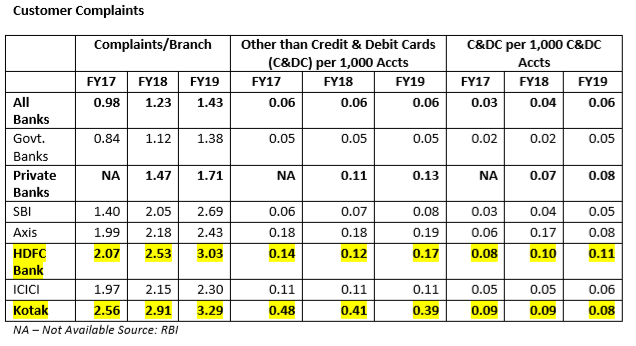

EXECUTIVE SUMMARY. A disturbing revelation in the annual report of the banking ombudsman scheme, 2018-2019 (year end June 30), released by the Reserve Bank of India, was the high number of customer complaints per branch of Kotak Mahindra Bank and HDFC Bank — two favourite banks of foreign institutional investors, both of which trade at hefty price-to-book value multiples. It appears that, while these banks have rewarded shareholders, they have sadly disappointed a sizeable number of their customers.

As against the all-banks average of 1.4 complaints per branch in 2018-2019, KMB reported 3.3 complaints per branch, and HDFC Bank had 3 complaints per branch. That these banks reported more than double the industry norm should be a matter of concern to the banking regulator, their board of directors and shareholders. Both banks reported significantly higher complaints per branch as compared with the industry norm in the last 3 years, indicating persistent customer dissatisfaction. As compared with the industry norm of a large number of complaints pertaining to ATM/debit cards and unfair practices, the largest number of complaints for KMB and HDFC Bank were on account of unfair practices and credit cards. As usual, the fact that two prominent private sector banks have consistently reported high customer complaints per branch is not considered newsworthy by the business media, nor is it worthy of further analysis by the sell-side, who remain bullish on these banks. It remains to be seen whether HDFC Bank and KMB can sustain their present reputation without addressing customer grievances.

The bad stuff about both these banks will almost always be neglected and suppressed. They both carry large weight in NIFTY and SENSEX. They are and will be used to stroke “animal spirits” and sell the bull market story to public and MF investors.