EXECUTIVE SUMMARY. ICICI Bank reported strong profits for 2QFY2022, with standalone net profits increasing by 30% YoY to Rs 55 bn., enthusing the market. The bank has been focusing on retail loans to drive its assets and profits, after heavily haemorrhaging on corporate loans prior to FY2020. The retail asset emphasis was expected to provide stability to the bank’s earnings. However, the broader economic slowdown, combined with the Covid-19 pandemic, has unmasked the supposed stability in the retail strategy. In some ways this is a mystery, as 55.3% of retail loans are mortgages, which are regarded as being very secure. It is surprising that the bank does not provide any details regarding the erratic retail performance, and does not attempt to educate investors on why a retail portfolio largely consisting of mortgages should perform in such an unpredictable manner.

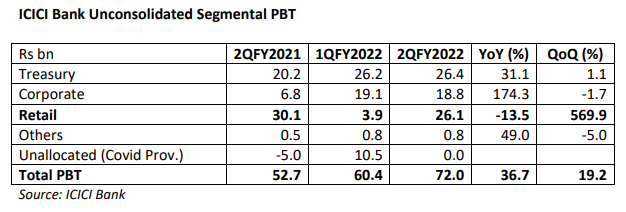

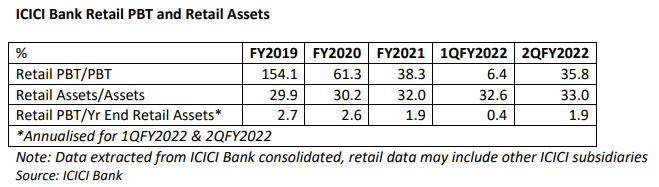

In 2QFY2022 ICICI Bank reported a YoY decline in retail Profit Before Tax (PBT) of 13.5% to Rs 26.1 bn (in 1QFY2022 Rs 3.9 bn), with retail loans of Rs 4,404 bn. Pertinently, the retail PBT in 1QFY2021 was Rs 27.6 bn with retail loans of Rs 3,449 bn. Even though retail loans since 1QFY2021 increased by 28%, the retail PBT in 2QFY2022 is still below the level of 1QFY2021. The bank’s overall domestic net interest margin in 2QFY2022 is higher than 1QFY2021 and 2QFY2021, which indicates that the performance was not impacted by a squeeze in margins but more likely by credit costs.

Shareholders in ICICI Bank should be concerned regarding the volatility in the bank’s retail PBT. It could be on account of an industry-wide impact on retail loans brought about by Covid19 which impacts quarterly performance, or it could be peculiar only to ICICI Bank’s retail loans. Whatever the reason, it reveals that a strategy of increasing retail loans, the bulk of which are mortgages, is not insulated against a broad economic downturn, and results in high volatility in performance. Whether this volatility is transitory or for the long term only time can tell.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in ICICI Bank. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.