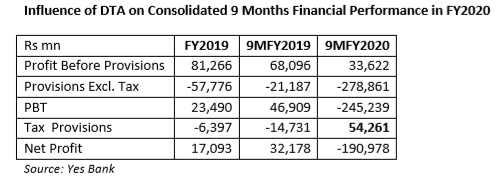

EXECUTIVE SUMMARY. Yes Bank reported a staggering consolidated net loss of Rs 191 bn ($2.6 bn) for the 9 month period ended December 31, 2019 (for 3Q FY2020 the net loss was Rs 185.6 bn). However, even this is understated on account of the huge increase in the deferred tax asset (DTA). Without this, the consolidated net loss for the 9 month period would actually have been 29% higher at Rs 246 bn ($3.3 bn). Yes Bank’s DTA increased from Rs 25.4 bn as on March 31, 2019 to Rs 80.3 bn as on December 31, 2019, depressing the loss. The market must factor the large increase in DTA which will weigh down future profits. This writer has been regularly highlighting how banks have been reporting better financial performance than warranted through the creation of DTA. While AS-22 permits such a practice, in the opinion of this writer the RBI must curtail this practice as it leads to a misrepresentation of the financial performance.

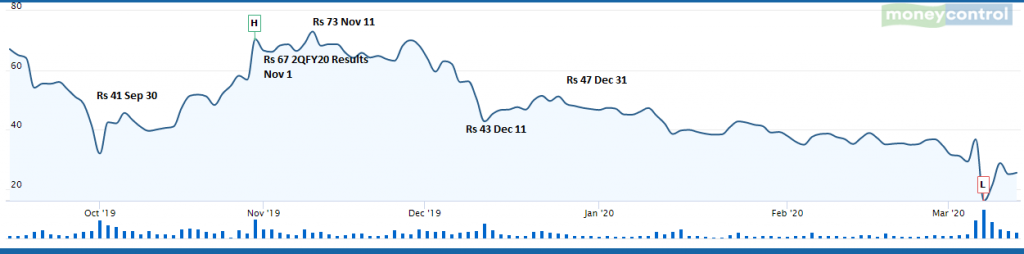

The disclosures in its 3QFY2020 results also reveal the silent run that the bank had been experiencing, which probably was a critical factor in the RBI imposing a moratorium on the bank and superseding its board of directors on March 5, 2020. Yes Bank’s total deposits declined by 34% to Rs 1,375 bn on March 5, 2020 from Rs 2,095 bn on September 30, 2019, a fall of Rs 720 bn ($9.7 bn). What is revealing is that, prior to March 5, 2020, there were no long queues of retail depositors at the bank branches waiting to withdraw their deposits, but apparently wholesale and high net worth depositors were quietly moving their deposits to safer havens. Interestingly, while deposits declined by Rs 437 bn in the 3QFY2020, the share price did not throw any red flags during this period — indeed it was even higher than the September 30 price! — but during the subsequent further decline in deposits by Rs 283 bn after 3QFY2020, the share price started falling.

In the current environment with concerns regarding private sector banks, the Yes Bank episode sadly reveals that share price movements may not serve as an early warning indicator of the health of the bank, and would not send a signal to depositors to pull out their deposits in time.