By Nupur Acharya and P R Sanjai June 15, 2021, 10:06 AM GMT+5:30 Updated on

Confusion over three Mauritius-based funds that whipsawed shares of companies controlled by Indian billionaire Gautam Adani this week has underscored a deeper risk for investors in such stocks owned by opaque entities.

Shares of Adani’s firms nosedived Monday after a local media report said accounts of these funds — owning about $6 billion of shares across the conglomerate — were frozen by India’s national share depository. The Economic Times said the action was taken probably due to insufficient information on the owners, citing people it didn’t identify. The stocks recouped losses after the conglomerate refuted it. A Tuesday filing stoked doubts again after Adani group said the three funds were facing some suspension due to a years-old regulatory order.

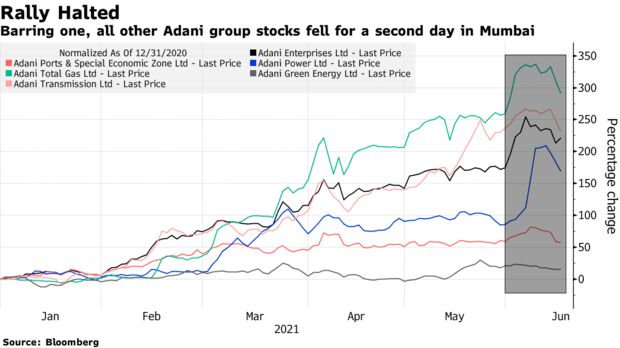

Adani Total Gas Ltd., Adani Power Ltd. and Adani Transmission Ltd. all fell by their 5% daily limit in Mumbai on Tuesday. Adani Ports & Special Economic Zone Ltd. and Adani Green Energy Ltd. also slipped a little. Flagship Adani Enterprises Ltd. fell initially before reversing the losses to close the day with 2.5% gain.

“It is important for investors and the regulator to be aware of the ownership in listed companies, especially when they originate from tax havens like Mauritius,” said Hemindra Hazari, an independent research analyst in Mumbai. “The names of the funds are not very well known in the capital market and they have high concentration into a select number of stocks, which in itself is unusual.”

Opacity

Even as a massive share rally in the companies of the ports-to-power conglomerate has this year more than doubled the net worth of Adani — a first-generation entrepreneur — to $73 billion, this week’s events have pointed to a deeper pain point: opacity around the group and its key non-founder shareholders. There’s also scant analyst coverage for Adani companies, highlighting the information lacunae could be a chronic issue.

The Economic Times said Monday the National Securities Depository Ltd. froze the accounts of Albula Investment Fund, Cresta Fund and APMS Investment Fund.

The Adani group denied the report and called it “blatantly erroneous” in a statement Monday but clarified on Tuesday that three demat accounts of Cresta, Albula and APMS are “suspended for debit,” adding to the confusion over the status of the offshore funds.

“It is extremely crucial for the Adani Group to disclose relevant details regarding ultimate beneficial ownership of foreign portfolio investors holding substantial shares of its group companies,” said Zulfiquar Memon, managing partner of Mumbai-based law firm MZM Legal LLP. Disclosing these details is necessary “as part of being transparent,” he said.