“It is apparent that Yes Bank is the bad boy in the eyes of the regulator,” independent banking analyst Hemindra Hazari.

As Deutsche Bank AG veteran Ravneet Gill moves into the 27th floor of Yes Bank Ltd.’s headquarters in downtown Mumbai, he brings the curtain down on one of the more colorful chapters in Indian finance.

His predecessor, founder and Chief Executive Officer Rana Kapoor, built Yes into India’s fourth-largest private lender over 15 years until the central bank forced him out amid a controversy over bad-debt accounting. While Kapoor stepped aside as CEO in January, tensions between Yes and the regulator have persisted, and it now falls to Gill to ease them.

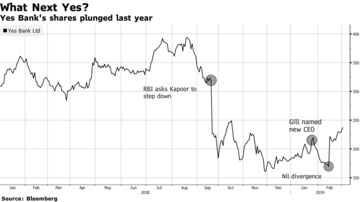

Gill, who took the helm Friday, will have to walk a fine line. Repairing relations with the central bank will require reining in a culture that helped Yes shares vastly outperform Indian peers — until they crashed last year, wiping out almost half of the bank’s market value. They have since recovered some of that ground.

“Investors hope that Gill, working with the board, will change the culture at Yes Bank and make it a transparent bank,” said Shriram Subramanian, founder at InGovern Research Services, a corporate governance advisory firm. “Governance concerns at Yes Bank and the overhang of Rana Kapoor on the credibility of the bank would hopefully be laid to rest.”

Gill started as its chief executive officer and managing director on Friday, Yes Bank said in an exchange filing. Shares of the lender rose 2.7 percent to 237.4 rupees, the highest since October, in Mumbai trading.

As Gill moves to put his stamp on the bank, chances are its mercurial founder will be watching from the wings.

Initially, Kapoor wanted to keep his office in Yes Bank’s building in Mumbai’s Lower Parel by transforming it into a founder’s office, people familiar with the matter said. But some board members worried that Kapoor would try to wield influence behind the scenes, the people said, asking not to be named discussing confidential deliberations.

Now, Kapoor is considering moving out of the building and into an office at Yes’s old headquarters, they said, a 20-minute drive away.

Yes and Gill didn’t respond to emails seeking comment, while Kapoor didn’t respond when emailed on his Yes account and contacted by phone.

Grave Concern

The RBI never said publicly why it forced Kapoor to step down. But, according to a Mint report at the time citing documents from the central bank, the RBI had pointed to a “poor compliance culture” and “grave concern and regulatory discomfort” with Kapoor in rejecting a request to reappoint him.

Even when Yes put to rest concerns about its bad loans, it landed in hot water with the RBI. After central bank audits found a bigger pile of non-performing debt than the lender had reported for the 2016 and 2017 financial years, Yes said Feb. 13 that there were “nil divergences” for the year to March 2018, triggering its biggest one-day stock rally in 14 years.

Two days later the lender revealed that the central bank report had also identified several lapses and regulatory breaches in various areas of its operations. The criticism emerged only because the regulator censured Yes for making a “deliberate attempt to mislead the public” by previously revealing only one positive element of the confidential report.

‘Bad Boy’

“It is apparent that Yes Bank is the bad boy in the eyes of the regulator,” independent banking analyst Hemindra Hazari, who has been tracking Indian lenders for more than two decades, wrote in a Feb. 18 report on the Smartkarma platform. “The bank will have to renew its efforts to change that perception,” he wrote, noting that other lenders hadn’t been publicly pulled up for similar disclosures.

Kapoor brought a unique style to Indian banking. He was skilled at identifying companies about to suffer financial stress and offering them loans at higher interest rates, according to Yuvraj Choudhary, an analyst at Anand Rathi Financial Services. The loans were backed by collateral so Yes could be confident of getting its money back even when accounts were overdue, he said.

When companies struggled to repay, Kapoor would pressure key executives and call founders into the night, people familiar with his methods said.

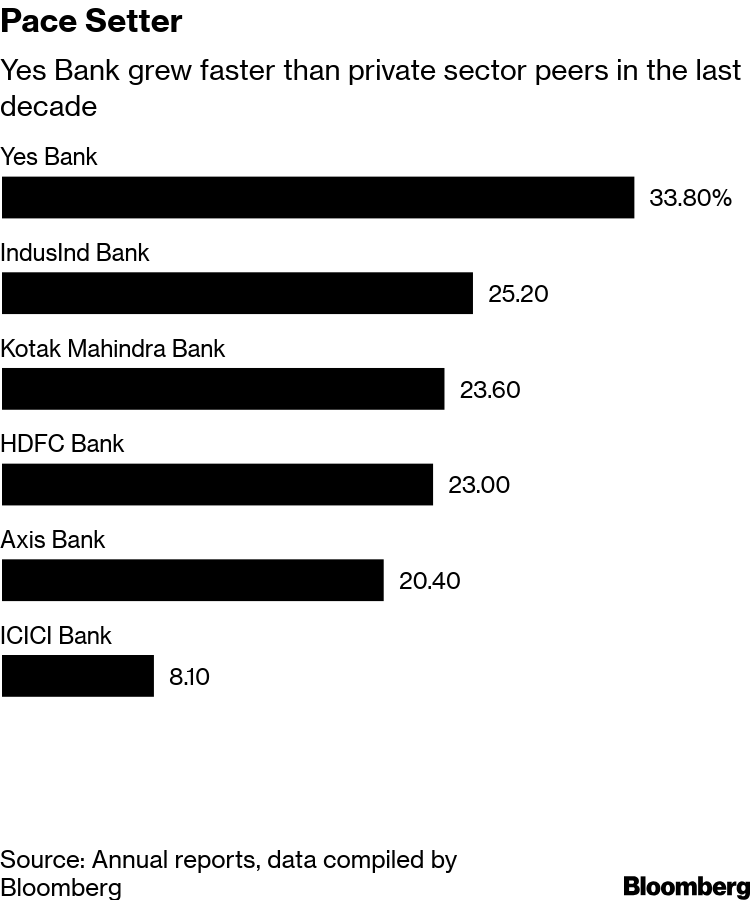

Under Kapoor, total assets of the bank grew at a compound annual growth rate of 34 percent in the 10 years through March 2018, outpacing peers.

But a crackdown by the central bank on a system-wide legacy of shoddy lending led to action against several lenders. Yes has argued that the impact of its so-called bad-loan divergence was small because many loans classified as problematic by the RBI were subsequently recovered.

Compliance Focused

Gill, who ran Deutsche Bank’s Indian unit for more than six years, joins Yes with a reputation for being conservative in taking risks and focusing on processes and regulations, according to people who have worked with him.

He has already reached out to executives at other lenders as he moves to revamp the leadership team, people with knowledge of the matter said. One role that immediately needs filling is that of Pralay Mondal — hired in 2012 to boost retail lending and build low-cost checking accounts — who quit last month.

Sins Forgotten

Investors will soon get a measure of Gill as some analysts expect Yes to sell shares so it can buttress its capital reserves to sustain growth. The bank’s tier 1 common equity ratio was at 9.1 percent at the end of last year, the lowest among its major private-sector peers.

With non-performing loan data from the bank no longer in question, the lender may be able to make a “more rapid return to market,” according to a Citigroup Inc. report last month. The optimism is reflected in 36 buy recommendations for Yes among analysts tracked by Bloomberg, the highest proportion since September for such calls.

“What has gone wrong is only the perception of the management,” said Chokkalingam G, head of research at Equinomics Research & Advisory Pvt. Ltd. “If Gill can ensure quality of assets doesn’t drop badly and business continues to grow the way it is growing, the remaining things will be forgotten.”(Updates shareprices in fifth paragraph.)