EXECUTIVE SUMMARY. Despite reporting a 36% yoy fall in 3QFY2021 net profits and being below consensus estimates, Axis Bank’s share price on January 28, 2021 closed 6% up, while the Nifty-50 declined by 1%. The strong and positive response to the bank’s results was surprising, as Axis Bank declined to voluntarily disclose its 30+ days past due loans, a critical indicator which the bank had disclosed in its 2QFY2021 results conference call. The 30+ days past due loans serves as a benchmark to analysts to estimate future non-performing loans and incremental credit costs, especially at a time when past trends for credit costs may not hold on account of the unprecedented Covid-19 related lockdown, which severely curtailed economic activity.

Even though 30+ day past loans is not a mandatory disclosure, once the senior management of a bank takes a decision to voluntarily disclose the indicator in a certain quarter, thereafter, from a transparency perspective, the bank would be well advised to continue to disclose the number. By failing to voluntarily disclose the 30+ day past due loans in the 3QFY2021, there would be a valid apprehension that the lack of disclosure is because of a sharp deterioration in the indicator, which the bank was uncomfortable in revealing to the market.

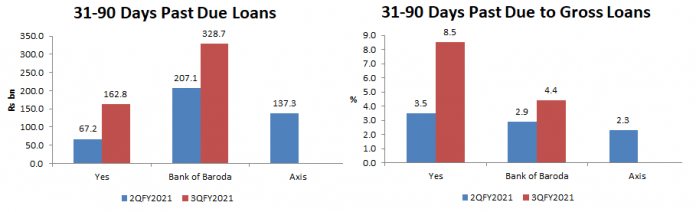

It is commendable that banks like Yes Bank and Bank of Baroda (BOB), which reported 3QFY2021 results on January 27, voluntarily disclosed the 30+ days past due loans in their analyst presentation, despite the number revealing a significant deterioration in asset quality as compared with 2QFY2021. The equity market severely punished their share prices on January 28, with Yes Bank falling by 4% and BOB by 10% on January 28.

Participants in the capital market such as shareholders, business media and analysts need to publicly call out companies (in this case banks) which cease to voluntarily disclose critical data points that were earlier disclosed, as its sudden absence in all likelihood indicates a negative development which the company does not want to share with stakeholders.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I have no exposure to equity investments in the banks mentioned in this insight. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.