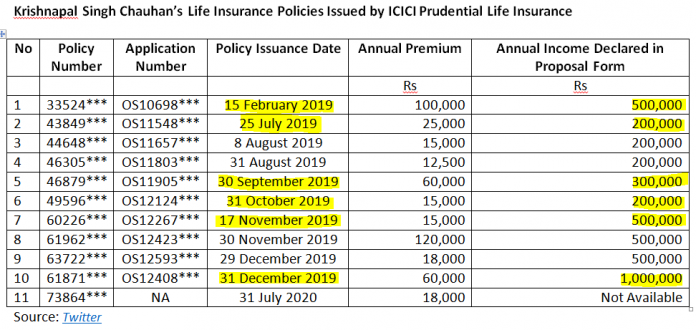

EXECUTIVE SUMMARY. Despite ICICI Prudential Life Insurance (IPru Life) reporting improvement in long-term persistency ratios, there are worrying examples of brazen mis-selling of life insurance policies by the company through its corporate agent, Angel Financial Advisors and even its parent, ICICI Bank. The cases of two 21-year old customers reveal the state of underwriting at IPru Life: Sachin Khilari (the first of three policies mis-sold to him commenced in October 2014) in Sangli district, Maharashtra and Krishnapal Singh Chauhan (who was sold his first policy in February 2019 and a further 10 in 12 months) in Banswara, Rajasthan, both highlighted by Insurance Angels. These cases illustrate the mis-selling of policies by violation of rules; non-compliance with anti-money laundering (AML) to determine source of funds of the policy holder; non-verification of income of customers; alleged forging of the signatures of policy holders; inflating of policy holders’ income on the forms; and the sale of multiple policies to an individual, where the collective premium exceeds the annual income of the policyholder.

Each customer in a financial services company has a unique customer id where her/his Know Your Customer (KYC) protocols, proof of individual income and financial products sold are mapped. When multiple policies are sold by an insurance company to a single individual, it would show up on the customer’s profile. Prior to approving any further policies the underwriting team would examine whether the customer’s income can service the insurance premiums, and approve the sale. What is extremely alarming in these mis-selling cases is that when additional policies were sold to both Khilari and Chauhan, where the collective annual premiums were more than their annual incomes, the underwriters were readily approving the policies without verifying their income. Such professional misconduct completely exposes the underwriting system at IPru Life. The Insurance Regulatory and Development Authority of India (IRDAI), the regulator, and stakeholders in the company need to critically evaluate how such cases are bypassing IPru Life’s underwriting system.

With such poor underwriting and basic protocol systems it is no surprise that ICICI Bank, IPru Life’s parent, has discontinued selling traditional life insurance policies for the last couple of years, even those of its subsidiary where senior ICICI Bank officials are deputed as CEOs. Anup Bagchi, executive director, ICICI Bank and non-executive director (nominated by ICICI Bank), ICICI Prudential Life Insurance, has gone on record on his apprehension that the low long-term persistency ratios in the industry could have an adverse impact on their own bank customers. That a parent company which has firm control on senior executive management at its subsidiary declines to sell the subsidiary’s traditional life insurance products, as it cannot ensure near 100% long-term persistency ratio, speaks volume of IPru Life’s capabilities.

It is time stakeholders and the regulator look beyond the neat and tidy persistency ratios and closely evaluate individual customer mis-selling complaints to understand how life insurance is actually mis-sold on the ground to unsuspecting customers and how underwriting is done by companies like IPru Life.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in ICICI Bank and HDFC Standard Life Insurance. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

Dear Sir,

I respect the views expressed in the article. However, I have discomfort from the analysis. I think the analysis suffers from sample size bias – “drawing conclusions from a small sample for entire population.” One can not draw firm conclusions from a sample size of two in population of lakhs.

If we extend the analysis from your research to other areas, one can conclude that a Bank’s entire portfolio is NPA (extending the conclusion after looking at two NPL exposures of the Bank); one can conclude that toppers in IITJEE or CAT are mediocre students (judging their performance by two wrong answers) and so on.

In my humble opinion, you should have compared grievance ratio, mis-sell ratio and persistency across companies and make conclusions as these numbers are for entire population of policies.

The conclusions can be correct but the data the current analysis is not sufficient to drive the stated conclusion.

Best regards,

Nidhesh

Dear Nidhesh,

Thank you for reading the article and commenting on it. I take your point that one cannot generalise from a sample of two. However, by examining these 2 cases it indicates that there is something seriously amiss with the company’s underwriting. As multiple policies to the same individuals at different points in time should normally go to different underwriters who have access to the customers details. Yet different underwriters at different points in time approved the policies without verifying customers’ income. This alone is a very grave lapse in underwriting and life insurance is all about underwriting. In my opinion along with ratio analysis one should also analyse individual customer cases.

Hii hemindrahazari I have been a victim of the same story at it is posted by you and icici prudential have acted like a bucher with me I was sold 15 traditional policy under the name of fixed deposite not mentioning any lockin periods of 10 years plus 10 years and they have terms of u do not pay minimum money they will forfite the first two premiums paid the whole icici prudential get daily 10000 of missselling after vivid they r hiding and ignoring and hanging coustomers harrasing them to pay more or else they will not get der basic money back aswell it’s a big scam that has come into picture my mother who is 67 year old has no source of income has bee sold pension plans with a lockin of 10 plus 10 that is after 87 she will get her money where I’m the advisor told her it’s an investment like fixed deposite u can withdraw when ever u want to and sold total 15 traditional policies to her they cheaters with a person having no itr is senior citizen is been sold policy without verification the bank and the insurance company employees both pair up together and sell these policies to earn big fat comission and fool poor people and der hard earned money bank is also involved so it the company not verify the coustomers like lic does and just selling blindly through der agent portals they r completely making money making monsters who can just eat up hard earned lifetime money of senior citizens also

Der r 1000 cases each day coming to icic but they r ignorning der own coustomers and hiding the fact ..big fat chunk of commission is been shared between the agents and the bank employees bcz of which poor retired senior citizens housewife’s all life savings r stuck it’s not few cases over the time you will see icici prudential has done no verification and background check of income-tax as well before allotting policies not one but many have been fooled and sold traditional plans by banks and agents both

There is definitely something wrong with ICICI Prudential as far as transpency is concerned. No information is sent to policy holder. The value of units don’t seem to appreciate inspite of markets doing well.

Bad management and handling of funds