Hemindra Hazari

Everyone knows public sector banks are less profitable, more prone to political influence and have higher ratios of non-performing assets (NPAs) than their private sector counterparts. In contrast, new private sector banks, set up post 1991, are media and stock market darlings. Most analysts tend not to mention that public sector banks carry the main burden of the government’s developmental policies — from rural lending to infrastructural development and now the Jan Dhan Yojana. Rather, the private sector’s better profits are taken as a sign of superior management.

Government banks are rightly criticised for their poor credit management and corruption. But who remembers the private banks that faltered and were merged with other banks? Global Trust Bank, established in 1994, was involved in the 2001 Ketan Parikh-managed stock scam that resulted in losses of Rs 1,000 crores. These were finally borne by the majority government-owned Oriental Bank of Commerce in 2004. Other banks like Times Bank, Centurion Bank and Bank of Punjab were ultimately merged with HDFC Bank as their promoters lost interest or ran into difficulties.

Glimpse behind the veil

The new private sector banks pride themselves on their low reported NPAs and attribute this to their superior credit skills. As in the normal course of business, banking secrecy laws do not permit the disclosure of clients, the reported NPAs are the only public indicator of the bank’s credit risk management. However in 2013, Deccan Chronicle Holdings became a celebrity fraud case and the banking industry’s exposure was made public. Interestingly, in this high risk company, as compared to Canara Bank’s Rs Rs 347 crores and IDBI Bank’s Rs 263 crores exposure, ICICI Bank had Rs490 crores, Axis Bank Rs400 crores, Yes Bank Rs194 crores and Indusind Bank and Kotak Bank Rs100 crores each. In this particular case, not only did new private sector banks have exposures but two of them had lent the highest to the company.

Private banks appear to enjoy a charmed regulatory environment. In May 2013, an investigation by the online media firm, Cobrapost, showed officials of both private and government banks soliciting clients for laundering black money and offering bank lockers to store the black money. The sting videos revealed these practices to be so widespread, even systemic, and not the work of rogue employees. Rajiv Takru, the then Union banking secretary, remarked in an interview with CNBC-TV on 14 March 2013, “What worries me about the whole thing, everybody in these sting operations is coming out with a same kind of response, although it is carried out at a number of places. If these are actually bank employees, this would mean a remarkable coincidence that these people are doing it individually and coming out with the same reaction.”

Nevertheless, the Reserve Bank of India merely fined 25 banks on the lesser charge of not complying with Know Your Client (KYC) norms: Axis Bank and HDFC Bank were fined the most, at Rs 5 crores and Rs 4.5 crores respectively, while government banks like State Bank of India, Canara Bank, Bank of Baroda, Indian Overseas Bank and Bank of India were each fined Rs3 crores. The quantum of fines suggests the problem was more severe in Axis and HDFC Banks as compared with the government banks, most of whom have a much larger branch network than the private sector banks. The banks happily paid the trivial fines, while the senior management of the implicated banks were not held responsible by the regulator despite the online videos revealing that the problem was systemic and not the work of rogue employees.

DLF’s accomplices

Let alone journalistic exposes, even findings of other regulatory bodies do not seem to carry weight with the RBI. The Securities and Exchange Board of India (SEBI) order of October 2014 found the real estate giant DLF to have engaged in “sham transactions” to “camouflage the association of DLF with its three subsidiaries.” SEBI found the company guilty of “active and material suppression of material information to defraud and mislead investors.” DLF appealed the order; but what is of interest here is what SEBI said of Kotak Bank. Kotak Bank gave personal unsecured loans to the key management personnel (KMP) of DLF, who in turn gave loans to their spouses; they in turn bought out the shareholdings of DLF in its subsidiaries. As a result of these sham transactions, the three subsidiaries of DLF were no longer reported as subsidiaries — the ownership had changed hands, to the wives of the KMP of DLF.

The SEBI order revealed a similar pattern for 355 DLF subsidiaries, although it did not say who financed the transactions. While Kotak Bank provided the personal loans, its subsidiary, Kotak Mahindra Capital Company, was a part of a consortium of eight lead investment bankers for the DLF initial public offering. The offer certified that these 355 entities owned by wives of KMP of DLF were not DLF subsidiaries. Strangely, since the SEBI order, the RBI and SEBI do not appear to be concerned that a commercial bank is facilitating financial transactions to disguise the ownership of subsidiaries; nor that the bank’s investment banking subsidiary is introducing such companies to the capital market. Since the SEBI order, there has been no news that the regulators have penalised Kotak Bank or Kotak Capital, or that Kotak Bank employees involved in the sham transactions have been disciplined.

The new private sector banks report significantly higher fee income than government banks. A part of it can be explained by their selling of third party products like insurance. However, the Cobrapost expose and the SEBI order on DLF provide a possible insight on the business model of these banks and the drivers of their profitability. The normal banking customer, being cost conscious, would be reluctant to pay fees, but those engaging in questionable activities would pay handsomely to disguise their activity. The media and the vast tribe of analysts appear disinterested in probing the sources of the high fee income of new private sector banks. While banks publicly claim to maintain the “highest standards of integrity” the Cobrapost online videos and the SEBI order on DLF depict otherwise, and the onus is on the regulator to crack down on such practices.

Never a rainy day

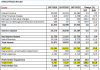

The divergent performance of the Indian banking sector was reflected in the fourth quarter (Q4 FY2015) earnings: 11 private sector banks posted a robust 35 per cent rise in net profits while 10 government banks declared a 59 per cent fall in net profits. (Business Standard, May 14, 2015) No doubt private banks are more profitable but exactly how are private banks doing so well, when the economy is not?

Strangely, despite corporate sales growth decelerating, industrial growth remaining anemic (2.8 per cent for 2014-2015) and a general squeeze on corporate cash flows, the private sector banks with significant exposure to Indian companies appear to be immune to the general economic slowdown. Private sector banks attribute their performance to better credit appraisal and monitoring and stringent asset recovery procedures, resulting in superior asset quality. For example, in 4QFY2015, ICICI Bank, the largest new private sector bank by assets, reported gross and net impaired (non-performing plus restructured standard) loans of 6.5 per cent and 4.4 per cent of total loans respectively, while Punjab National Bank, the largest of the nationalised banks, reported gross and net impaired loans of 16.3 per cent and 14.2 per cent respectively.

If the business media and analysts were to probe deeper, they would detect some highly questionable practices adopted by some private sector banks in reporting low poor quality loans.

In the current industrial slowdown, many corporate projects (the setting up of new capacities) financed by bank term loans are stuck for diverse reasons and companies have been unable to commence commercial production. As cash flows for the project will commence once commercial production starts, the date of commercial production is extremely important. As the projects are unable to achieve completion, some of the private sector banks go so far as to extend the date of commercial production by backdating credit committee meeting minutes. This is, to put it very mildly, highly irregular. By extending the date of these projects in this manner the banks are able to classify the loans as standard and not non-performing even after the original date of commercial production has past.

Ever-greening loans

The practice of lending a defaulting borrower more money, so that the loan does not have to be classified as non-performing, is called ‘ever-greening’. However, such practices could be noticed by the regulator during onsite inspection, so certain private sector banks adopt another innovative practice: when a promoter-controlled company is about to default on a loan, the bank provides a loan to another company managed by the same promoter which in turn lends the funds to the company which was about to default. The company is able to service its loan, and the bank can continue to claim the debt is not bad.

Private sector banks having foreign branches have used dubious methods to keep loans standard. In the case of a prominent infrastructure company which was awarded a large foreign contract, the loan was financed by a private sector bank’s Singapore branch. When the company was about to default on its loan, the bank extended a further loan from its Dubai branch, the proceeds of which were used to service the Singapore branch loan. Since different foreign destinations and regulators were involved it escaped the notice of regulators. However, the problem has become so extensive that the Monetary Authority of Singapore reportedly instructed Indian banks operating in Singapore to desist from financing Indian companies.

While even government banks resort to “ever greening” to report lower non-performing loans, it is undertaken by select individuals and done on a much lower scale. In certain private sector banks, however, it appears to be systemic. The absence of the Central Vigilance Commission, a compliant board of directors and the existence of lucrative performance incentives in private sector banks (in the form of increments, bonuses and disproportionate stock options granted to senior management) encourage such practices.

RBI must regulate

The RBI also lends a helping hand in allowing banks to report higher profits. ICICI Bank in 4QFY2015 reported a net profit growth of 10 per cent to Rs 2,922 crores but a note to accounts stated that with the regulator’s permission the bank had reversed Rs 929 crores of interest income till FY2008 as a direct deduction from reserves (in a single quarter as against RBI allowing it over three quarters) instead of reducing the profit in 4QFY2015. If the RBI had not given this largesse, ICICI Bank’s 4QFY2015 net profits would have declined instead of the rise it reported. The regulator apparently did not seem to mind that the bank had inflated its income, yield on credit, net interest margin (interest income less interest expenditure/average interest earnings assets) and profits till FY2008 and that it is disclosed to shareholders and the public after six long years.

Indian companies are confronted with major issues: a demand slowdown impacting sales, unfinished projects set up at inflated costs, lengthening working capital cycle squeezing cash flows, and rising debt. Corporate India banks with both government and private sector banks, and hence problems in the corporate sector should impact the entire banking sector, as corporate loans form a significant component of total bank loans. Yet it is only government banks which report high non-performing loans and lower net profits, while private sector banks report low bad loans and higher profits.

The media may be excused for their softness towards private banks; not only are the latter big advertisers, but some media houses have stakes in them while promoters of banks have also stakes in media houses. More puzzling is the regulator’s feather-touch approach which permits these banks to continue to do business as usual.

(Hemindra Hazari is a Mumbai based financial analyst)