Shareholder activism is here to stay, as many recent instances of pushback at companies like Zee and JSPL have shown. The writing on the wall is clear: If you want to build a public company, investors need to have an equal footing

BY POOJA SARKAR, Forbes India Staff 12 min read PUBLISHED: Sep 27, 2021 03:56:14 PM ISTUPDATED: Sep 28, 2021 12:25:38 PM IST

Shareholder activism is not new to India but over the last four years especially, proxy advisory firms have come to play a significant role in shareholder voting

Shareholder activism is not new to India but over the last four years especially, proxy advisory firms have come to play a significant role in shareholder voting

Illustration: Chaitanya Surpur

Late night on September 13, around 9:15 pm, Bombay Stock Exchange (BSE), the oldest bourse in India, updated a notice. One of the largest media networks in the country, Zee Entertainment Enterprises Ltd (Zee), had announced that a day before, it had received a letter from its institutional shareholders Invesco Developing Markets Fund (formerly Invesco Oppenheimer Developing Markets Fund) and OFI Global China Fund LLC—who collectively hold 17.88 percent shares in the company—having requisitioned for calling an extraordinary general meeting (EGM) of company shareholders under Section 100(2)(a) under the provisions of Companies Act, 2013, for removal of key directors from the board of the company.Basically, the investors wrote to the company that it is seeking removal of Punit Goenka who is the managing director and a director on the board of the company and two other directors Manish Chokhani, and Ashok Kurien. Later, Kurien and Chokhani resigned citing personal reasons but over the next forty-eight hours, Zee pulled a merger card with Sony, while it is still under 90-day due diligence, and announced that Punit Goenka will remain the managing director of the newly-formed entity that will be listed on the bourses. In its second letter to the board on September 23, Invesco reiterated its EGM requisition, where the demands are in contrast with the terms of the Zee-Sony non-binding merger announcement.

While the news took the business community by storm, for some it did not come as a surprise. A year ago, during the annual general meeting (AGM) of Zee, corporate governance and proxy advisory firm Institutional Investor Advisory Services (IiAS) had, in fact, recommended voting against Punit Goenka’s re-appointment as managing director.“We had recommended (voting against the appointment) last year but the shareholders did not vote against, but some are asking for change this year,” says Amit Tandon, founder and managing director at IiAS. Tandon started the firm in 2011 and in the early days they were assessing 287 companies which were part of NSE200 and Futures and Options stocks. As per his last count they now analyse over 850 companies.

IiAS had raised concerns in FY20 when the auditors of Zee put out their observation over related party transactions and raised concerns over the adequacy of the company’s internal financial control. IiAS report says that both directors (Chokhani and Kurien), as members of the nomination and remuneration committee, failed to address the governance issues raised by independent directors who eventually resigned from directorships. To add fuel, disclosures show that Goenka’s remuneration increased by 46 percent while employees got no raises during the year (FY20). That the shareholder approval was glossed over and that Punit Goenka was paid more than what was approved by shareholders added to the investors’ cup of woes.

Separately, on September 6, private lender Yes Bank, which holds 25.63 percent stake in Dish TV and is the single largest shareholder of the company, wrote to Dish TV seeking removal of five directors in the company citing the board’s approval of rights issue that the bank has been objecting to. Yes Bank has reasoned that Dish TV undertook the rights issue to dilute its shareholding. Kurein, who is known as the founder-promoter and sits on the board of both the companies as director, has been asked to be removed by investors. While this is the latest case hot off the oven, this is not the only one.

Earlier in May this year, Jindal Steel & Power Ltd (JSPL) had proposed to sell its 96.42 percent equity stake in Jindal Power Ltd, the company’s power business to Worldone Private Ltd (Worldone) for a consideration of Rs 3,015 crore. When the transaction was first announced, a clutch of shareholder advisory firms including Mumbai-based IiAS and Bengaluru-based InGovern Research asked JSPL shareholders to reject the sale proposal. The reason being, Worldone is part of the promoter group and it is a related-party transaction. In fact, Worldone is owned by Naveen Jindal, Shallu Jindal and Arti Jindal, with Naveen Jindal holding majority of the shareholding.

The proxy advisory firms informed the shareholders of JSPL to vote against the proposal as they believed that for a fully operational power plant with 3400 MW capacity the deal is hugely undervalued and they expected the value of the transaction to be around Rs 10,000-12,000 crore. InGovern pointed out that the company had not presented its valuation report to shareholder and it further argued that advances and inter-corporate deposits (ICDs) paid by JPL to JSPL to acquire captive power plans were converted to loan.

After much uproar by proxy advisory firms, the company withdrew the EGM notice to approve the sale process and it later revised the deal. Finally, in late August, InGovern recommended the shareholders to vote for the revised deal. While three proxy advisory firms asked the shareholders to vote for the deal, IiAS still recommended voters to vote against it. According to the company the new proposal was successfully passed with 96 percent votes.

Institutional Shareholder Services group of companies (ISS) which is majorly owned by Deutsche Börse Group, along with Genstar Capital and ISS management in its note in August recommended voting for the revised deal. “The proposed terms reflect a revision in approach from the earlier offer (which attracted significant shareholder scrutiny). The acquirer will now buy out both the equity and preference shares, it will take over the outstanding liabilities owned by the company to Jindal Power,” the note said.

Shareholder activism is not new to India but over the last four years especially, proxy advisory firms have come to play a significant role in shareholder voting on the resolutions of listed companies. A lot of corporates in India Inc are promoter-driven, despite having dispersed shareholding on paper.

A decade ago, in 2010, when Shriram Subramanian started InGovern, the only such proxy advisory firm, the markets regulator SEBI had, in February 2010, just come up with regulations for mutual funds to vote at AGMs. This was followed by the crucial the new Companies Act 2013 effective April 1, 2014.

Subramanian, founder and managing director at InGovern says, “The new Companies Act and subsequent regulatory changes gave more powers to minority shareholders. Over time, the regulators, SEBI and IRDA have pushed mutual funds and insurance firms to act in the interest of unit holders and policy holders. Also, in the last ten years assets under management (AUM) of mutual funds and insurance companies have gone up by 5 to 6 times, which begs the importance of fiduciary responsibility because investors have trusted them with capital.”

The two crucial regulations which played a pivotal role in ensuring high standard of corporate governance across Indian companies are the Companies Act and the listing obligations and disclosure requirements regulations (LODR) by the Securities and Exchange Board of India (SEBI). Ministry of Corporate Affairs (MCA) revamped the Companies Act in the year 2013 and so did SEBI in the year 2021 in regards to LODR.

“Is that enough?” asks Neha Malviya, executive director at Wilson Financial Services, a financial firm that specialises in foreign portfolio investments. “We constantly hear stories about how promoters misuse their powers and how directors, including the independent directors, could not say no to a transaction or resolution. It is time the directors understand their duty towards the shareholders and become objective in their approach rather than acting as puppets for the promoters,” she says.

Some of the resolutions that gained traction in the initial days include the merger of Sesa Goa and Sterlite Industries by promoter Anil Agarwal in 2012. Back then, Templeton Asset Management, an investor in the company, and IiAS, had recommended voting against the proposal. Other cases include sale of health care division of Siemens Ltd, among others.

But Subramanian says one of the momentous case was in 2014, when institutional and minority shareholders defeated proposals by Tata Motors for remuneration of three of its employees, late Karl Slym, the former managing director of the company, Ravindra Pisharody and Satish Borwankar. According to the rules, 75 percent votes are required for the proposals to go through.

More recently, compensation resolutions that have been rejected by shareholders include Eicher Motors Managing Director Siddhartha Lal’s reappointment and remuneration package. While the company two days later unanimously reappointed Lal as the MD and will rework on the compensation, the board will now go to shareholder for approval via postal ballot.

One reason experts say that more people are voting is all thanks to depository services making online voting possible. As depository services firms send links and reminders to shareholders via email, more and more minority shareholders are participating in e-voting and getting their voices heard. Recently, market regulator SEBI’s

Chariman Ajay Tyagi said during a market summit that shareholder activism is good for everyone, especially minority shareholders. The question, however, is why corporate governance issues are cropping up so often over the last two years. Is there any co-relation between bull markets and governance lapses?

Subramanian points out that over the last one and a half years new breed of investors have entered the market and a lot of these investors do not even bother to read financial statements and analyse governance structures before investing in a company, as stock markets head for continual highs, they keep buying.

For example, a pharma company announced a transaction that turned out to be a related-party transaction and the stock fell by over 30 percent. Later, the company reversed the transaction. Another important aspect that shareholders need to watch out are auditor resignations. While most auditors do not clearly ascribe the reason for resignation, frequent auditor resignations or big four firm resignations are certain red flags institutional investors are taking note of.

Initially, institutional investors were voting against certain transactions, mostly mergers and acquisitions. But things have changed over time as investors are now concerned about compensation, director movements, related-party transactions, sale and acquisition of assets.

Tandon of IiAS says, “In 2011, we were looking at boards if they had women director, then slowly when regulations changed we asked if companies had independent women directors. Now we ask if they have more than one independent women director. Until 2014, investors were not really bothered about resolutions on raising debt but then they started asking the management to explain if it is just an enabling resolution for the year or they really need to raise the entire debt amount. Now compensation has started entering the discussion.”

As one starts thinking about issues, for a long time, global investors were worried about induction of independent directors but now domestic investors too are taking note, take the case of IDFC. Around September 24, IDFC’s shareholders rejected the re-appointment of Vinod Rai as non-independent and non-executive director to the board, with 62.3 percent shareholders voting against the resolution. Rai is the non-executive chairman of the board and his term ended in July 30.

Hemindra Hazari, who runs HKH Research that asks critical questions about management and corporate governance, says, “In the critical financial sector, there is a reason why regulators stipulate maximum continuous tenures for auditors and independent directors.

The purpose is to prevent excessive proximity to promoters. It is surprising that not only does the IDFC board fail to comprehend this basic principle, but also that Vinod Rai himself is willing to compromise his independence and stature to continue on the IDFC board on such terms.” Earlier in September, during IDFC’s investor call, shareholders had cited their apprehension towards this appointment.

While the needle has started to move, Indian shareholder concerns are still behind what global investors are seeking these days. For example, US-based proxy advisory firm Glass Lewis, noted that during 2021 proxy season, issues related to climate change, human capital management and racial equity were highlighted, with proposals on many of these topics frequently receiving strong, if not majority shareholding support. ESG, which was a fringe issue until half a decade back, is now one of the major rationale for investors, especially for sovereign funds, endowment and pension plans who deploy billions of capital around the world.

According to BloombergQuint on September 24, California State Teachers’ Retirement Fund (CalSTRS) has decided to vote against the appointment of Saudi Aramco’s chairman as an independent director to the board of Mukesh Ambani’s Reliance Industries. CalSTRS’ voting decision is based on Glass Lewis’ recommendation.

Many-a-times, recommendations made by proxy advisors are sharply divided between two firms. “Similarly, sometimes promoters or the management of a listed company seek action on proxy advisory firms from SEBI when they have a divergent view. SEBI recently tightened the processes of proxy advisory firms while maintaining their independence.

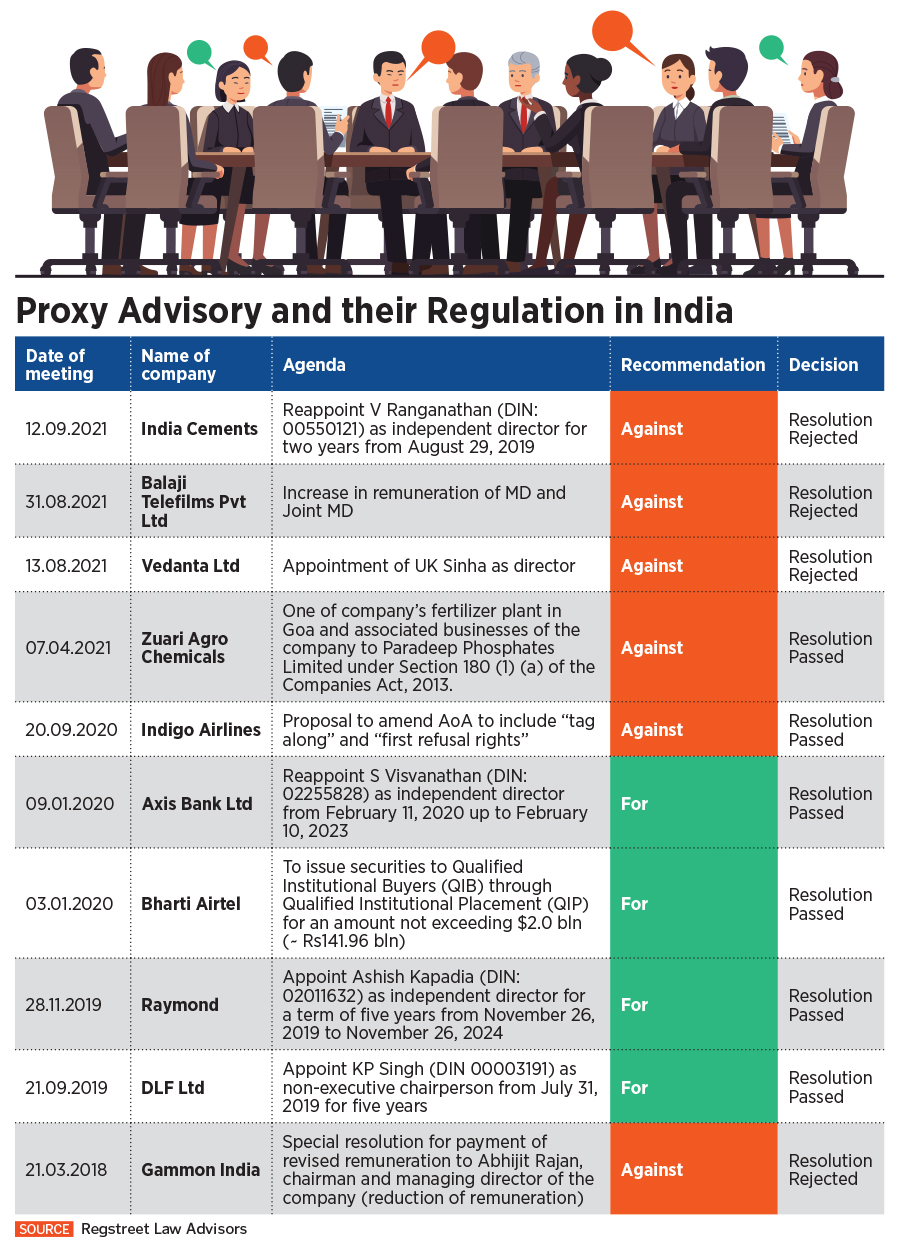

SEBI had recommended disclosure of conflict of interest and response of the listed company available in the proxy reports,” says Sumit Agrawal, managing partner at Regstreet Law Advisors and former SEBI officer.

While one may vary on recommendation of proxy advisory firms, “it is difficult to deny that corporate governance issues at crème de la crème companies such as KPIT, Raymond, Finolex, Fortis, Suzlon, Gammon India, Vedanta, Bharti Airtel etc received attention because of their reports. From a broad perspective, it only inures to the benefit of investors. The voting decisions of individual investors as well as institutional investors such as mutual funds, pension funds and financial institutions at shareholder meetings are shaped by the guidance and research analysis received from proxy advisors,” adds Agrawal.

According to the fifth report on the Indian Corporate Governance Scores, which is based on the Indian Corporate Governance Scorecard and is developed jointly by the BSE, the International Finance Corporation (IFC) and IiAS, the 30 constituents of the S&P BSE SENSEX account for nearly 48 percent of total market capitalisation. At an aggregate level, Sensex companies have improved their overall governance practices from last year.

Companies where there have been concerns on financial statements in the past three years has risen to 31 percent in 2020 compared to 25 percent in 2019. While this data does not include emphasis of matter (EOMs) issued due to Covid-19-related limitations, what this indicates is an improvement in audit quality and the fact that auditors are finally asserting themselves.

Malviya argues that not just listed firms, but also even unlisted companies should be equally accountable in terms of disclosures to be made to their shareholders, which currently is not the case. After all, she says, companies with better corporate governance always generate far more returns and that shareholder activism is likely to gain more momentum as we keep uncovering scams after scams in listed companies.As Tandon finally says, “investors understand that governance failures will lead to value destruction and you can’t ignore the interest of minority shareholders anymore”.

While enabling laws of the land are changing, Subramanian cites that there is a generational shift in promoters. Earlier investors were subservient to promoters which is longer the case. The writing is on the wall: If you want to be a public company then investors have an equal footing and will claim their rights; it is their company too.