EXECUTIVE SUMMARY. The Reserve Bank of India’s (RBI) draft scheme for the reconstruction of Yes Bank is unlikely to restore the confidence of the bank’s depositors, especially its current and savings account (CASA) depositors, who are likely to desert the bank once the moratorium is lifted. Once a bank is put under a moratorium its deposit franchise is irrevocably eroded, as banking is all about trust, and that is lost when depositors are allowed to withdraw only Rs 50,000 (US$ 676). In such a situation, to prevent a run on deposits once the moratorium is lifted, Yes Bank should have been nationalised, or merged with a large government bank like State Bank of India (SBI) or with a credible private sector/foreign bank. Since the government and the RBI have been unable to achieve a merger with another bank, they have gone in for the proposed option of SBI holding 49% in the reconstituted equity of Yes Bank. To remain viable, Yes Bank requires an equity injection estimated at around Rs 214 bn (US$ 3 bn), which is difficult for any credible private sector entity or large foreign bank to deploy. The alternative of a SBI-led consortium of investors reviving the bank is unlikely to be viable once the moratorium is lifted.

During the moratorium, the asset quality of Yes Bank’s borrowers is likely to further worsen, especially for those who are mainly dependent on Yes Bank to finance their working capital. As per a CRISIL (a S&P Company) report, in the case of 210 companies, “Yes Bank’s share exceeds 40% of their aggregate CRISIL-rated bank facilities.” This will put further stress on the bank and on the financial system.

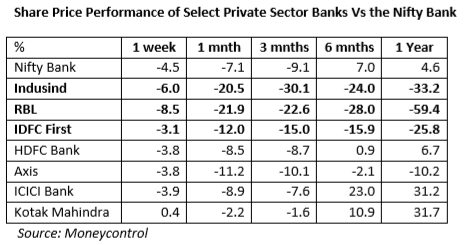

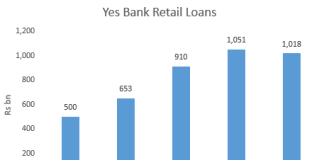

The failure of Yes Bank, with deposits of Rs 2,094 bn (US$ 28.3 bn) and loans of Rs 2,195 bn (US$ 29.7 bn) as of September 30, 2019 is likely to result in a loss of confidence in other private sector banks which are facing asset quality issues. The share price declines of Indusind Bank, RBL and to a lesser extent IDFC First Bank in the last 1 year make them particularly vulnerable.

When a large private sector bank fails, it is the responsibility of the government and the RBI to either merge the failed bank with a larger bank or nationalise the bank to restore depositor confidence in the economy. Unfortunately, the fetters of fiscal consolidation imposed by global capital and credit rating agencies have tied the hands of the Indian government. So when a large bank like Yes fails, the authorities avoid using the direct budgetary route, and instead choose to compel a bank like SBI to invest in the failing bank to restore confidence. The obsession with the fiscal deficit has contributed to the slowdown in the economy, and is likely to further weaken the banking system as the government abdicates its responsibilities, shoving them on to other state-backed players and thereby further lowering confidence in India’s strategic banking system.

Unless and until the trust in banking is restored through result oriented governance without the interference of the politicians and by disciplining the borrowers through a self corrective mechanism to make good the loan losses by levying some precautionary reserves the crisis seen in banking cannot be resolved for ever. Just rhetoric talks and looting the depositors and tax payers cannot have any lasting solution to the banking crisis.