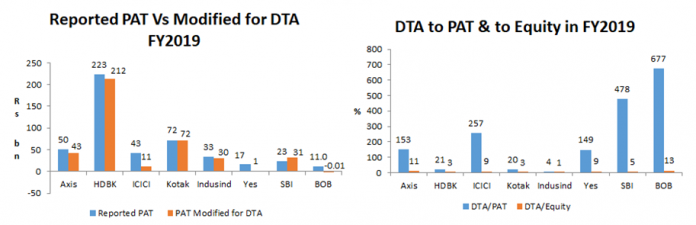

EXECUTIVE SUMMARY. While the market is commending banks like ICICI and Axis Bank for cleaning up their balance sheets with aggressive loan loss provisions, what is being ignored is the role played by net deferred tax assets (DTA) in partly neutralising the impact of the provisions. DTA is being widely used across the banking industry to inflate current profits and defer the accounting charge to future years. While the creation of DTA is allowed in accounting standards, in the opinion of this writer it is not a prudent practice as it merely defers the inevitable charge to profits. It is time investors paid more attention to this intangible asset, and the regulator modified norms to stipulate a short term reversal in DTA. The practice is rampant in the banking industry, as this study of 8 prominent banks reveals, and it is being used to inflate current profits while giving an impression that the balance sheets are finally being cleaned.

Recent Posts

Most Popular

Is Yes Bank Providing Custodial Services to RInfra for Its Valuable Property?

A high-profile bank collapses on account of high-risk, bulky non-performing corporate loans. With the intervention of the Reserve Bank of India (RBI), the errant...

Karnataka Bank board showed who’s the boss

As Hemindra Hazari, a Sebi-registered independent research analyst, has pointed out in his report, “Bank boards have clear-cut policies on the approval powers of all...

Economist – Prof R Ramakumar’s Speech at Tarakeswar Chakraborti Memorial Lecture – 1

https://www.youtube.com/watch?v=l72vK9c1RFg

Hemindra Hazari Speech at Tarakeswar Chakraborti Memorial Lecture – 2

https://www.youtube.com/watch?v=eXiLiqh6tuo

Memorial Lecture Held on June 14, 2025, at the Walchand Hirachand Hall, Indian Merchants Chamber, Churchgate, Mumbai

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and...

Official Trailer | The Great Indian Illusion | a Film By Varrun Sukhraj ।...

https://www.youtube.com/watch?v=nuJUMCz7yI8