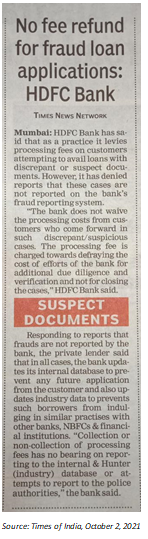

EXECUTIVE SUMMARY. This analyst’s research note on September 24, 2021 highlighted HDFC Bank’s disturbing practice of extracting ‘processing fees’ from prospective customers who applied for loans using false/fabricated documents. Following this, the media finally woke up (here and here) from their self-induced slumber. HDFC Bank was forced to issue a media statement on October 1, 2021 wherein it justified levying processing fees, citing the additional due diligence required when loan applicants submitted “discrepant/suspected documents”. HDFC Bank also claimed that the bank filed police complaints in a “number of cases” where the processing cost was levied. The bank also explicitly stated that the fees were not for closing the case.

There are some issues with HDFC Bank’s clarification to the media:

- The statement by HDFC Bank has not been published as a press release, nor has it been informed to the stock exchanges, which would have been the proper procedure. It has been given to select media agencies and to those analysts who have specifically requested it. This is unfortunate, as it is an important clarification, which required that it be publicly disclosed.

- Most Indian banks do not levy fees for rejecting a loan application where false documentation has been detected. It is also unlikely that a person who was not a customer of the bank would voluntarily agree to pay a processing fee to a bank which has rejected his/her loan application.

- There is no specific mention in HDFC Bank’s statement to the effect that Income Tax authorities had been informed in cases where fake Permanent Account cards (PAN) and dual PAN were submitted by retail individuals applying for a loan. The bank has specifically mentioned that internal and industry databases were updated and the police were informed.

- HDFC Bank had earlier informed this analyst that it had recently stopped levying processing fees for false documentation. If the bank’s practice was legitimate and conformed to the law why did it discontinue the practice soon after the whistle blower raised these allegations?

These questions can only be answered by a thorough investigation by the Reserve Bank of India (RBI) and by the Income Tax authorities to determine whether HDFC Bank was indulging in unfair practices, and whether loan applicants who were not HDFC Bank customers were voluntarily paying the “processing fees”.

It is important for the regulator and for stakeholders to examine HDFC Bank’s significant fee income and the practices and policies that are driving it. HDFC Bank should not suffer the fate that befell Wells Fargo Bank.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in HDFC Bank in this report. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.