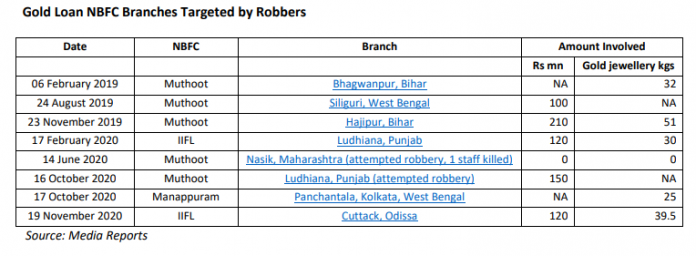

EXECUTIVE SUMMARY. Even though non-bank finance companies (NBFCs) dedicated to providing loans against gold ornaments are highly profitable and enjoy significant net interest margins (NIMs), stakeholders should be concerned about the vulnerability of their branches to robberies. The spate of robberies indicates that thieves are specifically targeting branches because they follow inadequate security protocols for the substantial gold ornaments they hold in custody for their customers. Examining the robberies reported in the media indicates that each of the targeted branches held gold valued at a minimum of Rs 100 mn (equivalent to atleast 25 kgs of gold ornaments). The fact that a robbery of a single branch can yield so much, and that they have poor security protocols in place, makes them an attractive target for thieves. The average metropolitan bank branches (excluding currency chests), in contrast, have superior security protocols, while normally holding far less amounts of cash in their branches (as excess cash is immediately transferred to currency chests).

While the gold ornaments held in NBFC branches are insured, robberies are a law and order issue, especially when staff and members of the public are injured or killed during such robberies. If such robberies continue because NBFCs do not want to improve the security arrangements (for cost reasons), the police will be compelled to intervene and insist NBFCs invest in the necessary security protocols (strongrooms, armed guards, CCTVs being operational 24×7, technology) failing which the police will close branches to maintain law and order.

In general, in the business of loans against gold, the credit, market and liquidity risks are taken care of by the nature of the commodity gold, and management therefore are to focus on operational risk management. The spate of robberies and the poor state of security protocols indicate that managements, for cost reasons, are ignoring these critical issues as they believe insurance will cover the risk. Stakeholders in NBFCs specialising in gold lending should be cognisant of the poor operational risk management, especially the poor security arrangements in the branches, which are attracting robberies. They must insist that these companies invest in the necessary protocols before the state decides to intervene.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I have no financial investments with the companies mentioned in this report. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.