9 min read. Updated: 22 Oct 2020, 08:48 PM IST Shayan Ghosh

Incoming CEO Sashidhar Jagdishan inherits a bank in fine fettle. Where will he take it from here?

Over the upcoming Dussehra weekend, more than 100,000 employees at HDFC Bank will come together, virtually, to offer a befitting farewell to outgoing chief executive Aditya Puri. Various teams at the bank have been tirelessly working to ensure that it goes just as planned, a grand internal affair with intermittent audio-video clips and people reminiscing about the good old days.

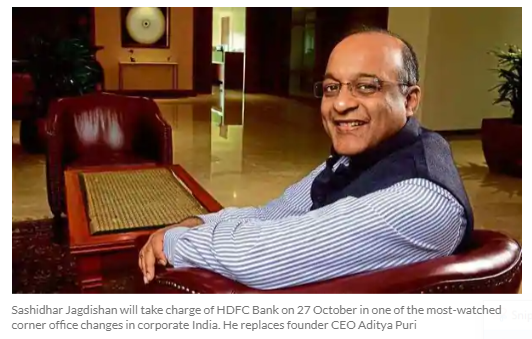

The farewell will set the stage for Sashidhar Jagdishan to take over on 27 October in one of the most-watched corner office changes in corporate India. “What I can see internally is that since the process of transition started a couple of months ago, it has been smooth so far. The new CEO knows the bank like the back of his hand,” said a person in the know on condition of anonymity.

Although Jagdishan (or Sashi, as he is known) might have been Puri’s choice, the formation of a search committee just seven months before his retirement had irked many. “It was imperative on the current CEO and HDFC Ltd as a large shareholder to build consensus over the last two years,” foreign brokerage firm Bernstein had written in a note on 19 March.

While this is in the past now, all eyes remain on Jagdishan. Many believe that the new chief, a finance executive, might find it challenging to adapt to his new role, which demands a more rounded approach. Of course, there’s huge expectations about his strategic vision for India’s largest private bank and a stock market bellwether.

A banking sector expert who has recently interacted with both the incumbent and the to-be chief says they appear to be on the same page in terms of strategy. “Puri seems to have groomed Sashi to be his ideal successor, at least in the last few months if not earlier,” the person says.

Moreover, given that he has been at the bank for close to 25 years, Jagdishan will be the classic insider. “I don’t think Sashi will want to change anything drastically as he has been very much part of the strategy. I doubt he will change something which is not broken,” said a former executive on condition of anonymity.

In terms of identifying the bank’s drawbacks at present and beyond, both Puri and Sashi would have assessed the problem, added the executive cited above.

“Is it related to individuals or does it require larger reinforcement or tightening of processes, weeding out people? Depending on that, several small things would need to be addressed.”

What could be expected from HDFC Bank under Jagdishan is a sharper focus on digital banking, given that a majority of transactions are already done through electronic channels. Moreover, since the bank wants to become a “digital first” lender, that’s a clear strategic imperative for the new CEO.

This can be seen from the bank’s latest announcement of a dedicated digital platform for vehicle loan customers to be unveiled in the next three months. Arvind Kapil, country head (retail assets) at HDFC Bank said on 17 October that the bank sees significant opportunities to transform the automotive landscape over the next three to five years as 90% of the car purchase journeys in the industry are already initiated online.

The learnings required in the digital space are steep. There was a severe outage in online banking services in December 2019. Jagdishan, an executive director then, had said in January that the outage was not owing to any cyber attack but because the lender “underestimated” growth in payment volumes.

All told, analysts are of the opinion that Jagdishan will stick to the basics of what HDFC Bank has been doing so far in retail loans and digital access to customers. Increasing transparency is another ask. Some of his key aides would include Arvind Kapil, Jimmy Tata (head of risk and credit), Rahul Shukla (head of corporate banking) and Parag Rao (head of payments). These executives, along with senior hand Kaizad Bharucha, will lead the bank at a time covid-19 has forced lenders to allow staff to work from home.

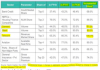

Puri’s legacy is impressive. The organisation he has built over the years has not only performed well but has also built an image of a bank that constantly delivers. Growth has been phenomenal: the bank now has advances of over ₹10 trillion from ₹615 crore (including placements and investments) at the end of 1994-95 when Puri took charge as its founder CEO. Deposits have moved to ₹12.29 trillion from ₹642 crore in FY95. A darling of the stock markets, the bank has delivered 300 times return to investors since listing.

For a bank driven by targets—it has constantly delivered strong numbers quarter after quarter—Puri seems to have been the ideal captain, hands-on and always in control. However, questions are now being raised as to whether the bank went too far in chasing targets, at times even allegedly bypassing basic norms laid out by the RBI and the government.

One such case is the bank forcing customers to buy a vehicle tracking device or a global positioning system (GPS), bundled with the bank’s vehicle loan. HDFC Bank came clean in July amid reports that it has done an internal investigation and not renewed the tenure of one of its top executives linked to the “misselling”.

Thanks to this, Jagdishan inherits a class action lawsuit filed in New York. Pomerantz LLP has filed the suit against HDFC Bank, outgoing managing director Puri, CEO-designate Jagdishan and company secretary Santosh Haldankar. The lawsuit, filed in the court for the eastern district of New York, pertains to losses suffered by some investors because of alleged false and misleading statements by the lender related to the GPS case.

A senior consultant says on condition of anonymity that in the realm of transparency within the bank, a lot is left to be desired. “Considering the recent fiasco with regard to the GPS cross-selling has now taken the shape of a class action lawsuit, the bank should focus on better communications with all stakeholders and leave no room for adverse discoveries like these in the future,” he said.

The consultant believes the next decade will belong to private sector banks in India and HDFC Bank will therefore remain even more relevant than it is today, gnawing away at public sector banks’ market share. “The bank now stands at a juncture where it needs to distinctly differentiate,” he added.

Analysts agree that apart from sharpening the core areas of HDFC Bank, Jagdishan will have to work towards greater transparency within the institution. “In its bid to chase shareholder returns, the bank seems to have lost sight of the fact that they cannot bypass regulations. The target-based approach of Wells Fargo that Puri tried to emulate could have come home to roost,” said Hemindra Hazari, an independent commentator.

A GPS-like cross-selling fiasco had erupted in Wells Fargo in 2013 where bank executives had sold debit or credit cards without the knowledge of customers, just to meet their internal targets.

“Since some individuals were successful in getting more business, their indiscretion was overlooked. That means there is something in their culture that allows for such misdemeanours,” Hazari added. He referred to an anonymous whistleblower whose persistent social media campaign has led to the media and the regulator taking a hard look at the bank.

That apart, the regulator recently ruled against HDFC Bank’s stance in the case of Altico Capital. In July, RBI asked HDFC Bank to return ₹210 crore to Dubai-based Mashreq Bank, which was debited from non-bank lender Altico Capital’s account last year to net off its loans. In September 2019, the Indian private sector lender had debited a part of the money raised by Altico through an external commercial borrowing (ECB) from Mashreq Bank. These ECB funds were parked by Altico in HDFC Bank.

The private lender’s action was prompted by initial signs of stress at Altico. “The episode also showed us how the bank will go to any extent to check loans from turning bad. While this may serve shareholder interests, you cannot take regulations for granted no matter how noble your intentions are,” said Hazari.

Fighting covid fallout

At a time when the entire banking system is concerned about the effects of covid-19, HDFC Bank does not seem perturbed. Going by the management commentary in its September quarter financial results, the bank’s collection efficiencies were almost at pre-covid levels and still improving.

Analysts at Kotak Institutional Equities wrote in a report on 19 October that it remains to be seen if this collection efficiency is only for HDFC Bank. “From what we have been able to assess of the market, it appears to be that HDFC Bank is having a strong lead here,” the report noted, adding that the bank has demonstrated that it has “one of the best banking franchises among private banks and usually tends to use the regulatory forbearances sparingly… It is this comfort which allows us to build a positive view.”

However, one senior analyst seemed baffled by the management’s optimism despite the gloom and doom in the economy. Suresh Ganapathy, an analyst at Macquarie Securities asked Jagdishan at a recent analyst call: “You guys are painting a completely different outlook of the market compared to what the reality is. It looks like you guys are in a completely different world because the commentary says there is no problem with you guys.”

Another analyst Mint spoke to said on condition of anonymity that while the bank is projecting better collections ahead, it needs to be backed up by similar statements from other large peers.

Meanwhile, continuing its tradition of beating expectations, the private sector lender reported a 18.4% year-on-year (y-o-y) rise in net profit to ₹7,513 crore for the three months to September. The profit was even higher than ₹6,409 crore estimated by a Bloomberg poll of 15 analysts. Its retail loans grew 5.3% and wholesale loans by 26.5%, which is enviable to peers at a moment characterised by slowing credit growth amid a consumption slump.

HDFC Bank is certainly doing things others are not able to, given the divergence in outlooks and financial results. The fact is very few in the industry are able to replicate its performance. That’s going to set a high bar for Jagdishan.

According to Ashvin Parekh, managing partner, Ashvin Parekh Advisory Services LLP, HDFC Bank has established exemplary standards in banking, particularly in the areas of current account and savings account mobilisation, payments and customer services. “The leadership has maintained a demonstrative standard of governance and this is reflected in the investor and the general acceptance of the brand,” he said.

Parekh, who was recently part of the KV Kamath committee for debt recast, says that HDFC’s past performance also provides a lot of challenges to the new leadership. However, he pointed out that the bank has institutionalised good practices and created a good cadre of officers who are empowered with decision-making. “Though we may find a certain change in the orientation arising out of a change in leadership, I am sure the bank will continue to be one of the best performing ones,” he added.

Gopika Gopakumar contributed to the story