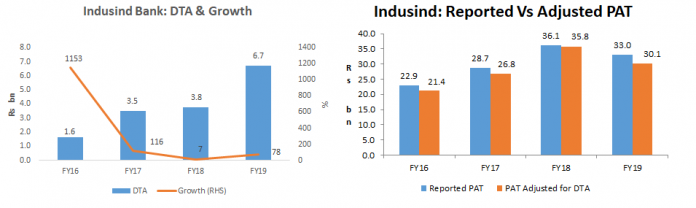

EXECUTIVE SUMMARY. Indusind Bank not only declared 4QFY2019 results far below consensus expectations, but FY2019 net profits have been inflated by a significant increase in net deferred tax asset (DTA). As usual, the business media and sell-side analysts have ignored the significance of the rise in DTA in inflating profits in the case of HDFC Bank, Yes Bank and now at Indusind Bank. The sell-side, in near unanimity, is bullish on a bank which reported two consecutive years of fudged accounts, and whose credit and risk management made an ill-advised, large unsecured loan to the insolvent IL&FS and the bank consistently guided for a much lower provision for this loan than warranted. The sell-side is, instead, enthused by the bank’s disclosure that its stressed exposure is only 1.9% of its loans. Such is the quality of analysis in an over-brokered market.

Sell-Side Analysts’ Blind Faith in IndusInd Bank Need Not Blind Investors

This note was appreciated by my institutional clients with a prominent Hong Kong-based institutional investor using it to train their in-house analysts on how to cross check senior management commentary.

Very true…..InduInd will have the same fate as of YES Bank…..in next quarter….