India’s swift response to the crisis at Yes Bank Ltd., which includes rare restrictions on withdrawals, could help limit contagion in the financial system that is already facing growing mistrust, analysts say.

After Yes Bank could not secure enough investments to meet its capital needs for over a year, authorities took what analysts deem “extreme” measures in a bid to avoid another bank failure. Over just two days, the Reserve Bank of India took over Yes Bank’s board, placed it under a moratorium that limits withdrawals and lending, announced State Bank of India a potential buyer of a 49% stake, proposed to write down 90 billion rupees worth of Yes Bank bonds, cut its capital and share base, among other measures, according to official statements.

“It looks a bit aggressive … [but] it was the right move to step in,” Sandeep Upadhyay, CEO of Centrum Infrastructure Advisory, told S&P Global Market Intelligence.

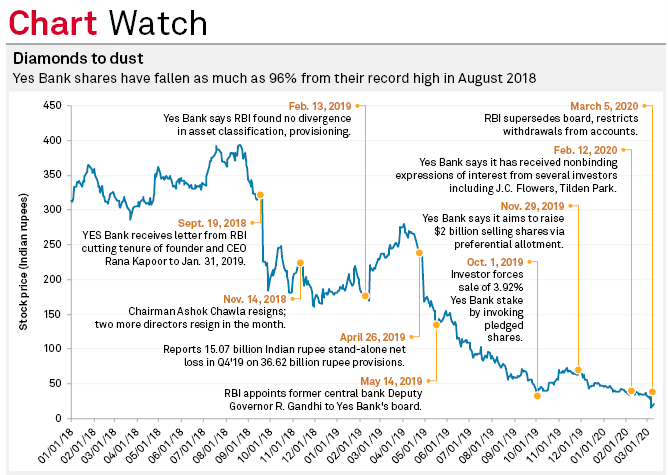

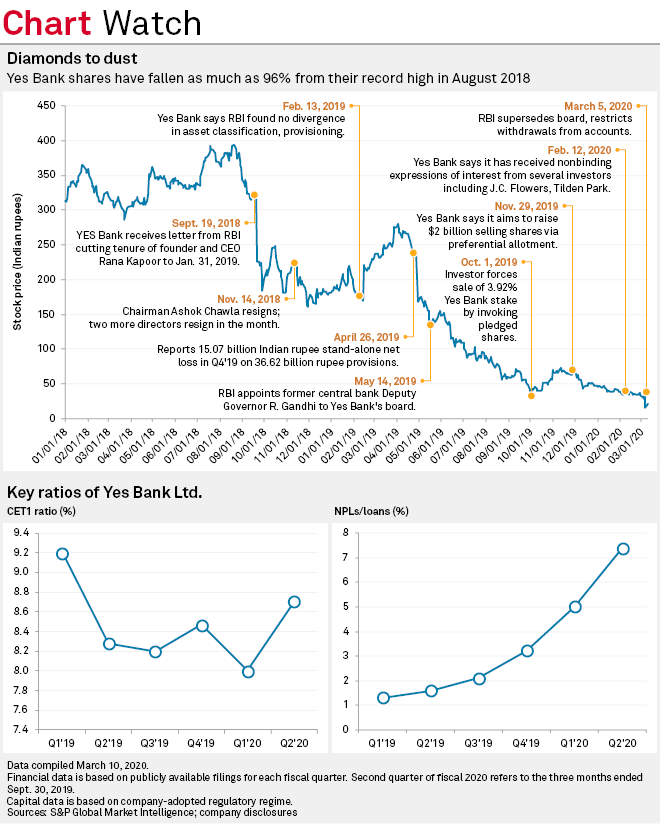

As of last week, Yes Bank’s share price had declined as much as 96% from its record high of 394 rupees on Aug. 20, 2018. Once the country’s fifth-biggest private lender by assets, it has undergone a gradual deterioration of its financial position, due to its inability to raise capital to buffer against potential loan losses. Meanwhile, credit ratings downgrades had triggered invocation of bond covenants by investors and withdrawal of deposits, the Reserve Bank of India said in its March 5 statement.

“If Yes Bank’s resolution process is prolonged, there is a risk the broader banking environment may take a hit. This may raise investors’ perception of credit risk in the system, tightening funding,” S&P Global Ratings said in a March 9 note.

The agency added that the government’s eagerness to resolve the crisis for relatively small banks also reflects concerns over uncertain and slowing economic growth, both local and global. Yes Bank accounted for 1.8% of India’s total bank deposits as of March 31, 2019.

The government was criticized for not acting fast enough in handling previous crises of the financial sector, such as the collapse of major nonbank lender Infrastructure Leasing & Financial Services Ltd. in 2018, Upadhyay said.

IL&FS is still trying to sell its assets and raise cash amid ongoing troubles at several Indian nonbank financial companies, or NBFCs. Defaults by large NBFCs, including IL&FS, Dewan Housing Finance Corp. Ltd. and Reliance Capital Ltd., have made banks less willing to lend to the sector, or charge a risk premium on loans, creating a vicious cycle that leaves these lenders more fragile than before.

These NBFCs lend mainly to infrastructure and real estate builders, which operate on a much longer time horizon than the short-term loans that fund them.

To be sure, the central bank has acted more swiftly to rescue banks where public deposits are involved. The last time a bank imposed a moratorium on a commercial bank was in July 2004 when it got state-run Oriental Bank of Commerce to take over Global Trust Bank Ltd.

The federal cabinet earlier this month approved a plan to merge 10 state-owned banks into four entities, effective April 1, to help create lenders with scale to compete globally.

Not a better plan for everyone

While analysts in general applaud the government’s action, Yes Bank’s bondholders and minority shareholders may have to shoulder the brunt.

Under the RBI’s restructuring proposal, Additional Tier 1 bonds issued by Yes Bank will be written down permanently. S&P Global Ratings said “this may increase the risk premium on all Indian bank sector Tier 2 subordinated bonds.”

Many credit mutual funds that own Yes Bank securities, including subordinated debt and Additional Tier 1 bonds, are likely to be hit by the complete write-down, potentially triggering capital outflows from these funds. That could widen spreads and drain the credit available to lower-rated entities, S&P Global Ratings added.

The rescue plan involves issuing new shares likely at “extremely beaten down value,” ICICI Direct Research, a part of the investment banking unit of ICICI Bank Ltd. said in a note March 6.

“All these will lead to huge dilution, leading to value erosion for minority shareholders,” ICICI said, downgrading Yes Bank’s shares to a ‘sell’ rating from ‘reduce.’

Declining trust in banks

Fitch Ratings said the central bank’s plan probably intends to restore depositor confidence but could backfire if they shift their money to institutions that are perceived to be safer. “This could pose liquidity challenges, particularly for smaller banks with weaker franchises or more limited access to support parent entities,” Fitch said in a March 6 note.

The RBI repeatedly assured depositors that their interests will be fully protected and “there is no need to panic.”

India’s wholesale debt markets may face another crisis of confidence and tightening of financial conditions, Fitch said, adding it could overshadow the central bank’s recent efforts to boost liquidity in the system.

The central bank’s plan is unlikely to restore the confidence of Yes Bank’s depositors, especially current and savings account holders, who may leave the bank once the moratorium is lifted, Hemindra Hazari, an independent analyst, wrote on his online portal HKH Research.

“Once a bank is put under a moratorium, its deposit franchise is irrevocably eroded, as banking is all about trust,” Hazari wrote.

Crisis lays bare weak governance

Analysts believe a lax loan approval mechanism is among the contributing factors to its sharply higher loan-loss provisions and nonperforming assets in recent years. India’s Finance Minister Nirmala Sitharaman named some “very stressed corporates” such as Reliance – ADA Group Ltd., Essel Group, Dewan Housing and IL&FS as among Yes Bank borrowers, according to media reports, citing a March 6 news conference by the minister.

Yes Bank’s founder Rana Kapoor was arrested by the economic crime investigating agency and his daughter was stopped from leaving India, according to local media reports.

Also, the asset quality of Yes Bank may worsen during the moratorium, especially on those who mainly depend on the lender for their working capital needs, Hazari said. He added that would put further pressure on the financial system.

According to data from CRISIL Ratings, a unit of S&P Global, the share of Yes Bank exceeds 40% of their aggregate rated bank facilities for 210 companies.

“India’s financial sector broadly needs to raise governance standards and restore trust … The central bank’s assessment of nonperforming loans for a number of banks was higher than lenders’ own assessments, suggesting transparency was poor at the institutions,” S&P Global Ratings said.

As of March 10, US$1 was equivalent to 73.86 Indian rupees.