HDFC Asset Management Co. (HDFC AMC), promoted by HDFC is in the news for all the wrong reasons, a rare situation for a blue-blooded group which is the darling of institutional investors. The only saving grace is that it is not the only AMC which has been impacted by its mutual fund schemes’ exposure to the troubled Essel founder group of investment companies (flagship: Zee Entertainment Enterprises). What should be of concern to HDFC AMC’s shareholders is not only the relatively high concentration of Essel group exposure in its Fixed Maturity Plan (FMP) schemes, but its investment policy, which permitted it to invest in these companies. This development thoroughly exposes the mutual fund’s credit appraisal and risk management systems and should be a wake-up call to its shareholders and investors in its debt schemes.

The Indian mutual fund exposure to the cash-strapped founder of the Essel group, especially in the FMP products, is well documented (here, here and here). The objective of this article is to focus on how the credit rating agency rated the securities as investment grade, and how HDFC AMC’s investment policy allowed it to subscribe to these securities, which were essentially equity risk masquerading as credit risk. And when the issuers of the debt were unable to honour their commitments, the mutual funds apparently did not take action against the issuers, nor did they demand additional security. Instead they gave an extension to the companies to settle their dues, and did not monetise the security, as they feared it would result in a collapse in asset prices.

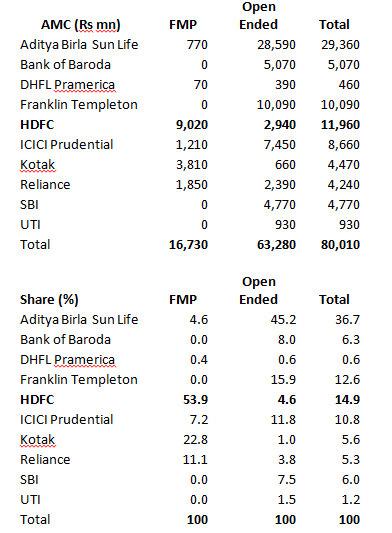

The total exposure of the mutual fund industry as on December 31, 2018, to the Essel group founders’ companies was Rs 80 bn, with HDFC AMC having the second highest exposure at 14.9%. In FMP schemes, HDFC AMC with investments of Rs 9 bn in these companies had the highest exposure at 53.9% (see Annexure-1).

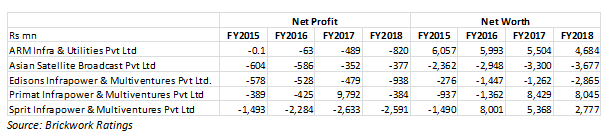

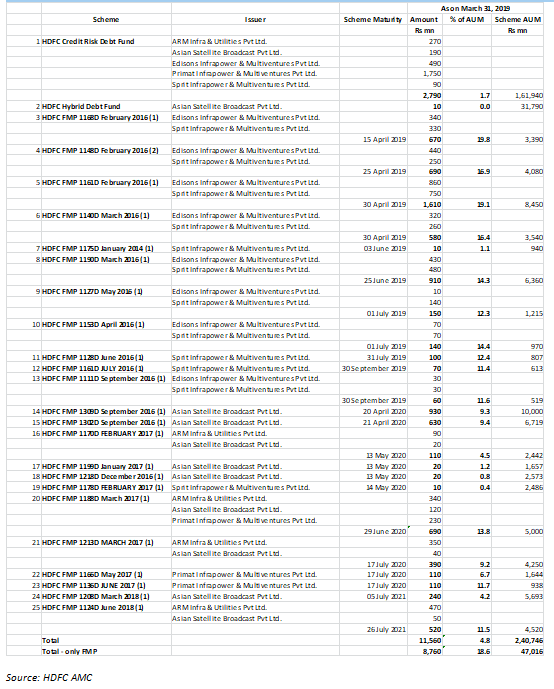

The HDFC AMC mutual fund schemes had exposure to five investment companies of the founders of the Essel group, whose flagship is Zee Entertainment Enterprises. The five investment companies of the Essel founders’ group are

- ARM Infra and Utilities Pvt. Ltd

- Asian Satellite Broadcast Pvt Ltd.

- Edisons Infrapower and Multiventures Pvt Ltd.

- Primat Infrapower and Multiventures Pvt Ltd

- Sprit Infrapower and Multiventures Pvt Ltd.

As per Annexure-2, as on March 31, 2019, 25 schemes of HDFC AMC held the Essel group founders’ exposures aggregating to Rs 11.56 bn, constituting 4.8% of the schemes’ total assets. However, the concentration in HDFC AMC FMP schemes, at 18.6% of their total assets, was much higher. When there is such a high concentration and exposure to a single founder group in the portfolio, there should have been prudent credit appraisal and risk management. However, an analysis reveals the exact opposite.

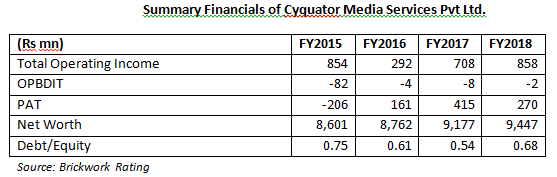

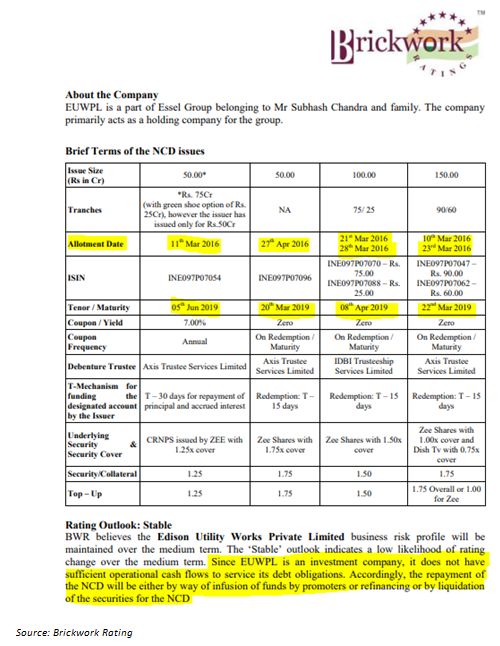

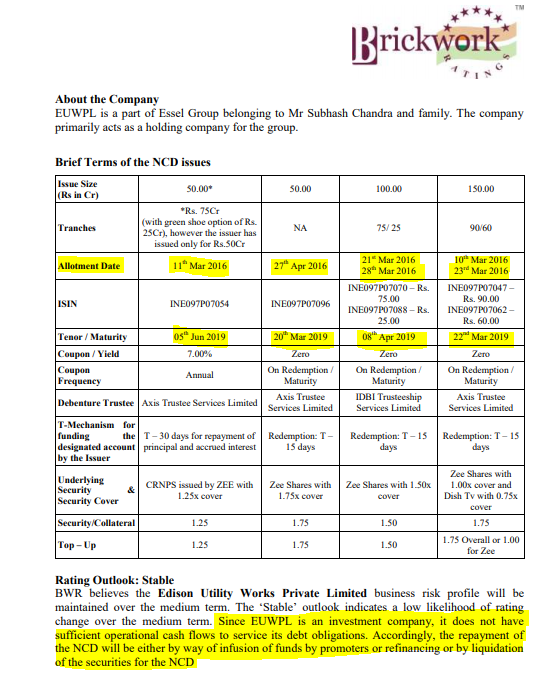

HDFC AMC FMP schemes which invested in the debt securities of the Essel group founders investment companies opened for subscription from February 2016 onwards and hence the FY2015 financials of these investment companies were available at that time. In FY2015, all five investment companies were not only loss-making, but four out of the five reported a negative net worth. Brickwork Rating, the credit rating agency which rated these companies as investment grade, acknowledged that in all the five companies, the operational cash flows were insufficient to meet the redemption, but the security of Zee Entertainment shares provided the comfort to enable these companies to get a Structured Obligation (SO) ‘A’ rating. In one case, of the debt raised by Primat Infrapower, another investment company, Cyquator Media Services Pvt Ltd., pledged shares of Zee Entertainment as security for the loan. Here again, the financial performance of Cyquator revealed poor financials (net losses in FY2015 and losses at OPBDIT for last four years), with Brickwork Rating agency stating that this company, which it also rated as investment grade, had inadequate cash flows to meet the redemption of its own debt.

Sample Extract from Brickwork Rating of Edisons Infrapower and Multiventures Pvt Ltd (erstwhile Edisons Utility Works Pvt Ltd.)

The ability of loss-making companies, some of whom reported a negative net worth, to be rated as investment grade on account of the shares pledged, despite the credit rating agency in all the cases stating that the companies had insufficient cash flows to meet the redemption of their debt, is a stark comment on the credibility of Brickwork Rating. Prudent credit rating and credit appraisal should have entailed a company to be investment grade on its own intrinsic worth. That is, on a standalone basis, the primary borrower should have been investment grade, and the notch up in rating should have come from additional security pledged. Instead Brickwork ignored the poor fundamentals of the issuers of debt and liberally gave an investment grade rating solely on account of the securities pledged. Furthermore, in the rationale for the investment rating, the rating agency does not disclose the specific end use for the debt raised. In some cases the rationale for the issuance of debt securities is classified as “general corporate purpose”. It is extremely relevant for the lender to be aware where the funds are being deployed. That a marquee mutual fund like HDFC AMC should invest in such companies’ debt securities brings to light the poor credit appraisal standards prevalent in the AMC. That the risk management department of HDFC AMC approved investing 18.6% of the AUM in the 23 FMP schemes in these investment companies merely on the security cover of the listed shares pledged exposes the competency of the department.

The credibility of Brickwork Rating as a rating agency got further exposed when these investment companies were unable to honour their debt on the maturity date. The agency did not downgrade the securities to default, but instead maintained the rating as investment grade, and as per the new terms agreed by the mutual funds and the issuers, extended the time line of the maturity of the debt. As a result of this imprudent decision the net asset value of the concerned funds is not being marked down to reflect the market value of the underlying securities, and hence the reported NAV is inflated and misleading.

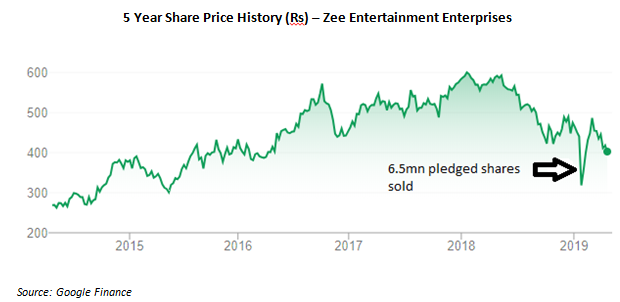

As per media reports, as on December 31, 2018 the Essel group founders owned 41.6% of Zee Entertainment and 59.4% (237 mn shares) were pledged with the lenders. On January 25, 2019, 6.5 mn pledged shares were sold by the lenders, resulting in a 27% fall in the share price. The steep fall led to a breach in covenants, increasing the risk of more pledged shares being sold. However, the company reached a standstill agreement with its lenders (MFs and NBFCs), which resulted in the present crisis in the mutual fund industry.

HDFC AMC’s response to the inability of the founders of the Essel group to meet their financial commitments raises several issues. Firstly, why did HDFC AMC and the other MFs not take recourse from the primary borrowers, the investment companies which issued the security when the first signs emerged of the debt obligations were not going to be honoured? The MFs could have demanded additional securities from the investment companies. Or is it that the MFs in the term sheets agreed upon are prohibited from taking action against the issuers and their only recourse is the equity shares pledged? A second issue is where all the funds that these companies raised from the MFs have been deployed, and why they are unable to honour their commitments. Finally, the MFs are stating that they are unable to monetise the securities, as it will lead to a collapse in the share price; but then the question arises: how did their investment committees approve such securities, and did they not factor in the amount of pledged securities, and its impact on the share price if they were all liquidated to honour the debt obligation?

The Essel group’s founders’ inability to honour their debt commitments exposes how caution was thrown to the winds by mutual funds like HDFC AMC, which invested in their paper. It is apparent that the investment committees in such MFs were enamoured more with the return that these securities offered, overlooked the risk, and showed total faith in Brickwork Rating’s assessment of these companies. Nor did the investment committees and the respective debt fund managers consider the impact cost of liquidating the security, and whether such liquidation would result in a collapse in the share price of Zee Entertainment.

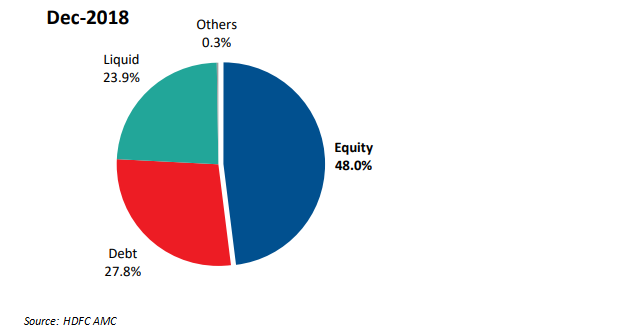

HDFC AMC – Composition of AUM

The professional conduct of HDFC AMC and in particular its critical investment, credit appraisal and risk mitigation policies have been thoroughly exposed in the Essel group founder financing fiasco. For HDFC AMC it is a major concern, as 51.7% of its AUM as on December 31, 2018 is in debt securities (liquid schemes are primarily invested in debt). Basic and prudent investment policies could have easily prevented investing in these high-risk debt securities, which only had an illiquid equity security. That a marquee name as HDFC could be undertaking such poor quality investments, resulting in losses to high net worth and retail clients, should be a rude wake-up call to the shareholders of HDFC AMC, and raise questions about the lofty valuation it commands in the stock market.

Annexure 1: Mutual Fund Exposure to the Essel Group Founders’ Companies as on Dec. 31, 2018

Source: Morningstar

Annexure-2 HDFC AMC Schemes Invested in Zee Group’s Founder Companies

DISCLOSURE & CERTIFICATION

I, Hemindra Hazari, am a registered Research Analyst with the Securities and Exchange Board of India (Registration No. INH000000594) I have no exposure to HDFC AMC referenced in this Insight. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

I entirely agree. It is shocking that HDFC Mutual Fund, headed by a financial wizard Mr Deepak Parekh as non-Executive Chairman is ditching the mutual fund investors who invested their hard earned savings in their fund. The irony is Mr Deepak Parekh was closely associated with ILFS until recently and he ought to have known that ILFS was heading for a disaster. The pity is most of the fund managers of mutual funds – HDFC AMC is no exception – have no credit expertise. They have the audacity to say the instrument was credit rated. Is there no obligation on the risk heads of these funds to do an independent check without being carried away by the external ratings. There is poor oversight by the AMC members or the Trustees. These are all big names and board /trustee membership is taken as a past time rubbing shoulders with pals and pocketing hefty sitting fees. As a senior citizen, I invested in Banking & PSU Debt funds and received a shocker mail this morning from HDFC mutual fund

“As of 12th April 2019, the following scheme(s) of HDFC Mutual Fund have exposures to NCDs issued by HREL:

(Amount in INR crore)

Scheme Name Total exposure to security in the scheme (Face Value)

HDFC Banking and PSU Debt Fund 8.5

HDFC Credit Risk Debt Fund 42.0

HDFC Dynamic Debt Fund 81.0

HDFC FMP 1146D April 2018 (1) 10.5

HDFC Hybrid Debt Fund 41.0

HDFC Short Term Debt Fund 49.5

Considering the default by HREL on its debt obligations, we have taken an additional markdown of 12% effective 15th April 2019 (over and above 25% markdown taken on January 22, 2019), taking the total markdown to 37% on prices provided by valuation agencies for January 24, 2019, the date on which HREL was downgraded to non-investment grade. Additionally, we have also taken a markdown of 37% on the interest accrued till date. Going forward, we shall not be accruing interest on our exposures in HREL..,”

1. Is it not time SEBI immediately directs those funds which have made such bad investments to stop declaring any dividend to shareholders and set up a loan loss reserve out of such dividends to meet the losses.

2. Should not SEBI direct the fund managers and the top management should take 20% hair cut in their salaries and bonuses.

3. Should not AMC Directors and Trustees undergo sacrifice ?

If you do not immediately intervene, many investors in mutual fund would lose their faith in this instrument.

You must make SEBi wake up from their slumber.

Regards

Moorthy