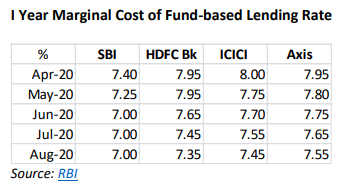

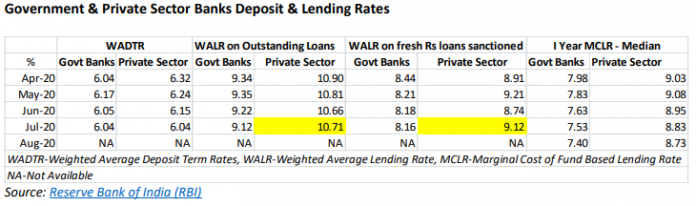

EXECUTIVE SUMMARY. Data from the Reserve Bank of India (RBI) reveal that, in the recent period of declining interest rates, while all banks have been reducing their deposit rates as well as their benchmark rates (marginal cost of fund-based lending rates), in July 2020 private sector banks have increased their effective lending rates on not only fresh loans but also on their outstanding loans. This was first highlighted in the Hindu Business Line newspaper of September 23, 2020. Apparently, either private sector banks have turned to higher risk lending, which is unlikely, or have increased the risk spread over their benchmark lending rate to factor the higher risk in the Covid-19-induced slowdown. This has effectively increased the interest rate by 38 basis points (bps), to 9.12%, on incremental rupee loans of private banks in July 2020. It also appears that private sector banks have increased the rate on the entire loans, as the weighted average lending rate (WALR) increased by 5 bps, to 10.71%, in July 2020 as compared with June. The rise in the WALR for private sector banks also may indicate that their quality borrowers too have been penalised, and that these borrowers have not benefited from the overall decline in the interest rates in the economy. As private sector banks continued to lower the term deposit rates in July by 11 bps, and assuming this continues till end-September 2020, the non-risk-adjusted net interest margins (NIMs) of private sector banks may increase in 2QFY2021 as compared with 1QFY2021.