It is difficult to read the SEBI’s scathing order and not wonder what on earth the NSE board was doing.

In Rudyard Kipling’s Jungle Book, Akela, the lone grey wolf leader, exhorts the pack to “look well” upon the cubs who are to be inducted into the pack as their own. In the opposite sense, the public and investors in India’s financial and corporate sector should take a hard look and examine the ‘pedigree’ board directors who are meant to represent their interests.

The Securities and Exchange Board of India’s (SEBI) Final Order Against Ms Chitra Ramkrishna and Others has unintentionally exposed the record of the directors of the National Stock Exchange (NSE). Unlike the cubs of Jungle Book, these directors are individuals mostly in their prime, and at the pinnacle in their organisations or professions of law, accountancy and corporate management. Indeed the NSE had a stellar board.

One key facet of the NSE controversy – brought into the public spotlight once again by SEBI this week – was the controversial appointment of Anand Subramanian as chief strategic advisor, his financial compensation and his re-designation to group operating officer.

Also read: ‘Spiritual Guru’ of Chitra Ramkrishna Ran NSE as ‘Puppet Master’, SEBI Probe Finds

The board of directors (with the exception of Ravi Narain) may have been ignorant of Anand Subramanian’s appointment and joining NSE on April 1, 2014, as he was categorised as a consultant and not part of the senior management.

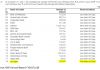

However, it was highly unusual that the directors, and especially the members of the Nominations and Remuneration Committee (NRC), were unaware of Subramanian’s importance. In the FY’15 and FY’ 16 annual reports, his name figures prominently in the second position after J. Ravichandran, which indicates Subramanian’s seniority in position as well as in remuneration.

Source: NSE Annual Report FY2015 & FY2016

If one accepts SEBI’s documentation of events at NSE, the most charitable explanation for the conduct of the non-executive directors is that it was irresponsible; at worst, it could be termed complicit.

Consider this: At a board meeting held on August 11, 2015, the board of directors delegated to Subramanian substantial powers – almost akin to those of the CEO. He was designated as a consultant, but had the title of Group Operating Officer and Advisor to the Managing Director. It should have been the responsibility of all the directors including luminaries such as Y.H. Malegam (chairman, Audit and Nomination Remuneration Committee), Justice (retd.) B.N. Srikrishna and S.B. Mathur (chairman of the board of directors) to have enquired about Subramanian’s background, relevant job experience and suitability for being part of the senior management team, and especially why a consultant was delegated with significant executive powers.

Apparently, either the board of directors did not undertake a thorough background check of Subramanian’s employment history, or, shockingly, they did so and found him suitable for the responsibilities they were delegating to him. Worse, after delegating Subramanian with substantial executive responsibilities, they failed to designate him as a key management person or even as a full-time employee.

NSE Directors Who Attended August 11, 2015 Board Meeting Which Delegated Considerable Executive Powers to Anand Subramanian

| S. Number | Name | Category |

| 1 | S B Mathur | Chairman PID & NRC member |

| 2 | Ravi Narain | Vice Chairman, Shareholder director & NRC member |

| 3 | Y H Malegam | Public Interest Director (PID) & Chairman NRC |

| 4 | K R S Murthy | PID & NRC member |

| 5 | Justice B N Srikrishna (Retd) | PID |

| 6 | Prof. S Sadagopan | PID |

| 7 | Chitra Ramkrishna | MD & CEO |

| 8 | S B Mainak | Shareholder Director |

| 9 | Prakash Parthasarathy | Shareholder Director |

| 10 | Abhay Havaldar | Shareholder Director |

If such conduct from the non-executive directors was not bad enough, the omission in the minutes pertaining to the “sensitive and confidential” discussion of the NRC’s report pertaining to Anand Subramanian’s appointment in the October 21, 2016 board meeting and the decision taken to remove him reveals the pathetic standard of corporate governance at NSE. Taking a decision to remove a senior executive with immediate effect is an extremely serious issue, which needs to be carefully documented for the record as well as for any possible future legal dispute.

Ashok Chawla

That the discussion was omitted from the board minutes indicates that it may not have been included in the Agenda for the board meeting, in which case Ashok Chawla as the public interest director and chairman of the board should have included it as an Agenda item, or allowed the discussion to be included in the “Any other item with the permission of the chair” category.

If the item was included in the Agenda and the discussion was not minuted, it is a grave lapse; and if it was not included in the Agenda and given its importance, all the directors, Dinesh Kanabar, a “stalwart” in the auditing profession, Naved Masood, TVS Mohandas Pai, Dharmishtha Rawal, Abhay Havaldar, Anshula Kant (representing State Bank of India) and Prakash Parthasarthy (shareholder director) should have persuaded Ashok Chawla as the chairman to include it and have the discussion minuted. As at this meeting the board had concluded that Subramanian had to step down; it was imperative for the minutes to document the decision-making. That none of the directors objected to the omission in the minutes indicates that they had aligned themselves with Chitra Ramkrishna and Ravi Narain, completely ignoring the public and shareholders’ interest.

NSE Directors Who Attended NRC and NSE Board meeting on October 21, 2016

| S. Number | Name | Category |

| 1 | Ashok Chawla | Chairman PID & NRC |

| 2 | Ravi Narain | Vice Chairman Shareholder director & NRC |

| 3 | Dinesh Kanabar | PID & Chairman, NRC |

| 4 | Naved Masood | PID |

| 5 | T V S Mohandas Pai | PID |

| 6 | Dharmishtha Rawal | PID |

| 7 | Abhay Havaldar | Shareholder Director |

| 8 | Anshula Kant | Shareholder Director |

| 9 | Prakash Parthasarathy | Shareholder Director |

The omission of minutes documenting an important event was again repeated by the directors at a board meeting held on November 29, 2016, when Ashok Chawla, chairman of the board and Dinesh Kanabar, chairman, NRC, informed the board of the exchange of emails between Chitra Ramkrishna and the unknown individual. Here again, on account of the sensitive and confidential nature of the matter, the directors decided to not minute the discussion.

The minutes of board meetings are extremely important and are not for public viewing. Hence stating that the issue is confidential and sensitive, in order to not document important board discussions or not include the item in the Agenda for board meetings, demonstrates extremely poor corporate governance. What is shocking is that the public interest and shareholder directors collectively decided to not document the board discussion, thereby abdicating their primary responsibilities. The approach by the board amounted to a cover-up of the entire episode, so that no outsider, including the regulator, would ever come to know. It is fortuitous that, on account of a complaint to SEBI and A.N. Ananthasubramanian and Co., the secretarial auditor query, that SEBI was able to investigate and unearth this sordid event.

The entire board’s complicity is further indicated by the fact that, despite being aware that Chitra Ramkrishna was divulging confidential information of the NSE to an anonymous individual and had recruited and excessively rewarded Anand Subramanian, the board allowed her to resign on December 2, 2016. For good measure, the board placed on record her “sterling contribution.”

The board’s decision to hide important events appears to have been matched by its own unusual willingness to attend board meetings without a notice or even an Agenda being circulated. Attending a board meeting without a Notice and an Agenda is highly irregular in the corporate world; even shell companies take care to perform these formalities.

For emergency board meetings a shorter notice must be given. Yet on September 16, 2016 the NSE had a board meeting in which neither a Notice nor Agenda was circulated. One wonders how the seven out of eight directors, including four of the five public interest directors, attended the meeting without a Notice or an Agenda being circulated – did the ‘Yogi’ in distant Himalayas spiritually communicate the Notice and the Agenda to them?

Extract from NSE’s Secretarial Audit FY 2017

Source: NSE Annual Report FY2017 p. 117

NSE has premier shareholders: in FY2017, the government-owned Life Insurance Corporation (LIC) had a 12.5% stake, followed by the State Bank of India (SBI) group with 9.5% (SBI-5.2% and SBI Capital Markets 4.3%) shareholding, and foreign shareholders as well had their representatives on the NSE board. The government-owned institutions manage public funds, and their representatives, along with the public interest directors, had a fiduciary responsibility to monitor the executive management of the NSE.

Source: NSE FY2017 Annual Report p. 109

However, as the SEBI Order against Chitra Ramkrishna and the others clearly highlights, all the directors, including representatives of LIC, SBI and foreign shareholders, not only did not object or complain to the SEBI regarding the grave irregularities at the NSE, but were complicit with the executive in not raising questions regarding the suitability of Anand Subramanian for the responsibilities they delegated to him. They suppressed board minutes and even attended a board meeting in which the Notice and Agenda were not circulated, and finally, they did not sack Chitra Ramkrishna but allowed her to resign gracefully.

Anshula Kant, the then Deputy Managing Director and Chief Financial Officer, SBI was appointed on the NSE board on October 19, 2016, and the SEBI Order has recorded her presence at the October 21, 2016 NSE board meeting in which the decision was taken to remove Anand Subramanian. Yet as a director representing the second largest shareholding in the NSE, she did not insist on minuting this important discussion, or even record her dissent at the minutes being omitted at the board meeting. Even if it was not included in the Agenda, as a director and representative of the second largest shareholder, she could have persuaded the chairman to include the item in the “Any other item with the permission of the chair” category during the board meeting and hence ensured that the discussion be documented. Such conduct has not impeded Kant’s career. Indeed, she was elevated as SBI’s Managing Director and, in July 2019, was appointed as the Managing Director and Chief Financial Officer, World Bank.

The conduct of long-time shareholder directors like Prakash Parthasarathy and Abhay Havaldar, both of whom were on the NSE board in this period of FY2014 to FY2017 (see table below), was no better. They attended the board meeting in which the board granted executive powers to a consultant, and Havaldar, like Kant, also did not object to the omission of the minutes at the October 21, 2016 meeting.

“It is apparent that NSE was trying to conceal the discussions relating to Subramanian that took place during the board meeting on 21 October, 2016 in the presence of Ramkrishna and also the discussions relating to the said exchange of emails,” the SEBI order said.

“Thus, Noticee no. 2 [NSE] and its Board were aware of the exchange of confidential information by Noticee no. 1 [Ramkrishna] with an unknown person having email id rigyajursama@outlook.com in its meeting held on November 29, 2016. However, Noticee no. 2 and its Board had taken a conscious decision to not report the matter to SEBI and keep the matter under wraps.”

NSE Board of Directors – FY 2014 to FY 2017

| FY2014 | FY2015 | FY2016 | FY2017 |

| S B Mathur (Chairman, member NRC) | S B Mathur (Chairman, member NRC) | S B Mathur (Chairman, member NRC) till 23.3.2016 | Ashok Chawla (Chairman) |

| Ravi Narain (Vice-Chairman, member NRC) | Ravi Narain (Vice-Chairman, member NRC) | Ravi Narain (Vice-Chairman, member NRC) | Ravi Narain (Vice-Chairman, member NRC) till 3.2.2017 |

| Chitra Ramkrishna (CEO) | Chitra Ramkrishna (CEO) | Chitra Ramkrishna (CEO) | Chitra Ramkrishna (CEO) resigned 2.12.2016 |

| – | – | Ashok Chawla (Chairman wef 23.3.2016) | J Ravichandran (CEO in charge wef 2.12.2016) |

| Abhay Havaldar | Abhay Havaldar | Abhay Havaldar | Abhay Havaldar |

| S B Mainak | S B Mainak | – | Sunita Sharma |

| Y H Malegam (Chairman, NRC) | Y H Malegam (Chairman, NRC) | Y H Malegam (Chairman, NRC) till 23.3.2016 | Dinesh Kanabar wef 13.7.2016 Chairman NRC wef 1.8.2016) |

| K R S Murthy (member NRC) | K R S Murthy (member NRC) | Dharmishta Raval | Dharmishta Raval |

| Prakash Parthasarathy | Prakash Parthasarathy | Prakash Parthasarathy | Prakash Parthasarathy |

| Prof. S Sadagopan | Prof. S Sadagopan | Prof. S Sadagopan till 23.3.2016 | T V S Mohandas Pai wef 13.7.2016, member NRC wef 9.11.2016 |

| Justice B N Srikrishna (Retd) | Justice B N Srikrishna (Retd) | Justice B N Srikrishna (Retd) | Justice B N Srikrishna (Retd) (Member NRC ceased to be director from 2.8.2016) |

| Pratima M. Umarji (member NRC) | Pratima M. Umarji (member NRC) | – | Anshula Kant wef 19.10.2016 |

| – | – | – | Naved Masood wef 13.7.2016 |

If this is the standard of conduct of senior executives who are delegated to protect the interests of their companies, it raises questions for the public about how the parent companies themselves – the LIC, the SBI group and the Stock Holding Corporations – are being managed. Do their board directors also conduct themselves in a similar manner? The LIC is coming to the market for its initial public offering, and prospective shareholders and policyholders have a right to demand an explanation from LIC on the unprofessional conduct of its representatives on NSE in this period. Similarly, shareholders of SBI also should demand an explanation from SBI on the conduct of its officers when deputed as directors in other companies.

The role of shareholder directors of government-owned institutions in the NSE highlights a troubling issue that when they are on the board of prominent private sector companies they apparently abandon their own companies and are ready to align themselves and take instructions from the executive management of the private sector companies.

Also read: SEBI Bars Reliance Home Finance, Anil Ambani, 3 Others From Securities Market

A leading stock exchange like NSE is a systemically important institution as it serves an economic function and is the symbol of the free market. Any disruption in the NSE has a repercussion on the economy and the country and hence cannot be put on par with a disruption in a private sector company. It is on account of its strategic importance that prominent individuals are appointed as public interest directors to safeguard stakeholders. SEBI’s order exposing abysmal governance standards has reduced India’s highly successful stock exchange to an institution of ridicule.

While SEBI’s order has only indicted Chitra Ramkrishna, Ravi Narain and other non-board members, the rest of the board directors who colluded with the executive appear have got a clean chit. The public should examine these episodes carefully. The directors who represent government-owned institution interests may be willing to collude with an executive management and cover up illegal acts by deliberately not documenting important board discussions, but publicly lavish praise on a CEO who is allowed to resign for her misdeeds.

The conduct of public interest directors is equally shameful. They were selected as authorities in their respective professions to protect the public’s interest in NSE. They adorn many blue chip corporate boards, and have a history of being associated with regulators and the government. Yet their record at NSE, in my opinion, has rendered them unfit for being directors in any public and listed companies.

Hemindra Hazari is an independent banking analyst.