In Ian Fleming’s iconic James Bond movie franchise, the dapper 007 manages to get away, however precarious the situation. Similarly, in Yes Bank, one Additional Tier 1 Capital (AT1) perpetual bond issued under Basel III classification has escaped from being written down. In the wide publicity that the write down of Yes Bank’s AT1 bonds received, analysts and the business media have not highlighted how this particular AT1 bond issued under the Basel III framework survived to live another day. Yes Bank’s AT1 issue of Rs 2.8 bn, at a coupon of 10.5% per annum issued on December 31, 2013, has not been written down, as the Reserve Bank of India (RBI) notification linked to the Basel III guidelines at that time did not incorporate the clause that “the write down of any Common Equity Tier 1 capital shall not be required before the write-down of any AT1 instruments (including the Bonds)”. The letters of offer of the other two AT1 bonds which were written down, and which were issued on December 2016 and October 2017 respectively, incorporated this vital clause, as by then Basel III guidelines had evolved to incorporate this loss absorption measure.

The draft reconstruction scheme of Yes Bank issued by the RBI on March 6, 2020 had the following statement,

“The instruments qualifying as Additional Tier 1 capital, issued by the Yes Bank Ltd. under Basel III framework, shall stand written down permanently, in full, with effect from the appointed date. This is in conformity with the extant regulations issued by Reserve Bank of India based on the Basel framework.”

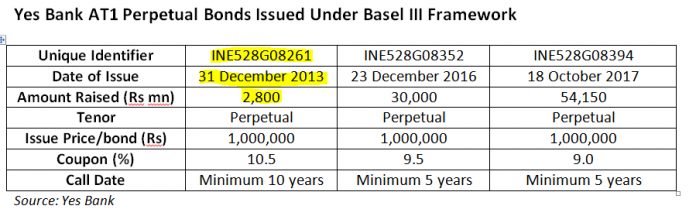

Yes Bank had three AT1 perpetual bonds issued under the Basel III framework aggregating to Rs 86.95 bn with the following particulars

Yes Bank AT1 Perpetual Bonds Issued Under Basel III Framework

| Unique Identifier | INE528G08261 | INE528G08352 | INE528G08394 |

| Date of Issue | 31 December 2013 | 23 December 2016 | 18 October 2017 |

| Amount Raised (Rs mn) | 2,800 | 30,000 | 54,150 |

| Tenor | Perpetual | Perpetual | Perpetual |

| Issue Price/bond (Rs) | 1,000,000 | 1,000,000 | 1,000,000 |

| Coupon (%) | 10.5 | 9.5 | 9.0 |

| Call Date | Minimum 10 years | Minimum 5 years | Minimum 5 years |

Source Yes Bank

In all the three bond offer letters stated that the claims of the AT1 bondholders were superior to the claims of the equity shareholders.

In the Gazette notification dated March 13, 2020, which notified the final Yes Bank reconstruction scheme, no mention was made of AT1 bonds being written down, and instead Para 6 stated,

“(3) All the deposits with and liabilities of the reconstructed bank, except as provided in this Scheme, and the rights, liabilities and obligations of its creditors, shall continue in the same manner and with the same terms and conditions, completely unaffected by this Scheme.”

Therefore even though the RBI draft reconstruction scheme had recommended the write down of all AT1 bonds under Basel III, the government of India did not include it in the final reconstruction scheme. However, a day after the Gazette notification on the bank’s reconstruction scheme, when Yes Bank declared its 3QFY2020 results on March 14, 2020, the bank stated that it had written down

“Basel III compliant AT1 Bonds aggregating to Rs 8,415 Crores [84.15 bn].”

The two AT1 issues aggregating to Rs 84.15 bn which were written down were

- INE528G08352, date of issue December 23, 2016, size Rs 30 bn at a coupon of 9.5% per annum

- INE528G08394 , date of issue October 18, 2017, size Rs 54.15 bn at a coupon of 9.0% per annum

Even though the write down of Yes Bank’s AT1 bonds received wide publicity, and some investors contested the bank’s decision and have taken the matter to the court, nobody bothered to unearth why one particular Basel III compliant issue of Yes Bank’s AT1 bonds was not written down.

Yes Bank’s Rs 2.8 bn AT1 (INE528G08261), date of issue December 31, 2013, size Rs 2.8 bn at a coupon of 10.5% per annum, was excluded from the write-down even though the RBI’s draft reconstruction scheme had stated that “qualifying” AT1 capital issued under Basel III would be written down.

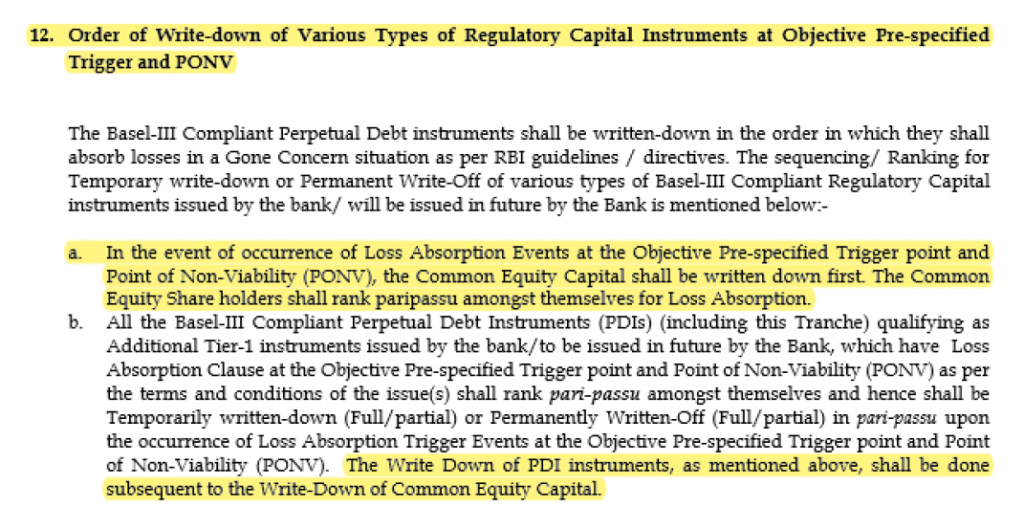

The reason for the Rs 2.8 bn AT1 not being written down is that the RBI guideline (Annexure 4, 14 and 16) on Basel III, which this bond was governed by, was in the early stages of the Basel III implementation. Hence according to this AT1’s offer letter, while it stated that the bond has loss absorption capability, equity capital had to be written off first prior to the write down of the AT1 bond.

Source: Yes Bank Offer Letter, p. 47

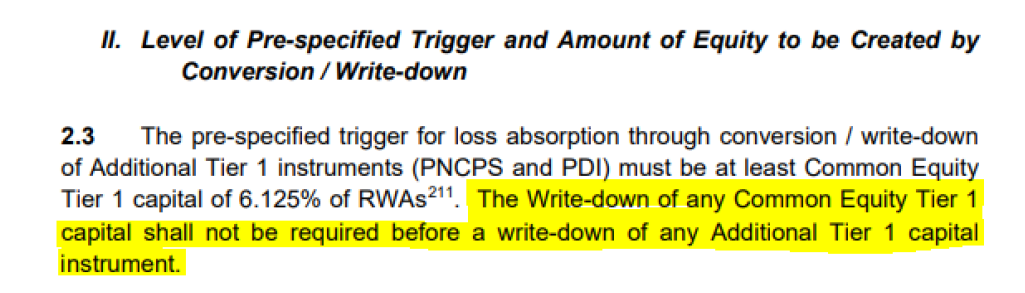

As the Basel III framework was evolving, by July 2015, the RBI had modified the order of the loss absorption capability of AT1 and henceforth all AT1 prospectuses explicitly stated,

“The Write-down of any Common Equity Tier 1 capital shall not be required before a write-down of any Additional Tier 1 capital instrument.”

Source: RBI Master Circular Basle III Capital Regulations, July 1, 2015 p. 259

As the December 2016 and October 2017 AT1 issues of Yes Bank were post RBI’s July 2015 circular, these two issues could be written down prior to the write down of equity capital.

While James Bond, in the movie franchise, miraculously escapes from the most perilous of situations, Yes Bank’s Rs 2.8 bn AT1 bond was specifically protected from such a situation in its letter of offer, as the Basel III framework was still evolving. Thus, unlike the later AT1 bond issuances, it could not be touched prior to writing off equity capital.

Disclosure

I, Hemindra Hazari, am a registered Research Analyst with the Securities and Exchange Board of India (Registration No. INH000000594) I have no exposure to securities referenced in this Insight. Yes Bank subscribes to this analyst’s research. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.