On October 21, 2023, Kotak Mahindra Bank (KMB) surprised the market by announcing that “the Reserve Bank of India (RBI) approved the appointment of Ashok Vaswani as the Bank’s next Managing Director & Chief Executive Officer (MD & CEO). This is for a period of three years from date of taking charge which shall not be later than January 1, 2024.”

Vaswani’s selection was unexpected, as the media had reported the shortlisting of two executive directors for RBI’s approval: KPS Manian, head of corporate, institutional and investment banking and Shanti Ekambaram, head of consumer banking.

Prakash Apte, Chairman of Kotak Mahindra Bank, said, “We are pleased to announce that RBI has approved the appointment of Ashok Vaswani as the next MD & CEO of Kotak Mahindra Bank. Ashok is a global banking leader with a proven track record of building and growing businesses at an international scale and has successfully steered organisations to greater heights. We are confident that Ashok will accelerate change and drive growth at Kotak.”

Uday Kotak, Founder and Director, Kotak Mahindra Bank, said, “I am delighted that the RBI has approved our recommendation, Ashok Vaswani, as the next CEO of Kotak Mahindra Bank. Ashok is a world class leader and banker with digital and customer focus. I am proud that we bring a ‘Global Indian’ home to build Kotak and India of tomorrow.”

Normally, successful organisations pride themselves in grooming CEOs from within, and a critical responsibility of the Nomination and Remuneration Committee (NRC) of the board is to nurture internal talent for leadership succession, especially for strategic posts such as the post of CEO. When Aditya Puri retired from HDFC Bank, Sashi Jagdishan (then 56 years of age), a senior HDFC Bank executive, succeeded him. In ICICI Bank, after Chanda Kochhar was sacked by the board, Sandeep Bakshi (then 58 years), a long serving ICICI Bank senior executive, was appointed.

In contrast, in the case of banks in which outside candidates replaced the CEOs, it was either because the banks were facing some serious issues and internal candidates were regarded as being part of the problem, or because the RBI lacked confidence in the internal candidates recommended by the board. Such were the cases in Axis Bank, when Amitabh Chaudhry (then 55 years) took charge from Shikha Sharma; in Yes Bank, when Ravneet Gill (then 56 years) replaced Rana Kapoor; and in RBL Bank, when R Subramaniakumar (then 63 years) replaced Vishwavir Ahuja.

In the case of KMB, the members of Uday Kotak’s leadership coterie were all employees who had been associated with the bank/group for a long period. It was therefore highly unusual for the board of directors to have ignored internal talent and recommended two individuals for CEO to the RBI, at least one of whom was an external candidate.

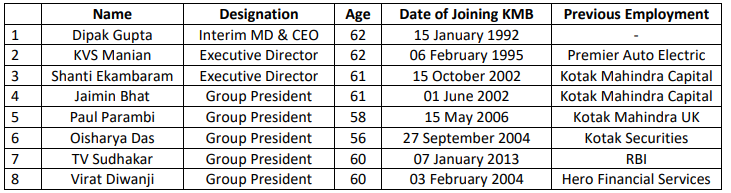

Senior Executives in KMB in FY2023

By recommending Ashok Vaswani, a senior citizen of nearly 63 years of age, and ignoring the internal talent for CEO, the board of directors, and especially the NRC of KMB, have abysmally failed in developing CEO succession in a bank in which senior leadership have been long-serving KMB/Kotak group employees. In nationalised banks, CEOs have to retire by 60 years of age, while in State Bank of India the retirement age is 62 years.

Prakash Apte, the chairman, is “pleased”, and Uday Kotak, founder and non-executive non-independent director, is “delighted”, to have a nearly 63-year old individual whose Linkedin profile reveals quitting commercial banking in July 2022, and whose banking experience is outside India, to be the next CEO of the bank.

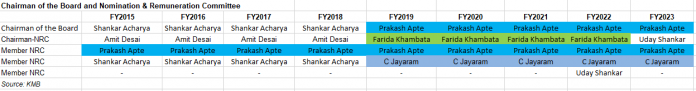

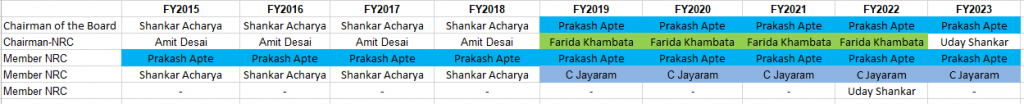

Chairman of the Board and members of the Nomination and Remuneration Committee

The board of directors should have been planning for CEO succession for a long period of time. This was the main responsibility of KMB’s NRC, chaired by Amit Desai till FY2018 and thereafter by Farida Khambata till FY2022. Moreover, Prakash Apte, the chairman of the board, has been a member of the NRC since FY2015. In the last 9 years, the NRC’s contribution to CEO’s succession was to ensure that with the exception of two individuals, the entire top leadership were senior citizens by FY2023 to succeed Uday Kotak. Even if the NRC had admitted its failure in grooming younger internal talent for CEO succession, they could have shortlisted external executives in their mid-50s who have an exposure to Indian banking, and brought them in as executive directors at an earlier date, in order to expose them to KMB’s work environment, culture and senior executives. Now Vaswani, with negligible experience in Indian banking, will be parachuted from a pleasant retirement from global commercial banking directly into the KMB CEO’s post. On landing, he is expected to do wonders in implementing a digital strategy in the Indian environment.

An alternative explanation for the selection of Ashok Vaswani is that he was a last minute selection; the banking regulator, the RBI, may have informed the KMB board that it would not approve an internal candidate, as it was uncomfortable with Uday Kotak’s continuance on the board as a non-executive director. This analyst had argued that Uday Kotak’s continuance on the board as a non-executive non-independent director would make him effectively the back seat driver of the bank, without any of the responsibilities of such a position. It is poor corporate governance to allow a long serving founder CEO to continue on the board as a non-executive director after stepping down as the CEO.

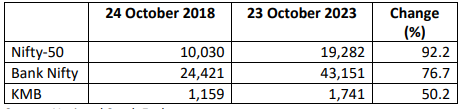

If Vaswani’s selection was under such circumstances, on account of Uday Kotak’s continuance on the board, then again the NRC and the board have to be held accountable. KMB’s stock price has been an under-performer as compared with the Nifty-50 and the Bank Nifty for the last 5 years, on account of apprehensions regarding CEO succession. The stock market was in favour of an insider to succeed Uday Kotak, as it would indicate a continuity in the bank’s strategy; moreover, the market was familiar with the senior executives of the bank. The announcement of a relatively unknown external candidate with negligible experience in Indian banking, and who had apparently retired from commercial banking, should make the stock market even more apprehensive.

KMB Share Price Vs Nifty-50 and Bank Nifty

The KMB board and its NRC have failed stakeholders by recommending Uday Kotak’s continuance as a non-executive non-independent director, which may have resulted in regulatory displeasure and consequently the last minute selection of an external retired global banker as the CEO. Having Uday Kotak’s presence on the board will make it extremely difficult for Vaswani to forge an independent policy for the bank. If there is a disagreement between Uday Kotak and Ashok Vaswani on future strategy, or if senior executives undermine Vaswani’s authority and consult with Uday Kotak, or if there is a difference of opinion on a further fast track promotion for Jay Kotak, the son of Uday Kotak, who will prevail and whom will the board support? A long serving founder CEO who continues on the board as a non-executive non independent director undermines the authority of not only the CEO, but also the chairman of the board.

It is no surprise when Shaktikanta Das, the RBI governor, addressing board members of urban co-operative banks on September 25, 2023 and commenting on the excessive dominance of one or two directors at board meetings of large commercial banks said, “We have told banks that this is not the way. One or two directors cannot dominate, excessively dominate. They should not think that whatever they say is correct and others do not get a chance to speak.” This analyst has repeatedly highlighted (here and here) the major risk in KMB being the calibre of the bank’s board of directors, and the selection of Vaswani as the CEO reinforces this concern.

This article was also published in The Wire.in and can be read here.

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). Please see SEBI disclosure here. HDFC Bank subscribes to this analyst’s research and a member of this analyst’s family is employed with HDFC Bank. I own equity shares in all the banks mentioned in this report. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security. All rights reserved.

No portion of this article may be reproduced in any form without permission

from the author.

For permissions contact: