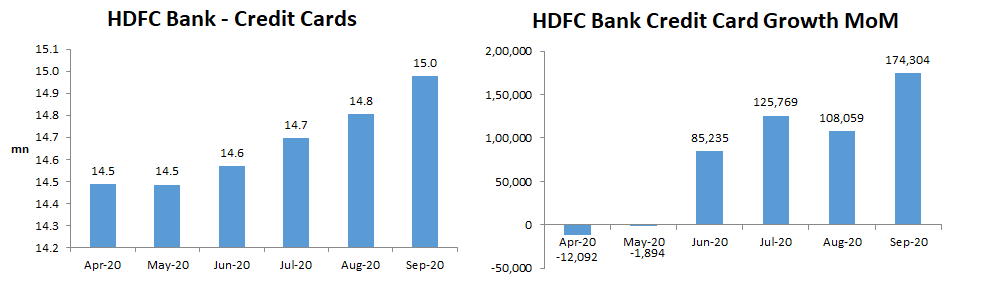

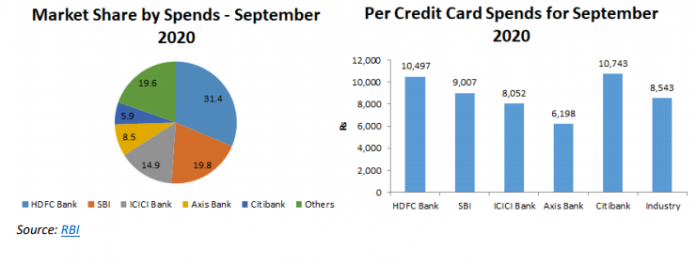

EXECUTIVE SUMMARY. The Reserve Bank of India’s (RBI) decision to temporarily put a halt to all digital launches of HDFC Bank’s financial products and also cease all new issuances of credit cards by the bank brings to the fore the huge reputational risk on account of the bank ignoring its technology issues. But further, it impacts its future revenue, especially from its highly lucrative credit cards business. The bank is the market leader in credit cards, with a 31.4% share by card spend, and its 3 month average (July-September) addition was 136,044 cards per month, which is the likely loss to the bank as rivals compete for these additional cards in the following months. In FY2020, 95% of customers initiated transactions via its digital (internet and mobile) channel and as on September 30, the bank had consolidated assets of US$ 225 bn.

In December 2019, this analyst was one of the few to highlight the obvious deficiencies in HDFC Bank’s digital operations, the lack of clear and relevant communication to the public and to customers by the bank, and, most worryingly, the absence of a disaster recovery plan, which should have been taken up on a war footing by the bank’s board of directors.

The RBI’s order specifies that the “Bank’s board examines the lapses and fixes accountability”, which indicates that in the past year the HDFC Bank’s high profile board of directors has not given this issue the importance it deserves by examining the cause for the failure of its digital operations, and the remedial actions to be adopted to prevent its recurrence; nor has it fixed accountability. A professional board would have given such a basic task high priority soon after the lengthy digital outages of last December. That it takes a humiliating public directive from the banking regulator to remind the HDFC Bank’s Board to do its job is indicative of the corporate governance practiced in India’s most valuable bank.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own HDFC Bank equity shares. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security

It is very surprising that how this Govt is using RBI for pulling down such good bank and 100times better than any PSU banks as of date.

Doubtfully again the Adani or Ambani may be behind this plan so as to tarnish bank immage. But no investor or publick will belive on such remarks of the RBI which is most corrupted Govt organization as of date. See the PMC and many other banks and their audits done by same RBI fools and today ‘s situation!!!

The public is doubtful may be sure that some business tycoons are using RBI!!!!

Good action taken by RBI , to protect the Innocent people banking with Hdfc , why such professionally run organisations also takes things for granted and put people on risk in this uncertain time , when lot of cyber crime and online frauds are happening, I never Expected this laxity from a company like Hdfc bank

The fact that 95% of HDFC banks customer initiated transactions were generated through digital network should be proof enough that there is no serious deficiency in their infra setup. RBI wants to show who’s the boss by flexing it’s muscle. That’s all.

I really thinknthis is good step by rbi as I have seen how irresponsible hdfc is and how they suck every drop from innocent people

Frank opinion

RBI is modi, ambani, adanis puppet

Sorry to say..but thats truth