EXECUTIVE SUMMARY

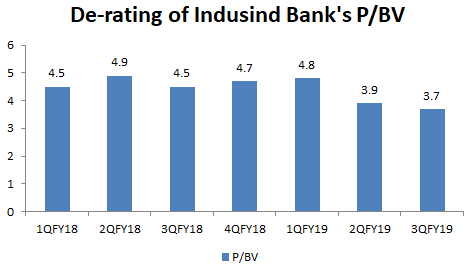

Indusind Bank’s reckless decision to provide a Rs 20 bn (8% of the bank’s capital) unsecured bridge loan to IL&FS, an insolvent infrastructure company has led to a significant de-rating of its valuation multiple. In the 3QFY2019 results call, Ramesh Sobti, the bank’s CEO believes that the bank will eventually need to provide only 40-50% of this exposure and the bank has currently provided only 26.5%. The bank’s guidance on this appears to be as optimistic as its initial appraisal when it disbursed the loan, without any apparent scrutiny of the company’s financials. Shareholders in the bank need to be more realistic and factor a 100% write-off on the unsecured IL&FS exposure and need to examine all the bank’s loans more carefully for similar high-risk lending. The glory days of this once fancied stock are over and a bleak future beckons.