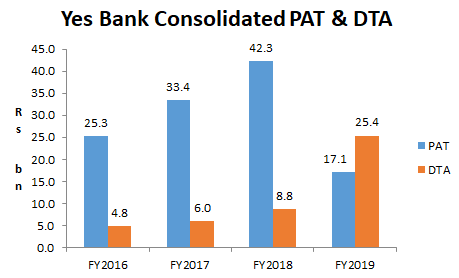

EXECUTIVE SUMMARY. Yes Bank’s loss in 4QFY19 would have been much higher, by Rs 16.6 bn, and its annual profit significantly lower, had it not been for the increase in the net deferred tax asset (DTA) of the same amount. The huge increase in the DTA partly offset the large provision the bank made for standard and non-performing assets. Although such accounting is permissible under regulatory norms, it inflates current profits, and depresses future profits. In the opinion of this writer, it is not a prudent practice. The management probably were of the view that reporting a larger loss than what they reported in the 4QFY19 would unnerve shareholders and depositors; as it is the stock market immediately reacted to the results with a 29% fall in the share price. The bank, though, has merely deferred the negative impact, and shareholders should be enlightened about the accounting treatment. The saving grace is that the new CEO is cleaning up the bank and its bad assets will become more transparent than in the past.

Recent Posts

Most Popular

Is Yes Bank Providing Custodial Services to RInfra for Its Valuable Property?

A high-profile bank collapses on account of high-risk, bulky non-performing corporate loans. With the intervention of the Reserve Bank of India (RBI), the errant...

Karnataka Bank board showed who’s the boss

As Hemindra Hazari, a Sebi-registered independent research analyst, has pointed out in his report, “Bank boards have clear-cut policies on the approval powers of all...

Economist – Prof R Ramakumar’s Speech at Tarakeswar Chakraborti Memorial Lecture – 1

https://www.youtube.com/watch?v=l72vK9c1RFg

Hemindra Hazari Speech at Tarakeswar Chakraborti Memorial Lecture – 2

https://www.youtube.com/watch?v=eXiLiqh6tuo

Memorial Lecture Held on June 14, 2025, at the Walchand Hirachand Hall, Indian Merchants Chamber, Churchgate, Mumbai

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and...

Official Trailer | The Great Indian Illusion | a Film By Varrun Sukhraj ।...

https://www.youtube.com/watch?v=nuJUMCz7yI8

First HDFCBANK, now YESBANK, is this another instance of both these banks following the same trajectory or is this a pre-cursor to an accepted practice in the private sector banks?

Banks resort to this to inflate profits, it is the role of the analysts & media to point out that it results in merely deferring the problem.

Banks resort to this to inflate profits, it is the role of the analysts & media to point out that it results in merely deferring the problem.