On July 27, 2017, the Reserve Bank of India (RBI), the banking regulator, probably responding to the significant underreporting of non-performing loans for the year ended March 31, 2016 (FY2016) by the new private sector banks, issued a notification. This notification may disrupt the comfortable relationship enjoyed by the ‘Big Four’ audit firms with the new private sector and foreign banks. The existing policy mandates that, after an auditor completes a four-year period, he/she is compulsorily rested for a subsequent two years. However, the RBI notes that the object of this policy had been defeated by bringing back the same auditor after two years. In some of these banks, not only did two audit firms take turns to audit the bank, but the same individual partner in the audit firm was back in the saddle. Now the RBI has lengthened the rest period to six years from the earlier two years. While this is a positive step, this writer believes that the individual auditor partner should be regularly changed even within the four-year period. It is also extremely disappointing that none of the regulatory agencies till date have taken stringent action against the chief executive officers (CEO), chief financial officers (CFO), audit committees of the boards and the auditors of the banks whose accounts diverged grossly from the RBI’s own findings.

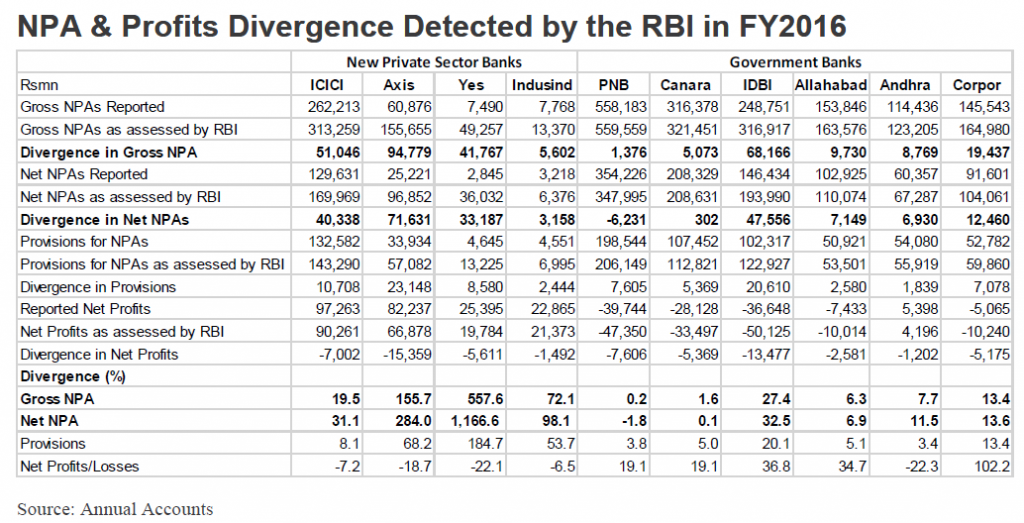

In their annual accounts for the year ended March 31, 2017 (FY2017), the RBI compelled banks to disclose significant divergence between their reported and audited non-performing assets and as detected by the RBI for FY2016. The list of banks which reported significant divergence included banks which have considerable foreign and institutional ownership and are covered by numerous analysts. The responsibility for the serious offence of misreporting accounts lies primarily with the CEO and subsequently with the CFO, audit committee of the board and the auditor.

On July 27, 2017, the RBI issued a notification to private sector and foreign banks informing them that henceforth, instead of the earlier system of appointing an audit firm for four years and thereafter resting the same firm for two years, the rest period has been extended from two years to six years. The notification specifically highlighted

- It has been observed in a review of the appointment of statutory auditors in private sector/foreign banks that, in some cases, the same audit firm was reappointed after a gap of two years’ rest. In a few other private sector/foreign banks, the immediately preceding statutory auditor firm was appointed on completion of the four year tenure of the current statutory auditor. The statutory central audit responsibility in such banks thus remained confined to two audit firms which were appointed on a cyclical basis [bold ours].

- The Rest and Rotation Policy in appointment of SCAs for banks has been mandated in order that audit functions are looked at afresh, as a new team is likely to examine the issues in a bank from a different perspective. The policy also aims to deter the auditors and auditee from establishing a comfortable relationship that may lead to compromise in strict adherence to audit principles

- To address the above and ensure that rest and rotation policy is followed in letter and spirit, it has been decided that, henceforth, an audit firm, after completing its four year tenure in a particular private/foreign bank, will not be eligible for appointment as SCA of the same bank for a period of six years.

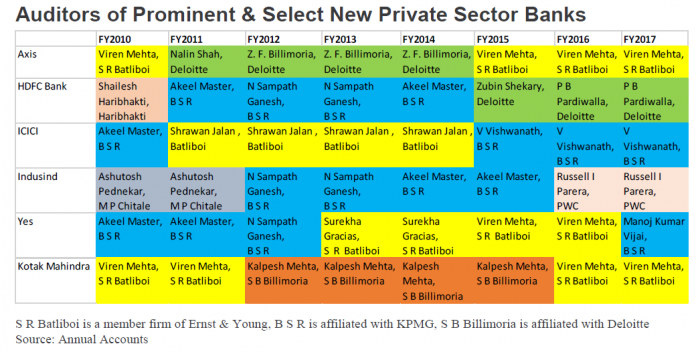

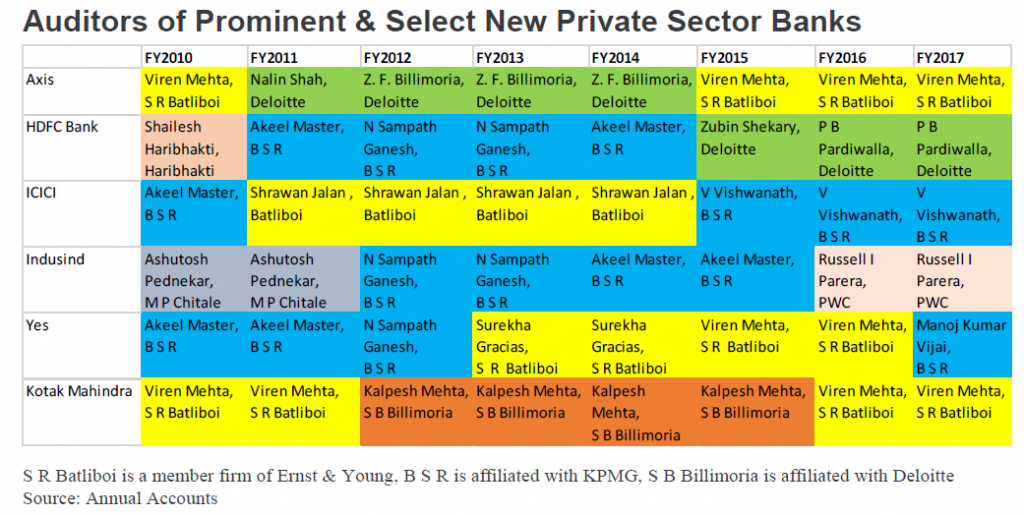

An analysis of six prominent private sector banks; Axis, HDFC Bank, ICICI, Indusind, Kotak Mahindra and Yes reveals that with the exception of HDFC Bank and Indusind in the last 8 years, the banks have repeated not only the same audit firm but also the same partner (barring ICICI Bank). Viren H. Mehta, partner, S.R. Batliboi, a member firm of Ernst & Young has been repeated as auditor at Axis Bank and at Kotak Mahindra Bank. More importantly, he was the auditor in FY2016 at Yes Bank where the gross NPA divergence was 558% and at Axis Bank where the NPA divergence was 156%. Collectively in the two banks he overlooked gross NPAs of an astounding Rs 137 bn (around US$ 2.1 bn). In India, NPA identification is rule-based and there is limited space for misinterpretation for asset classification.

Since FY2012, the Big Four (Deloitte, PWC, Ernst and Young and KPMG) audit firms have dominated the audits of the new private banks, as these banks have significant foreign ownership and have raised equity in foreign markets, and hence require a Big Four auditor for global credibility. Some prominent domestic audit firms have tied up with the Big Four: for example, B S R is affiliated with KPMG, S.B Billimoria is a member firm of Deloitte and S.R. Batliboi is a member firm of Ernst & Young. Credibility, though, is a matter of perception, as in FY2016, the Big Four audit firms overlooked gross NPAs of Rs 193 bn (around US$ 2.9 bn), or a 57% divergence collectively in Axis, ICICI, Indusind and Yes Bank.

It is extremely unfortunate that the regulatory agencies, the RBI (banking regulator), Securities and Exchange Board of India (SEBI, capital market regulator), and the Institute of Chartered Accountants of India (ICAI) have till date not penalised any senior individual in the banks or the partners in the audit firms responsible for the huge divergence in NPAs in FY2016. The lack of punishment so far raises concerns of ‘regulatory capture’ by the private sector banks.

The one positive outcome of the NPA divergence is that RBI has increased the rest period to six years from two years. However, it should also ensure that the same individual partner of the audit is changed even within the four year audit period. It also remains to be seen whether the banks respond by appointing audit firms outside the Big Four as a result of the change ordered by the regulator.

DISCLOSURE & CERTIFICATION

I, Hemindra Hazari, am a registered Research Analyst with the Securities and Exchange Board of India (Registration No. INH000000594). With the exception of HDFC Bank & ICICI Bank, I have no position in any of the securities referenced in this note. Views expressed in this note accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This note does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this note comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this note or hold any specific opinion on the securities referenced therein. This note is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.