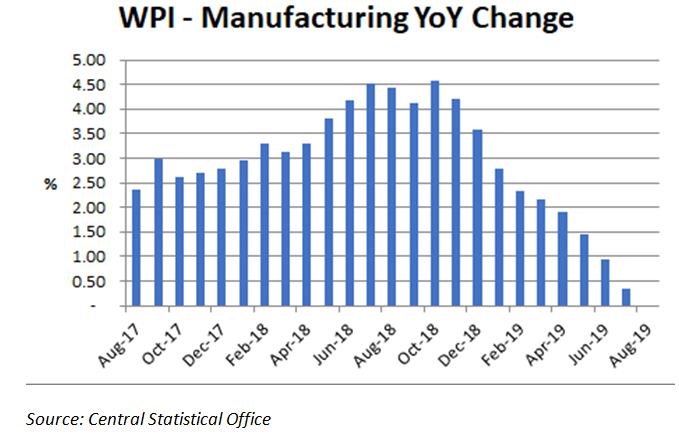

EXECUTIVE SUMMARY. The Finance Minister, Nirmala Sitharaman has announced the slashing of effective corporate tax to 25.17%, inclusive of all cesses and surcharges, effective from April 1, 2019, for domestic companies. Along with other relief measures this will result in a revenue forgone of Rs 1,450 bn (US$ 20.4 bn). This announcement resulted in a huge surge in the stock market on the expectation of the increase in corporate profits. The critical issue is whether this significant relief to corporate earnings will result in a boost to aggregate demand, investment, employment and sustainable economic growth in the economy. While shareholders will benefit handsomely from the reduction in corporate taxes and increase in profits it is doubtful whether the private corporate sector in a depressed economy where the Whole Price Inflation (WPI) for manufactured goods for August was 0% will play a counter cyclical role and invest in fixed assets.

Recent Posts

Most Popular

Is Yes Bank Providing Custodial Services to RInfra for Its Valuable Property?

A high-profile bank collapses on account of high-risk, bulky non-performing corporate loans. With the intervention of the Reserve Bank of India (RBI), the errant...

Karnataka Bank board showed who’s the boss

As Hemindra Hazari, a Sebi-registered independent research analyst, has pointed out in his report, “Bank boards have clear-cut policies on the approval powers of all...

Economist – Prof R Ramakumar’s Speech at Tarakeswar Chakraborti Memorial Lecture – 1

https://www.youtube.com/watch?v=l72vK9c1RFg

Hemindra Hazari Speech at Tarakeswar Chakraborti Memorial Lecture – 2

https://www.youtube.com/watch?v=eXiLiqh6tuo

Memorial Lecture Held on June 14, 2025, at the Walchand Hirachand Hall, Indian Merchants Chamber, Churchgate, Mumbai

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and...

Official Trailer | The Great Indian Illusion | a Film By Varrun Sukhraj ।...

https://www.youtube.com/watch?v=nuJUMCz7yI8

Couldn’t agree more …

Its nice to hear a sane voice amidst all the happy chirping which is all praise of the FM for her sops she rolled out for corporate.

While, corporate tax reform was due and is welcome…..

But I fail to.understand….when there are signs of economy under stress due to slowdown in consumption…. you could have done somehting that gets more money in hands of people who spend….I don’t see how this will ever help.

I hope something gets done personal income tax too…( people spend when they feel financially secure their future)