Credibility issues have plagued Yes Bank’s asset quality disclosures in the earlier (year ending March 31, 2016) annual report, added to these concerns is a top heavy organisational structure with significant expansions and contractions in the “top management” category in the last 2 years without any explanation in the annual report. Contradictory data on its human capital have been presented in the bank’s latest (year ending March 31, 2017) annual report which raises more questions about the veracity of the data, the management presents to its stakeholders. Investors, therefore, have to exercise caution when analysing data in Yes Bank’s annual reports.

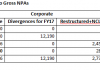

Shareholders of Yes Bank have barely recovered from the shock of the huge divergence in the bank’s FY2016 non-performing assets (NPAs) between the audited accounts and the regulator’s inspection when this writer has observed some major discrepancies in their “top management” data disclosed in the FY2017 annual report.

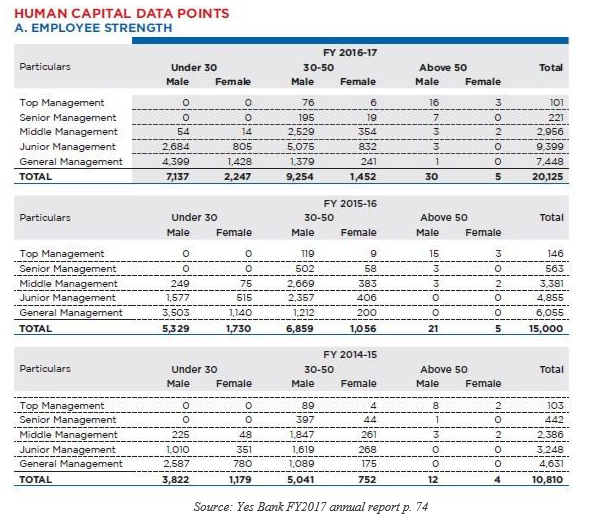

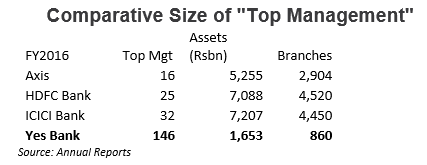

In the FY2017 Yes Bank annual report, the bank disclosed 5 layers of management; top, senior, middle, junior and general. The human capital data disclosed throws up two major issues.

- The large number of staff classified in top management which exceeds the number in much larger banks

- Discrepancy in Yes Bank’s own data, one set of tables reveals significant expansion and contraction in “top management”, while another set of data contradicts this sharp volatility

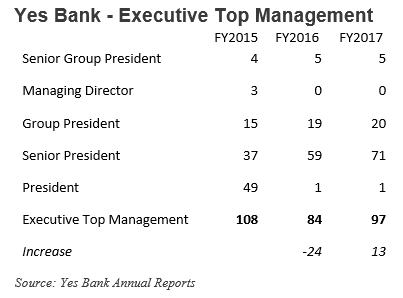

In the last 3 years, Yes Bank has over 100 staff in its senior-most management cadre which it calls “top management”. Larger banks have much smaller number of staff at the peak of their organisational structure as compared with Yes Bank e.g. in FY2016 ICICI Bank disclosed 32 while HDFC Bank and Axis Bank reported 25 and 16 respectively in their “top management” category. Why the much smaller Yes Bank needs to be so top heavy remains a mystery.

Discrepancy in human capital data

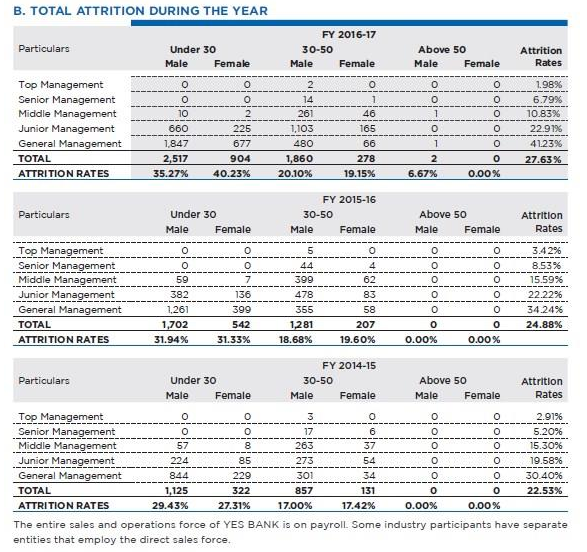

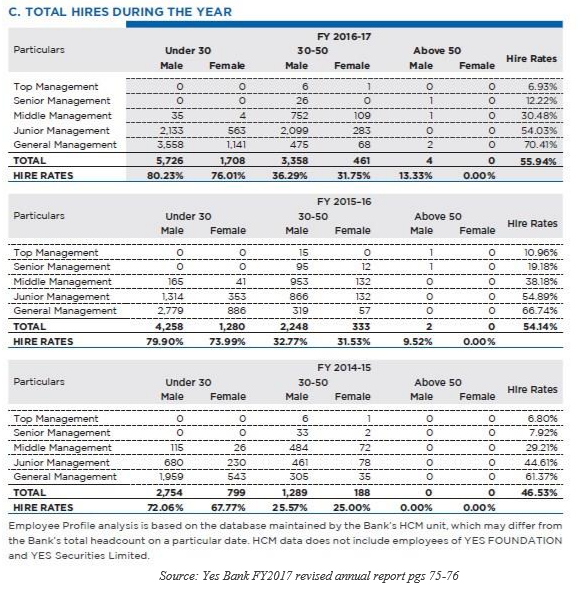

In Yes Bank’s FY2017 annual report on page 74, in the top management category, the number increased from 103 in FY2015 to 146 in FY2016 and came down to 101 in FY2017. For a bank the size of Yes Bank, adding 43 staff in its top management cadre and in the subsequent year reducing it by 45 individuals is a notable event. However, in the ‘ B and C’ tables titled attrition and hires shows a divergent number e.g. in FY2017 the net change in top management was +5 as compared with the -45 in ‘Table A’.

Moreover, in the original FY2017 annual report there were some more discrepancies in the % variance rate in attrition of the total workforce not tallying with the % attrition rate in the individual segments. A detailed questionnaire was sent to Yes Bank to understand the discrepancies in their human capital tables. Yes Bank responded with the following statement:

Question (xvi) – pertaining to Human Capital & Employee strength details

- [Tables] A, B & D – We would like to bring to your notice that the decline in Top Management and Senior Management numbers being reflected in the Annual Report is owing to the fact that YES BANK has reclassified its Management bands during FY 2016-17. This re-classification has also impacted the numbers in the Junior Management and General Management bands.

- [Table] C – The overall attrition rate of 24.88% is correct and the absolute numbers mentioned under the various heads are also correct. The discrepancy in the attrition rates is due to a typographical error, which we have now corrected in the Annual Report available at :https://www.yesbank.in/about–us/investorsrelation/financial–information/annual–reports . Please note that this is not a statutory disclosure and YES BANK has declared these numbers in the interest of transparency and in accordance with the GRI disclosures for our Sustainability Review section. We thank you for bringing this to our notice.

Yes Bank has devoted 11 pages on human capital in its FY2017 annual report but nowhere is it mentioned that the bank has reclassified its management bands. A reclassification of its management structure especially at the top of the hierarchy is a major exercise in human resource management which should have been disclosed to shareholders especially when the bank devotes so much attention in its annual report to human capital. And if indeed a reclassification took place, it implies that the structure was changed in FY2016 and it was again changed in FY2017 to explain the sharp expansion and contraction in two years.

Even though, Yes Bank is stating that there was a reclassification it appears that the top management number of 146 in FY2016 may have been an error as in its annual reports, Yes Bank devotes considerable space to providing photo profiles of its top management. Analysing the photo profiles data reveals that in FY2016, the number declined from 108 in FY2015 to 84 in FY2016 and it subsequently increased to 97 in FY2017. The photo profiles of its top management also contradict data in “Table A”.

Following this writer’s queries, Yes Bank had to change its recently released annual report and upload a rectified annual report which does not reflect well on the management, in fact-checking data that it is presenting to shareholders and the public.

The significant NPA divergence detected by the banking regulator in FY2016 casts the management of Yes Bank in poor light and combined with the discrepancies in the human capital disclosures in the FY2017 annual report indicates the quality of information provided to shareholders. Investors, therefore, must exercise caution when analysing Yes Bank’s disclosures.

DISCLOSURE & CERTIFICATION

I, Hemindra Hazari, am a registered Research Analyst with the Securities and Exchange Board of India (Registration No. INH000000594) I own shares in HDFC Bank & ICICI Bank referenced in this Insight. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.