The appalling record of incompetence, and likely worse, by India’s credit rating agencies (CRAs) continues to lengthen. The latest instance is the double default of commercial debt obligations (on June 27 and July 1, 2019) by Cox and Kings, a tour and travels services company. In this case the CRAs were CARE and Brickwork, who ignored problems which could have been easily identified at an earlier stage. Although Cox and Kings is not a prominent company, this default should be seen in the light of the debacle at IL&FS, and the forced leave of Naresh Takkar, the long serving CEO of ICRA (a Moody’s subsidiary). These events underline the fact that India’s CRAs are unfit and unaccountable. Investors in rated debt paper have to analyse investments independent of the CRAs, as they cannot be relied upon.

On June 24, 2019, CRAs, CARE and Brickwork reaffirmed their highest rating of CARE A1+ and BWR A1+ respectively for Cox and Kings’ commercial paper (CP) issue. Brickworks highlighted,

“High Receivables. The receivables of the Company has increased from Rs. 1981 Crs [19.81 bn] in FY 18 to Rs. 2418 Crs [24.18 bn] in FY19 on consolidated basis resulting in tied up of working capital… As per the clarification from management the receivables is on account of B2B business which generates higher profitability.”

Both CRAs also gave a ‘Stable’ outlook, which indicates a low possibility of rating change over the medium term. Yet a mere 3 days later, on June 27, Cox & Kings defaulted on Rs 1.5 bn of payments on CP and on July 1, 2019 the company again defaulted on Rs 500 mn CP payment. These defaults were despite the company’s consolidated audited accounts for March 31, 2019 reporting cash and cash equivalents of Rs 10.8 bn and a further bank balance of Rs 7.5 bn. The market was surprised, as the accounts were finalised on May 30, 2019 and the aggregate CP defaults could have been easily met through the cash and bank balances held by the company as on March 31.

Post the default on June 27, Brickwork on June 28 downgraded Cox and King’s CP from BWR A1+ to BWR D and the non-convertible debt issue from BWR AA-(Stable) to BWR C. Although the CRA emphasised that the company had adequate cash and bank limits to settle the CP payment they were at a loss to explain how and why the company had defaulted. CARE also downgraded the company’s Rs 3.75 bn CPs to ‘D’ rating from A+, and Rs 16.85 bn CPs to A4 from A+. The issue remained: did the company deserve to be rated as A1+, the highest grade of rating for CP prior to the default?

Analysing the Cox and King’s FY2018 financials, CARE in its report dated July 24, 2018 stated,

“Satisfactory operating performance; comfortable liquidity position: The company reported an improved operating margin of 14.03% in FY18 as against that of 12.35% in FY17 on account of better operating efficiency…The company also had a comfortable liquidity position marked by healthy cash and cash equivalents of Rs.1619 crore [16.19 bn] as on March 31, 2018…”

Similarly, Brickwork after analysing the consolidated accounts of Cox and Kings for FY2018 in a report dated August 13, 2018, stated,

“Healthy Financial Risk Profile. The company’s healthy financial risk profile is reflected in its comfortable coverage indicators and liquidity position.”

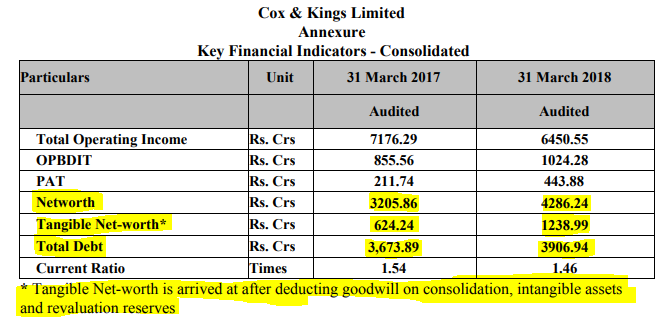

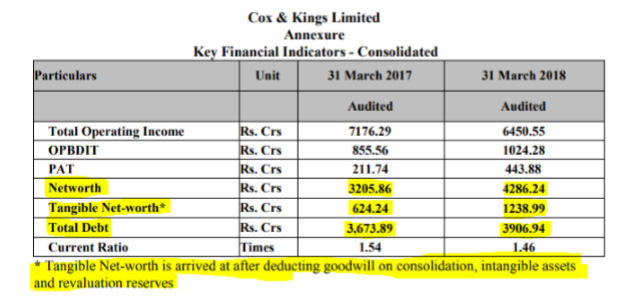

Brickworks even published the following summary of Cox and King’s financials

Source: Brickworks

As per Brickworks’ own table, the company’s tangible networth in FY2018 is nearly two-thirds less than the reported networth, and hence the ratio of debt to tangible networth is an alarming 3.2x. In service companies like banks and financials, goodwill and intangible assets have to be deducted from the reported networth. The fact that the total debt in the company rose from Rs 36.7 bn in FY2017 to Rs 39.07 bn in FY2018, and that the debt-equity was significantly more than 1, was not deemed a risk by Brickworks. Indeed, as per their evaluation the company had a “healthy financial risk profile.”

It gets worse. In its note dated August 13, 2018 commenting on the company’s non-convertible debenture (NCD) redemption, Brickworks stated,

“NCD redemption/refinancing risk: The redemption of NCDs is proposed to be made out of internal accruals and refinancing as necessary. Hence, ability of the company to generate sufficient cash flows and maintain sufficient liquidity for debt servicing will be crucial.”

This statement by Brickworks acknowledges the importance of cash flow from operations in financial analysis. Indeed, cash flow analysis is the heart and soul of corporate financial analysis, as it shows from where cash is generated and where it gets deployed, and is far more important than analysing profits and profit derivatives such as margins, interest coverage etc. which are based on accrual accounting.

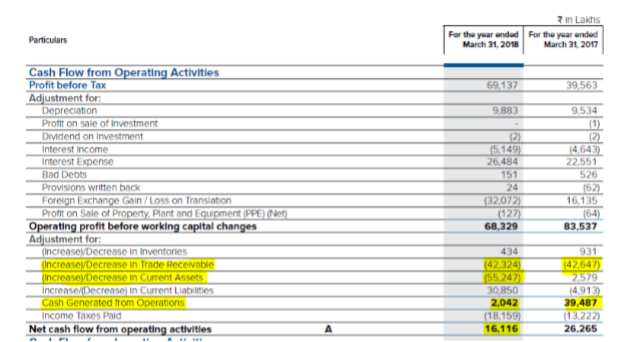

Extract of Cox & Kings Cash Flow Statement for FY2017 & FY2018

The consolidated cash flow statement which the CRAs should have analysed clearly reveals that the cash generated from operations plummeted from Rs 3.95 bn in FY2017 to Rs 204 mn in FY2018 and this was on account of cash outflows from trade receivables and other current assets. After cash outflows for taxes the net cash flow from operating activities sharply deteriorated from Rs 2.6 bn to a negative Rs 1.6 bn. Surprisingly, in the company’s duly audited statement it is shown as a positive Rs 1.6 bn in FY2018, instead of it actually being a negative Rs 1.6 bn. The company has not even bothered to publish an erratum for such a significant error.

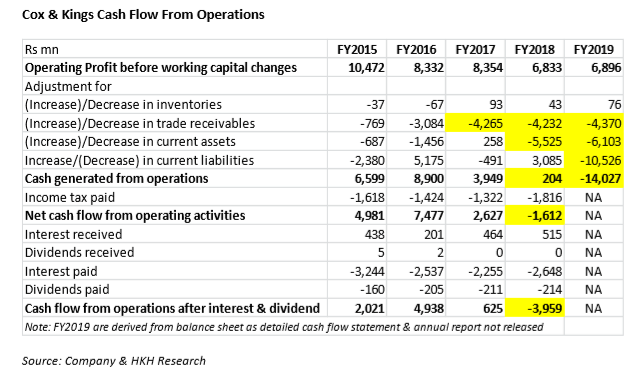

Analysing the company’s cash flow

from operations since FY2015 reveals the pressures from trade receivables from

FY2017, and the sharp deterioration in net cash flow from operations and post

interest and dividend. From the summarised consolidated balance sheet disclosed

by the company for FY2019, it is apparent that cash outflows from receivables

and working capital significantly deteriorated, contributing to the liquidity

shortfall in the company. When cash flow from operations is significantly lower

than operating profit or is negative, analysing profit growth or profit derived

ratios such as profit margins and interest coverage is redundant.

Cox & Kings Cash Flow From Operations

It was the duty of CARE and Brickworks to have commented on, and further probed, why the company’s working capital position had deteriorated in FY2017 and FY2018 to the point where the net cash flow from operations and post interest and dividend had become negative.

The steady and secular decline in the share price of Cox and Kings should have also raised a warning flag to the CRAs, as this is a normal metric used by CRAs, just as it is in the market for analysts to further probe. But both CARE and Brickwork chose to ignore it, and they reaffirmed their top rating for CP on Cox and Kings on June 24, 2019.

If the CRAs had raised the alarm earlier, the problem could have been nipped in the bud. But unfortunately, either on account of incompetence or undue lenience with the management of the company, both CRAs ignored the publicly available information, and instead gave Cox and Kings the highest rating of A1+ for its CP.

In the early 1990s, when CRISIL (established in 1987 and now a S&P global company), India’s first CRA, was in its infancy, this writer publicly debated (here and here) with the CRA on its inability to analyse and evaluate the importance of cash flow analysis when determining a credit rating of a company. Nearly 3 decades later, nothing has changed, and CRAs blissfully ignore all the red lights and are more influenced by the revenue from the issuers of debt than by their duty to protect investors.

The IL&FS debacle, in which the CRAs could not even identify that the company had a negative networth for 5 years and instead gave the company a ‘AAA’ rating till it defaulted, and the recent forced leave for Naresh Takkar, the long serving CEO of ICRA (a subsidiary of Moody’s), pending an investigation into the rating of IL&FS, are indications of the rot in CRAs and in India’s corporate world. Investors need to do their own research and/or depend on truly independent analysts to evaluate the risks in the system.

DISCLOSURE & CERTIFICATION

I, Hemindra Hazari, am a registered Research Analyst with the Securities and Exchange Board of India (Registration No. INH000000594). I have no position in any of the securities referenced in this note. Views expressed in this note accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This note does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this note comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this note or hold any specific opinion on the securities referenced therein. This note is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security