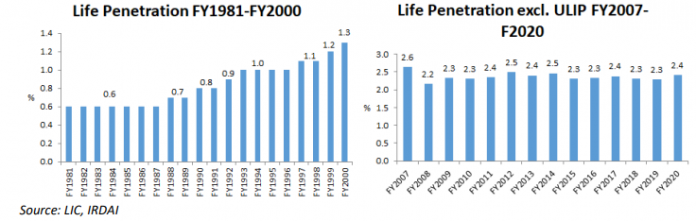

EXECUTIVE SUMMARY. The argument made at the time of opening up the life insurance sector and allowing the private sector was that doing so would increase life insurance penetration (life premium/GDP) and thereby increase long term savings, which would flow into infrastructure investments (which are inherently long-term). But despite the entry of 23 private companies, from FY2007 till FY2020 life penetration (excluding ULIPs) has stagnated. The theory that permitting the private sector to enter life insurance will increase penetration has been disproved in the 2 decades since 2000.

LIC which had been steadily increasing penetration in India prior to 2000 is losing market share, while the private sector is unable to increase overall life penetration, and is content with only taking market share from LIC. The higher income earning individual and profitable segment of the life insurance market has been targeted by the private companies at the cost to LIC. Simultaneously, perhaps on account of the depressed economic environment, the life insurance market does not appear to be growing, and all the players including LIC appear uninterested in growing the market as it may be less profitable.

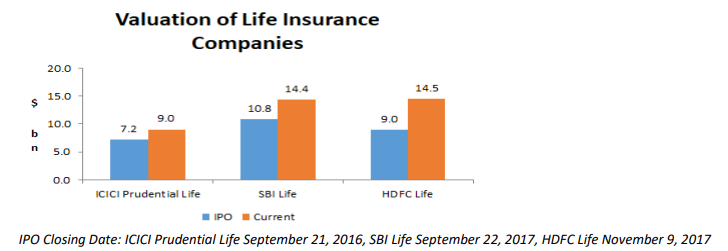

The entry of the private sector in life insurance has not resulted in the original objectives being achieved. Instead it has created market valuation for the shareholders, either directly, when the entities have been listed on the exchanges, or indirectly, where the parent companies are listed.

All discussion of the purported original purpose of opening up the life insurance sector – to secure long term funds for infrastructure investments – has been abandoned without a trace.

Note: The Research Unit for Political Economy (RUPE) in its December 1999 issue had correctly predicted the outcome of allowing the private sector/foreign participation in the Indian insurance sector. The entire report can be downloaded here and will also be available on the RUPE website.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in HDFC Standard Life Insurance. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.