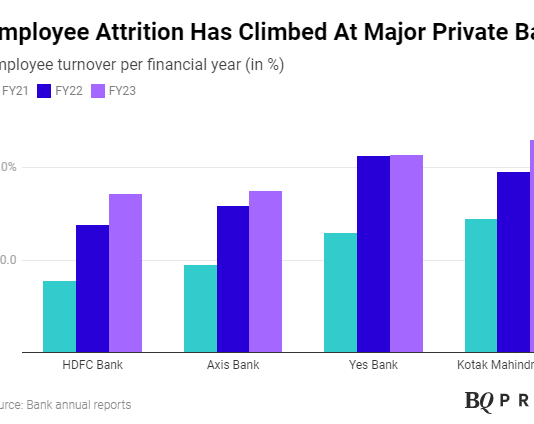

Analysts said that the stringency of the Paytm Payments Bank action,

while directed at a single entity, signals that the bank won’t tolerate lapses.

“This is a warning to the entire sector," said Hemindra Hazari, a banking

analyst in Mumbai

Chloe Cornish

Entire article can be read here

Please read disclosure here