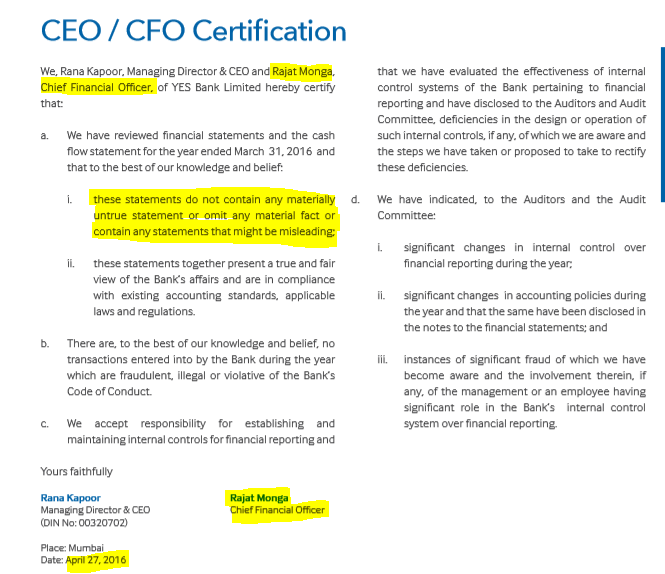

On May 12, 2017, Yes Bank, released its annual report for the year ended March 31, 2017 where the Reserve Bank of India’s (RBI) mandatory disclosure showed that for the year ended March 31, 2016, the bank’s gross non-performing assets (NPAs) was higher by 5.6x to Rs49.3bn instead of the reported Rs7.5bn. In percentage terms, the divergence exceeded that of Axis Bank and ICICI Bank.

Divergence in FY2016 Gross NPAs

Source: Banks

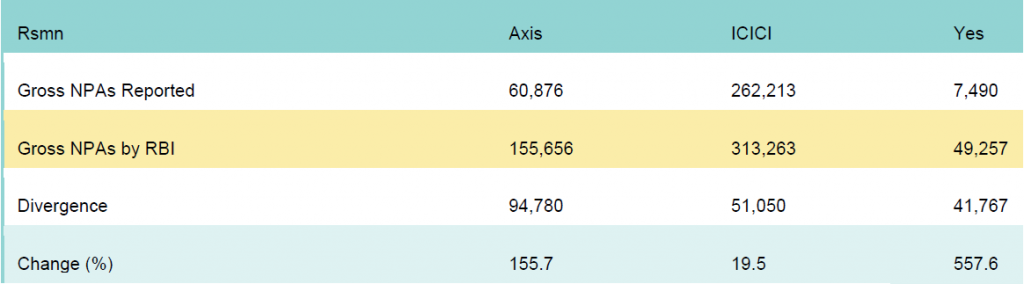

The huge under-reporting of its NPAs in FY2016 transformed critical parameters of valuation for Yes Bank – net NPAs to CET-1 (Common Equity Tier-1 capital) shot up from 2% in the audited number to 27% in the revised number, consequently adjusted book value (ABV, assuming 60% haircut for net NPAs), a key indicator used by analysts declined by 19% to Rs224 from Rs276. In FY2015, the bank’s ABV was Rs272 and hence the revised number for FY2016 had declined by 17.6%. A timely disclosure of such a deterioration will have resulted in a change of perception of the bank but the senior management of the bank in its wisdom withheld this critical disclosure till the release of its FY2017 annual report.

Lack of Transparency & Misleading Commentary by Senior Management

The senior management at Yes Bank, had cloaked the state of its asset quality in FY2016 with reassuring words providing comfort to the shareholders and the public. Yes Bank’s FY2016 annual report in a section on “robust risk management” stated,

“The risk management culture at YES BANK is top-down and bottom-up… The effectiveness of YES BANK’s risk governance was reflected in best-in-class indicators – the Bank’s Net NPA…was among the lowest in the industry at 0.29% even in an economically challenging FY 2015-16.”

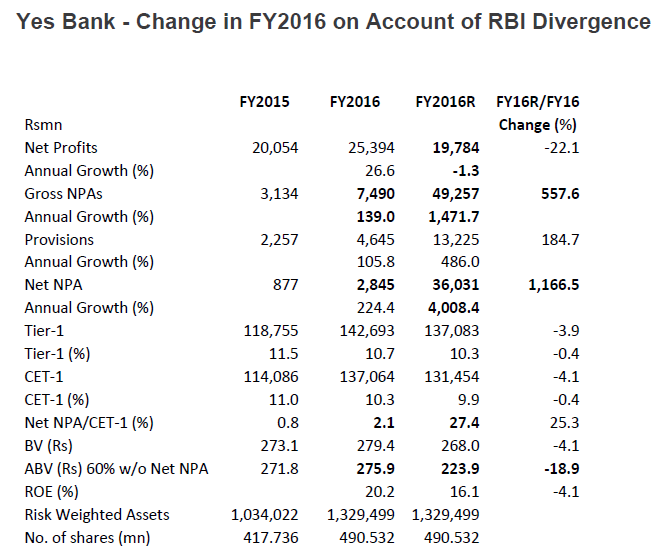

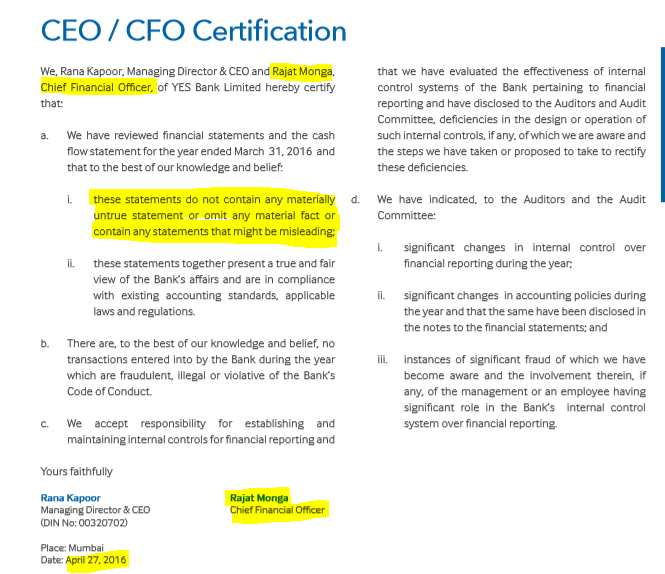

The CEO and CFO even provided an impressive certification of conforming to Yes Bank’s Code of Conduct and Ethics.

Source: Yes Bank Annual Report FY2016 p. 173

We now know the hollowness of their “true and fair” claim to shareholders as the revised net NPA for FY2016 was 3.7% as compared with the reported 0.29%. More alarmingly, Yes Bank did not mention the RBI divergence in the risk factors in its preplacement document for a qualified institutional placement of US$750mn which closed on March 29, 2017 at a price of Rs1,500 per share which was lead managed by CLSA India Private Limited, DSP Merrill Lynch Limited, IIFL Holdings Limited and Motilal Oswal Investment Advisors Private Limited.

Lead merchant bankers are required to undertake a thorough due diligence and such a huge under-reporting of Yes Bank’s FY2016 NPAs should have been disclosed in the preplacement document. Institutional investors in the issue may suffer losses if Yes Bank’s share price collapses and they may initiate legal proceeding against Yes Bank and its lead managers for this critical non-disclosure.

Even during the 4QFY2017 results analysts conference call , on April 19, 2017, Rajat Monga, (CFO), Yes Bank never revealed the quantum of NPA divergence and instead cleverly stated,

“There has been a recent circular issued by RBI on account of divergences in asset classification and provisioning so the bank has been able to incorporate all the financial impact rising out of the said circular in the current reported numbers…I will reiterate, divergence has been fully taken care of in this current [FY2017] financial presentation, our financials fully incorporate the divergence ask of RBI.”

Hence nobody suspected that the quantum of divergence was significant for FY2016.

Indeed, even in its latest FY2017 annual report, no mention or explanation is provided in the ‘Management Discussion and Analysis’ or in the ‘Directors’ Report’ for the divergence in FY2016 NPAs and whether the board conducted an exercise in determining accountability. When there is such a significant NPA divergence, the needle of suspicion points toward rampant ‘evergreening’ and the RBI appointed P.J. Nayak Committee to Review the Governance of Boards in India (May 2014) in its report stated,

“[if] significant evergreening is detected by RBI supervisors, it must mean that evergreening is wilful, with support from sections of the senior management of the bank.”

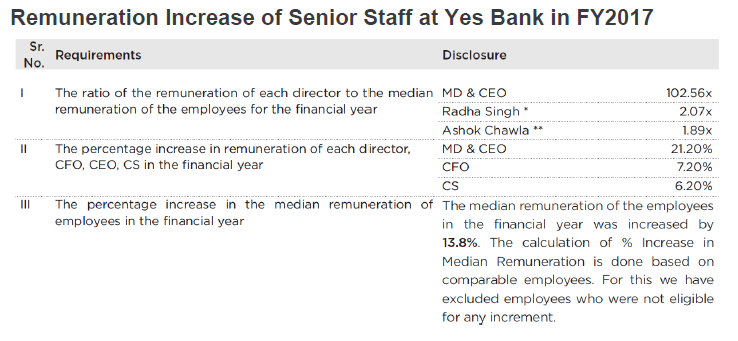

The integrity of Yes Bank’s accounts is primarily the responsibility of Rana Kapoor, CEO and promoter, Rajat Monga, CFO, the audit committee and the auditor, Viren H Mehta (same individual who also certified Axis Bank’s FY2016 and FY2017 accounts), partner Batliboi & Co. (a member firm of Ernst & Young). Such a huge divergence in NPA should have resulted in the removal of all the concerned individuals in FY2017 but instead not only did they retain their positions (exception of auditor as the term was over) but the key personnel were rewarded – Rana Kapoor’s remuneration increased by 21.2% and Rajat Monga’s by 7.2% (median remuneration increase of employees was 13.8%).

Source: Yes Bank Annual Report FY2017 p. 164

When the news finally broke on May 12, on the quantum of Yes Bank’s NPA divergence and the share price fell by 5.5% to Rs1,491 the bank issued the following statement,

“The reported divergence was for the prior period ended FY 15-16. With ongoing remedial actions undertaken by the Bank during FY 16-17, there have been several reductions/ exits/partial sale to ARCs/improvements in account conduct which significantly reduced the overall gross NPA outstanding to Rs 1039.9 Cr [Rs10.39bn] as on March 31, 2017.”

The bank’s lame defence of saying that out of the total RBI divergence of Rs41.8bn in FY2016, only Rs10.4bn became NPA in FY2017 and hence is not a major issue is irrelevant. As on March 31, 2016, the Rs41.8bn should have been identified by the bank as NPA and the necessary provisions charged to profits, subsequent status change to these accounts has no bearing for FY2016. Moreover, the reputation of its senior management is under a cloud and the same key individuals lack credibility when they state that the majority of the divergence has been resolved in FY2017.

It is a matter of grave concern when the board of directors and the banking supervisor does not take stringent action against the senior management of Yes Bank for this significant mis-reporting of NPAs. Such leniency may result in huge costs for an emerging economy like India as global credit rating agencies may de-rate India on grounds of fraudulent accounts and poor standards of transparency and corporate governance which may result in foreign capital outflows and a flight of deposits from poorly-managed private sector banks.

DISCLOSURE & CERTIFICATION

I, Hemindra Hazari, am a registered Research Analyst with the Securities and Exchange Board of India (Registration No. INH000000594) I have no position in Yes Bank securities mentioned in this report. Views expressed in this report accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This report does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this report comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this report or hold any specific opinion on the securities referenced therein. This report is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.