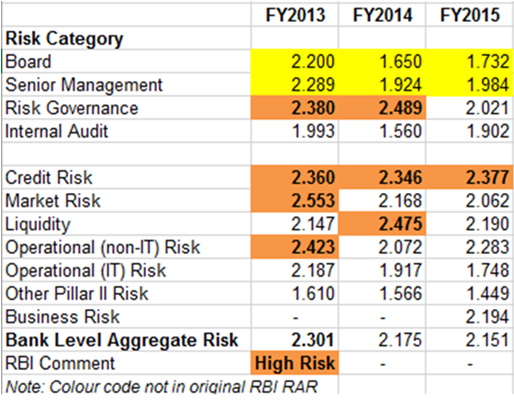

EXECUTIVE SUMMARY. Under the threat of being pulled up for contempt of court by the Supreme Court of India, the Reserve Bank of India (RBI) finally disclosed the confidential inspection reports, called Risk Assessment Reports, of some banks requested under the Right to Information Act (RTI), 2005. The reports, though dated (from FY2013 till FY2015), provide a valuable insight into the actual working of banks, at times in contrast to the management’s commentary to shareholders at that time. In the case of Axis Bank, the divergence of views of the management and the banking supervisor is evident. Many in the sell-side and business media tend to regard management’s commentary with reverence, and these supposed sentinels regurgitate the same to their clients and the public without the rigour of critical evaluation. The now public disclosures of the RARs of banks is a rude wake-up call to these watchpersons to thoroughly scrutinize and challenge audited accounts and management commentary. Media reports cite that Axis Bank may be considering a US$ 1.3 bn equity issue, and although a new CEO has taken charge, investors may well want to exercise caution regarding management commentary in light of the RARs that have been made public.

Recent Posts

Most Popular

IndusInd Bank Board Protects Senior Executives Responsible for Fraud

One of the most shocking episodes in the history of Indian banking was revealed by The Wire.in in a recent exclusive: namely, that the...

Tata’s Outside CEO Battles Multiple Crisis After Bad Year

“For the future growth of the Tata group, Chandra has to find new businesses which can replace TCS’s cash generation which at this time...

Not a Private Matter: Did Axis Bank Share Price Sensitive Information to a Select...

An ordinary meeting of Axis Bank on December 15, 2025 with institutional investors had an extraordinary outcome, one which may need to be probed...

Does the IndusInd Board Run the Bank? Or Is There a Centre of Power...

Ashok Hinduja, chairman, IndusInd International Holding, told the press recently:

"Could you have as a promoter taken steps to avert the crisis at IndusInd Bank?

Money...

Cobrapost Expose on Cholamandalam & Murugappa Group | Cobrapost Press Conference Live Lootwallahas 2

https://www.youtube.com/live/JjL1S77TQXA

Venue: Press Club of India, New Delhi.

My commentary starts from 30:00 mins.