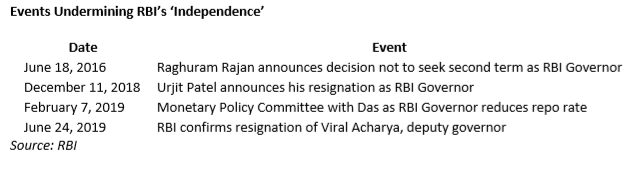

The resignation of Viral Acharya, deputy governor, Reserve Bank of India (RBI) six months before his term was to end, was preceded by the resignation of Urjit Patel. Earlier, Raghuram Rajan failed to get a second term as RBI governor. However, these developments did not bring on the “wrath of the financial markets” prophesied by advocates of central bank independence. Acharya’s days were numbered after his immature public rebellion against the government and the resignation of then RBI governor Urjit Patel. With the arrival of former government bureaucrat, Shaktikanta Das, as governor, the outlook of the monetary policy committee has also drastically changed from a hawkish stance on inflation to a dovish outlook. With the about-turn of the alpha hawk on the committee, Michael Patra, executive director, RBI who now favours lowering interest rates, there remains just one lonely hawk on the committee, and the government is firmly in control of the ‘independent’ monetary policy committee.

Contrary to warnings in the literature, the early departures of central bankers who had championed the cause of a central bank independent of the government, and the likely takeover by the government of monetary policy committee, have not ravaged the Indian financial market. The relatively benign reaction by the capital market to this heresy indicates that, when push comes to shove, the market is more influenced by international liquidity and interest rate differentials than by the host country’s perceived adherence to principles of central bank autonomy. On the eve of the Union Budget, perhaps the government may want to test whether the market can similarly absorb an expansionary fiscal policy to stimulate growth along with a lower interest rate regime.

Reserve Bank of India deputy governor Viral Acharya’s resignation, six months before his term was to expire, generated the usual commentary of concern for the central bank’s autonomy and independence from the government. Some commentators remarked that a dissenter had been forced out from the RBI. By law, the RBI is not independent and is indeed subservient to the government, and such operational autonomy and independence as it enjoys is de facto (flows from past practice and convention) and not de jure (enshrined in the law).

Dr Acharya is best known for his ill-advised public speech of October 26, 2018, “On the Importance of Independent Regulatory Institutions – The Case of the Central Bank”, where he threatened the government in his concluding remarks:

“Governments that do not respect central bank independence will sooner or later incur the wrath of financial markets, ignite economic fire, and come to rue the day they undermined an important regulatory institution.”

Acharya was fortunate that the government did not dismiss him for such an alarming and immature public statement, unbecoming of a central banker. However, his days were clearly numbered, and his resignation was merely a matter of time.

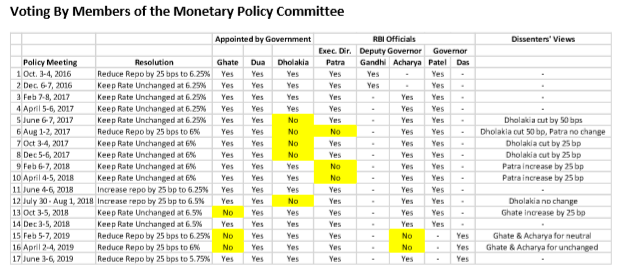

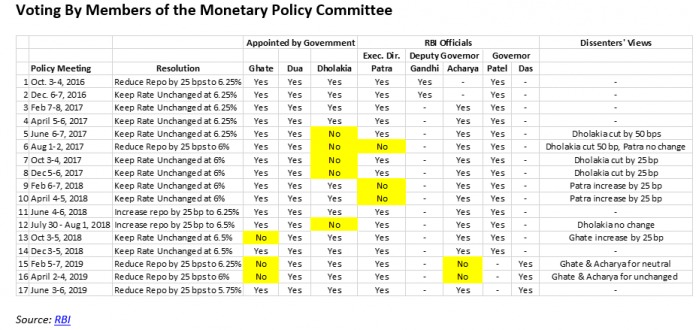

It is misleading to talk of Acharya as a “dissenter” per se. The voting pattern of the individual members of the monetary policy committee also reveals that other members dissented far more than Acharya, and that he was in agreement with all the decisions taken by governor Urjit Patel. It was with the arrival of Shaktikanta Das as governor that Acharya dissented on two of the three occasions, as did Chetan Ghate, Professor, Indian Statistical Institute.

The main dissenter on the Monetary Policy Committee since its constitution has been Ravindra H. Dholakia, former Professor, Indian Institute of Management, Ahmedabad, who has dissented on 5 occasions, all during the tenure of Urjit Patel as governor. Dholakia has been the chief dove, as his dissent has been for maintaining a soft interest rate policy. The second position for dissent is a tie between two hawks, Michael Debabrata Patra, executive director, RBI who is also responsible for the monetary policy department in the RBI, and Chetan Ghate. Both dissented thrice, arguing for a higher interest rate policy. Acharya, having dissented only twice, comes in third place. Pami Dua, the third member appointed by the government, has never dissented with the governor, whether that be the hawkish Patel or the dovish Das. Interestingly, the committee as a whole has always gone along with the RBI governor, and has never over-ruled the governor’s decision.

Source: RBI

Michael Patra, who was even more hawkish than Governor Urjit Patel, did a turnaround and became a dove under Governor Shaktikanta Das. It will be no surprise if he is rewarded for his change in outlook with the deputy governorship and replaces Acharya.

According to media reports, the two main candidates to replace Viral Acharya as deputy governor are Michael Patra and Sanjeev Sanyal, the principal economic adviser to the finance ministry who has advocated a soft interest rate policy. The government will obviously appoint an individual who will toe its line, which, in the current scenario, means a believer in a soft interest rate regime to stimulate economic growth, and not a diehard anti-inflation monetarist of the variety of Raghuram Rajan, Urjit Patel and Viral Acharya. These gentlemen also tended to dictate to the government to rein in the fiscal deficit.

In the likely scenario of a dove replacing Acharya as deputy governor and as a member of the monetary policy committee, the committee will have only Ghate as its sole resident hawk. In a span of 6 months, the monetary policy committee would have drastically changed from having 4 dedicated hawks (Ghate, Patra, Acharya and Patel) to a solitary hawk.

The early departures of Raghuram Rajan, Urjit Patel and Viral Acharya, central bankers who had publicly championed the cause of a central bank autonomous from the government and the effective take-over by the government of the monetary policy committee has not heralded the expected doomsday scenario as predicted by some commentators. It appears liquidity and interest rate differentials play a more decisive role in influencing financial markets than do theoretical considerations regarding central bank independence.

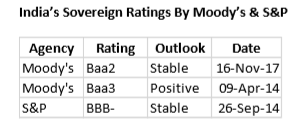

Pertinently, despite these developments, global credit rating agencies (CRAs), who have pressed for central bank independence from government, have not downgraded India. Indeed, Moody’s upgraded India’s sovereign rating from Baa3 with a positive outlook on April 9, 2014 to Baa2 with a stable outlook on November 16, 2017 despite Rajan not getting a second term as RBI governor. Either CRAs do not view these incidents as a significant erosion of RBI’s autonomy and independence, or they are outweigh by global liquidity and interest rate differentials which continue to make India an attractive destination for global capital. In which case the dire warnings of CRAs in effect served to lobby for deflationary policies, rather than representing real and imminent dangers. Equally, if international liquidity tightens and interest rates harden, even the most rigid adherence to the principles laid down by CRAs may not prevent capital from flowing out.

Source: Trading Economics

Although commentators prophesied financial apocalypse if the government undermined RBI’s autonomy, the early departures of two governors and one deputy governor, and the government effectively taking charge of the monetary policy committee, have not impacted the Indian market as yet. Similar predictions have been made against expanding the fiscal deficit, and yet, even though the government’s fiscal arithmetic has been challenged, to date there have been no capital outflows on account of a dodgy fiscal deficit. As India awaits the new Union budget, perhaps the government can test whether the market is willing to accept an expansionary fiscal policy.

DISCLOSURE & CERTIFICATION I, Hemindra Hazari, am a registered Research Analyst with the Securities and Exchange Board of India (Registration No. INH000000594). I have no position in any of the securities referenced in this note. Views expressed in this note accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This note does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this note comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this note or hold any specific opinion on the securities referenced therein. This note is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security

Thanks for finally talking about RBI’s Independence Quietly Buried, Without a Murmur from Credit

Rating Agencies. I Liked it!