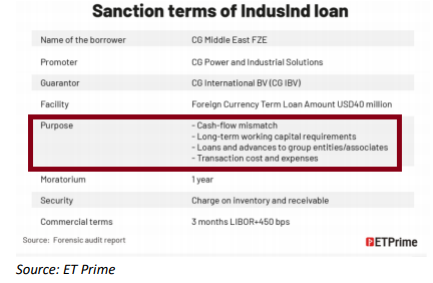

EXECUTIVE SUMMARY. In a major scoop, ET Prime on June 9, 2021 revealed the contents of the Securities and Exchange Board of India (SEBI)’s ongoing investigation into Indusind Bank’s October 2017 US$ 40 mn loan to CG Middle East FZE (CG ME), a step down subsidiary of CG Power and Industrial Solutions (CG Power). SEBI’s investigation highlights how Indusind Bank structured a transaction wherein the loan given to an unlisted company (Jhabua Power) part of the Avantha group (then founders of CG Power) became stressed, and was shifted to CG Power, adversely impacting the minority shareholders of the company. Subsequently, Tube Investments (part of Muruguppa group) in November 2020 acquired the controlling interest in CG Power, thereby providing some relief to the company’s creditors.

This episode poses a significant embarrassment for Indusind Bank. If the bank were to accept SEBI’s contention that it facilitated the shifting of liabilities from the unlisted company of the then promoters/founders of CG Power to the listed company, it would incur the severe displeasure of SEBI as well as the Reserve Bank of India (RBI). No doubt such a transaction, of providing a foreign exchange loan to a step-down subsidiary of CG Power, routed to various companies in the Avantha group, ultimately led to Jhabua Power repaying its rupee loan to Indusind Bank, enhancing the quality of the security on paper for the bank. However, the banking regulator will investigate whether in October 2017 it was permissible to raise foreign borrowings for working capital, to repay rupee loans, and whether the bank engaged in ‘evergreening’.

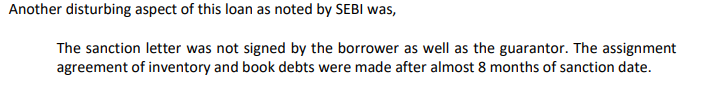

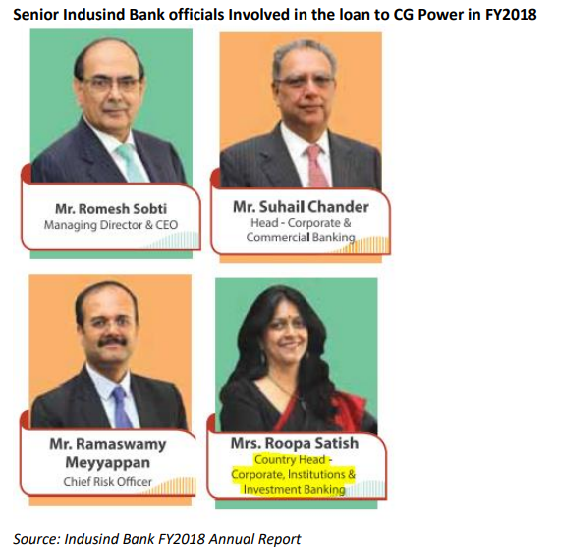

If, on the other hand, Indusind Bank sticks to the official version that the foreign exchange loan was provided to CG ME, and the bank was unable to monitor how the company deployed the funds, then shareholders of the bank should be extremely concerned about the bank’s poor credit appraisal, abysmal documentation, weak risk management, lack of compliance and complete absence of monitoring end-use of funds. This would indicate that the bank in general has very poor corporate credit lending systems which easily permit it to lend funds to a company which resembles a mere sales office, with negligible assets and income, on the sole basis of a corporate guarantee from its immediate parent. The checks and balances system of risk management, compliance and internal audit, the bedrock of banking had apparently been disabled in Indusind Bank. This analyst was one of the first in April 2017 (prior to the CG Power transaction) to raise and continued waving a red flag regarding Indusind Bank’s poor credit and risk management expertise under Romesh Sobti, the then CEO.

Responding to a query sent by this analyst, Indusind Bank’s spokesperson stated,

“The Bank strictly follows all applicable regulatory guidelines, corporate governance norms and Bank’s approved policies and procedures, in conduct of its business including sanction and disbursement of loans. Further, all necessary due diligence is done prior to all sanctions and disbursements.”

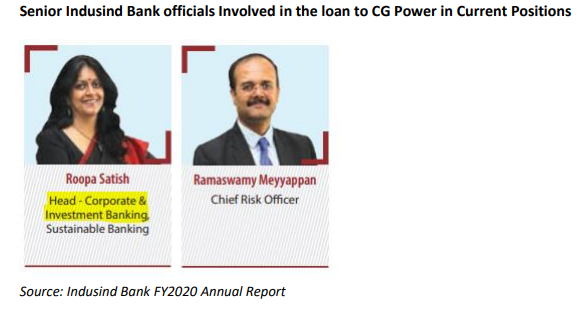

For Indusind Bank shareholders it is revealing how senior officials in the bank appraise, evaluate and monitor loans given to companies. It would be a matter of concern to shareholders that these officials, far from being punished, are instead rewarded through promotions. This conduct indicts the corporate credit and risk management in the bank and betrays extreme incompetence prevailing at the highest levels of corporate banking, risk management, compliance and internal audit. That Indusind Bank’s board of directors have rewarded such individuals by either promotion or permitting them to retain their positions speaks volumes of the corporate governance culture prevalent in the bank.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I do not own any equity shares in companies mentioned in this report. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

Thank you Mr Hemindra for exposing the rot and acting as a Guardian of the Hapless small investor; pl keep up the GOOD Work. Regards

Hemindra,

Your findings are indeed revealing. Congratulations on being such a thorough investigator with such high standards.