On December 14, 2020, Kotak Mahindra Bank (KMB) informed the exchanges that the Reserve Bank of India (RBI) had approved the appointment of Prakash Apte as non-executive chairman, Uday Kotak as managing director and Chief Executive Officer (CEO) and Dipak Gupta as joint managing director (JMD). All 3 appointments are for a period of 3 years effective from January 1, 2021. The board of directors and the shareholders had approved the names subject to the RBI’s approval at meetings on May 13, 2020 and August 18, 2020 respectively.

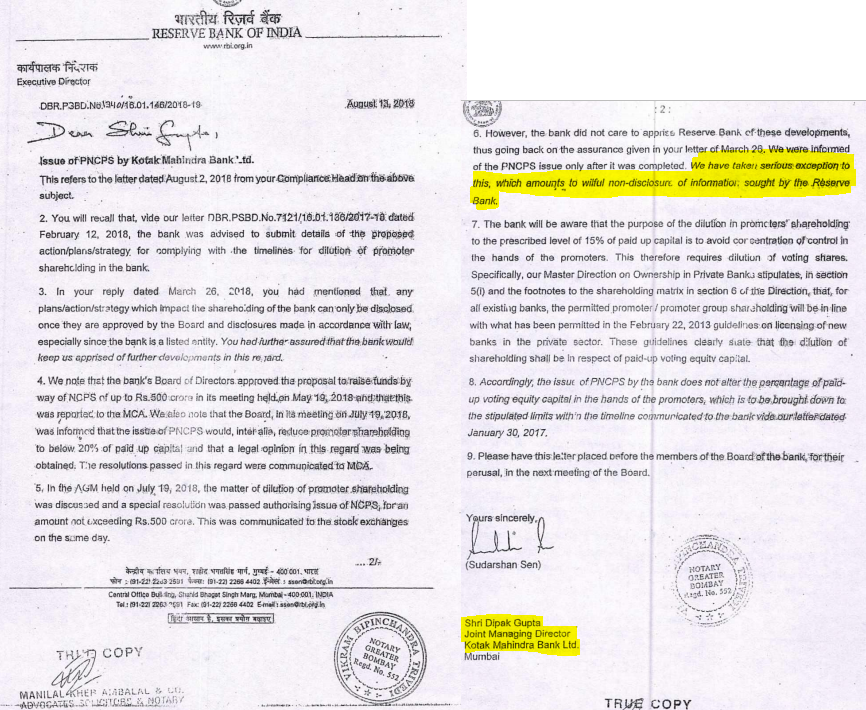

The public and investors in the capital market should take note of the RBI’s conduct in this issue, which reveals its impotence. In the Uday Kotak-RBI faceoff pertaining to reducing his shareholding in the bank, RBI’s Sudarshan Sen (then executive director) in a letter addressed to Dipak Gupta, JMD, KMB dated August 13, 2018 accused the bank of “wilful non-disclosure of information” sought by the regulator, and thereafter issued a show cause notice against KMB. As per Section 46(1) of the Banking Regulation Act, 1949, wilful non-disclosure of information is a criminal offence punishable with a term which may extend to 3 years or with a monetary penalty.

Source: RBI’s reply to KMB’s writ petition, published in The Wire.in

Instead of conforming to the regulator’s directions, KMB took the unusual action of not only taking the RBI to court but accusing the RBI’s action of being “wholly illegal, ultra vires the BR [Banking Regulation] Act, manifestly unreasonable, arbitrary, unfair, without the authority of law, and unconstitutional…” To use such language against the banking regulator, a bank must either be foolhardy or supremely confident that it can get away with it.

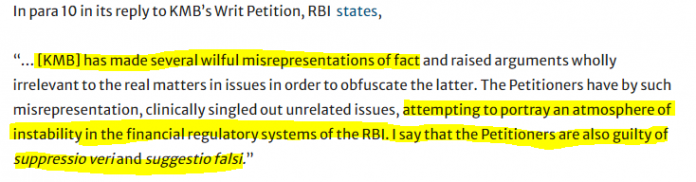

In the RBI’s reply to the KMB writ petition filed in the Bombay High Court, the regulator described the conduct of the bank and its senior officials in equally disturbing language when it accused the bank of “malafide intent”, “taking the regulator for a ride”, “making several wilful misrepresentations of fact”, undermining financial regulatory systems, and said the bank is guilty of “suppressio veri and suggestio falsi” (the suppression of truth is the suggestion of falsehood). It should be an issue of grave concern to senior bank officials and the financial market when the banking regulator documents such views on a regulated entity in a court of law. When the RBI uses such language, the bank’s senior officials should be concerned whether the regulator will allow them to continue in their posts.

For both Uday Kotak and Gupta to continue in their posts at KMB appeared doubtful as RBI released a discussion paper on corporate governance in banks on June 2020 which proposed,

“To build a robust culture of sound governance practice, professional management of banks and to adopt the principle of separating ownership from management, it is desirable to limit the tenure of the WTDs or CEOs. Therefore, it is felt that 10 years is an adequate time limit for a promoter / major shareholder of a bank as WTD or CEO of the bank to stabilise it’s operations and to transition the managerial leadership to a professional management. This will not only help in achieving the separation of ownership from management but also reinforce a culture of professional management. Further, in the overall interest of good governance, a management functionary who is not a promoter / major shareholder can be a WTD or CEO of a bank for 15 consecutive years. Thereafter, the individual shall be eligible for re-appointment as WTD or CEO only after the expiration of three years.” p. 54

Uday Kotak has been the founder-CEO of the bank for 17 years since the bank got its license in 2003, while Dipak Gupta was appointed as executive director (WTD) around May 2008, and was elevated to JMD in May 2011 and has had a continuous tenure of 12 years on the board of KMB. Given the already lengthy tenures of both the officials, and the language used by the RBI to describe the conduct of KMB, there was some scepticism in the capital market about whether the RBI would renew the terms of these officials.

However, when it comes to Uday Kotak and KMB, the RBI may appear to blow hot, but then meekly surrenders to the wishes of the bank. Despite submitting a strong reply in Bombay High Court challenging KMB’s writ petition, it made an exception and settled for a humiliating out-of-court settlement favouring Uday Kotak in January 2020. Thereafter, it even sought Uday Kotak’s counsel as an outside expert when its internal work group released a discussion paper on ownership guidelines for private sector banks in November 2020.

Strangely, in this entire episode regarding Uday Kotak and KMB, the RBI appears oblivious to its considerable loss of credibility as a non-partisan banking regulator entrusted by parliament to be the custodian of financial stability in India.

The Indian public, global credit rating agencies and global investors should note the sequence – the RBI first provides a long rope to Uday Kotak to reduce his shareholding, a relaxation not allowed to other founders of private sector banks. The relaxation results in a huge unrealised gain to Uday Kotak estimated at US$ 3.2 bn as on February 15, 2020. When the RBI finally insists that Kotak reduce his shareholding, KMB files a case against the banking regulator and the RBI settles the case out-of-court in favour of Uday Kotak. In June 2020 RBI proposes to curtail the tenure of founder-CEO to 10 years and for WTD to 15 years in banks; if finalised this would imply that Uday Kotak would have to step down as CEO of KMB. But on December 14, 2020 RBI approves a further 3-year term for Uday Kotak, taking his tenure as CEO to nearly 20 years.

In the last 17 years, RBI has kept giving special concessions to Uday Kotak and KMB. Not only do the latter not fear the regulator, but they have the confidence to challenge the RBI’s actions in a court of law. It is a rare event in any jurisdiction to find a bank legally challenging the banking regulator, and even rarer for the regulator to meekly surrender in an out-of-court settlement.

By allowing Uday Kotak a further 3 years as CEO, the RBI is going back on its own proposal of trying to separate ownership from management to promote sound governance practice and professional management in banks. Indeed it can now be argued that the RBI wants to implement the exact opposite in private sector banks. When the regulator cannot discipline an individual private sector banker who apparently enjoys political backing, how can it regulate powerful industrial houses if they are allowed to set up banks?

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I have no exposure to KMB securities. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

Very strongly and rightly argued !

Long live Indian banking !!