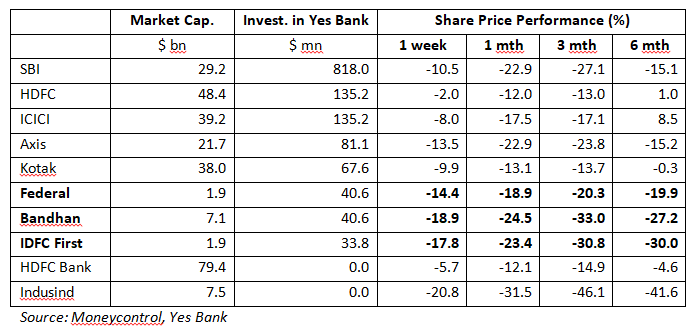

EXECUTIVE SUMMARY. In the SBI-led bail-out of Yes Bank assisted by private sector entities, HDFC Bank, the largest private sector bank, is notably absent, as is Indusind Bank. Stranger still, much smaller banks like Bandhan Bank, Federal Bank and IDFC First have decided to come to the rescue of Yes Bank even though their own share prices have been under considerable pressure. When the largest private sector bank, known for its superior asset quality and conservative risk management, decides to stay away from the blood transfusion, that is perhaps an indication of the likely outcome of the rescue mission of Yes Bank.

While HDFC Bank shareholders may be pleased by the bank’s decision to be a bystander, the same cannot be said about the shareholders of smaller banks like Federal, Bandhan and IDFC First whose share price already indicate shareholders’ displeasure with their existing performance. While it is understandable for larger private sector players to participate in the rescue of a private sector bank in the interest of financial stability, one is at a loss to understand why smaller players have rushed to lock-in their investment for 3 years when even the largest private sector bank is unwilling to take the risk.