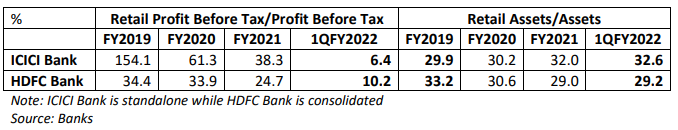

EXECUTIVE SUMMARY. ICICI Bank’s 1QFY2022 results on July 24, 2021 highlight the need for shareholders to re-examine the bank’s retail asset strategy. ICICI Bank’s strategy was to focus on retail assets to compensate for the bulky poor-quality corporate assets that it had earlier emphasised. However, the broad economic slowdown even prior to the Covid-19 pandemic impacted all segments of the economy, and the pandemic dealt small and medium enterprises, and indeed the whole informal sector, a severe blow. A section of organised sector employees too lost their jobs or experienced pay cuts. All these developments affected retail assets of banks. Unlike HDFC Bank, which started shifting from retail assets, ICICI Bank surged ahead in retail lending even when retail asset profits declined in FY2021, and this strategy continued in 1QFY2022 despite a drastic fall in retail profits.

Apparently the board of directors has taken a view that the bank has to continue to grow the overall balance sheet despite the weak economic conditions, and that, since corporate credit remains weak, the only other avenue is to grow retail assets. It is precisely this strategy that shareholders need to review and debate with the management. The past two years’ data from both ICICI Bank and HDFC Bank reveal that, on account of deteriorating retail asset quality, the contribution of retail profits before tax (PBT) to overall PBT is declining, and in 1QFY2022 it has fallen steeply. From ICICI Bank’s surge in retail assets in FY2021 and 1QFY2022, it appears that the bank believes that the past two years’ data are an anomaly, and that retail asset quality will bounce back.

According to ICICI Bank, additions to gross NPAs are expected to be lower in 2QFY2022, and further improve in 2HFY2022. Given the state of the Indian economy, it may be more prudent for ICICI Bank to curtail its asset growth, de-emphasise retail loans and focus on treasury and select corporate credit to boost profitability.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in ICICI Bank and HDFC Bank mentioned in this report. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.