In the wake of the collapse of Silicon Valley Bank (SVB) in the United States of America on March 10, 2023, the United States Federal Reserve (Fed), on April 28, 2023, released its report on the review of the bank’s supervision and regulation.

The report is highly relevant in the Indian context and should serve as a template for the Reserve Bank of India (RBI) and other Indian regulators in its objectivity, lucidity and self-critical analysis. The report not only reveals the unusual causes of SVB’s failure, which have been documented in the media, but, most importantly, repeatedly highlights the failure of the Fed in not taking action sooner. It is also noteworthy that the Fed published its report a mere 49 days after the collapse of SVB.

The abruptness of SVB’s collapse caught all stakeholders, including the regulator and the financial market, by surprise. This was on account of the concentration of uninsured deposits and the high composition of securities classified as held-to-maturity. In earlier bank collapses where credit risk is the major cause, the deterioration in loans normally takes a longer time to impact equity capital, but when interest rates rise sharply and banks have a disproportionate number of securities as compared with loans on their balance sheets, the impact on equity capital is more immediate. The problem in SVB got compounded by the social media and the high concentration of deposits amongst a select group of customers, who collectively decided to pull out their deposits, precipitating a run on the bank. This is a lesson for banking regulators and bank management. In future collapses, on account of the electronic round-the-clock transfer of funds and social media, the time frame to implement remedies is much shorter.

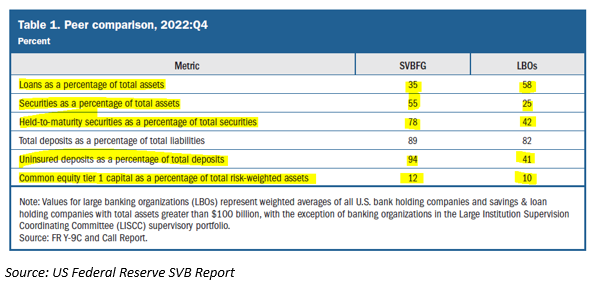

SVB Vs Peer Large Bank Organisations

In retrospect, it is also surprising that the regulator, the market and the credit rating agencies could not visualise the problems that SVB would face when interest rates rose sharply, given the bank’s excessive reliance on investments and concentration of uninsured deposits. The very facts in the table given above should have raised red flags. Pertinently, while the Fed noted some issues while examining SVB in 2022, it saw no smoking gun on these particular concerns.

An issue which the report has not examined, but which should be a major concern for all banking regulators, is the impact of a surge and contraction in liquidity mainly influenced by rapid decreases and increases in bench mark interest rates. It is on account of the sudden surge in liquidity that SVB’s deposits expanded exponentially, and these funds were deployed in securities which were highly sensitive to interest rate risk. The fact that the market value of Government securities would sharply decline as the Fed hiked rates was known; did the Fed carry out any exercise to assess the implications for bank balance sheets? According to the Federal Deposit Insurance Corporation (FDIC), as of end December 2022, US banks had around US$ 620 bn in unrealised losses on held-to-maturity and available-for-sale investments which “meaningfully reduced the reported equity capital of the banking industry.” The problem impacted the entire industry but was more severe for SVB given its customer profile and high concentration of investments.

Unpredictable global flows of capital create uncertainty and are linked to huge contraction and expansion of funds, exposing banks to greater volatility and risks. Banking regulators therefore need to take action or have back-up plans to mitigate such risks for banks. Moreover, every financial crisis has confirmed the fact that, in the expansionary phase, financial players tend to take all sorts of risks, and these have systemic impacts. In such macro cases, it is the responsibility of the central bank and not that of the capital market or the board of directors of banks to prevent bubbles and the subsequent busts from happening.

For those who have analysed regulatory reports in India, the candid Fed report highlighting the weaknesses in the Fed’s own regulatory oversight of SVB is surprising and refreshing. The report, right from the opening paragraph, is replete with self-critical comments on the Fed’s supervision of SVB.

And Federal Reserve supervisors failed to take forceful enough action, as detailed in the report.

SVB’s failure demonstrates that there are weaknesses in regulation and supervision that must be addressed. Regulatory standards for SVB were too low, the supervision of SVB did not work with sufficient force and urgency, and contagion from the firm’s failure posed systemic consequences not contemplated by the Federal Reserve’s tailoring framework.

Supervisors did not fully appreciate the extent of the vulnerabilities as Silicon Valley Bank grew in size and complexity

When supervisors did identify vulnerabilities, they did not take sufficient steps to ensure that Silicon Valley Bank fixed those problems quickly enough.

Such stinging remarks exposing regulatory oversight would be unheard of from the Indian banking regulator. Indeed, in the recent past, the RBI has presided over the self-inflicted disaster of demonetisation (2016), the spectacular collapse of IL&FS (2018) and Yes Bank (2020); but in none of these cases did the RBI release a review highlighting its own gross incompetence, which disrupted the financial system and harmed the economy.

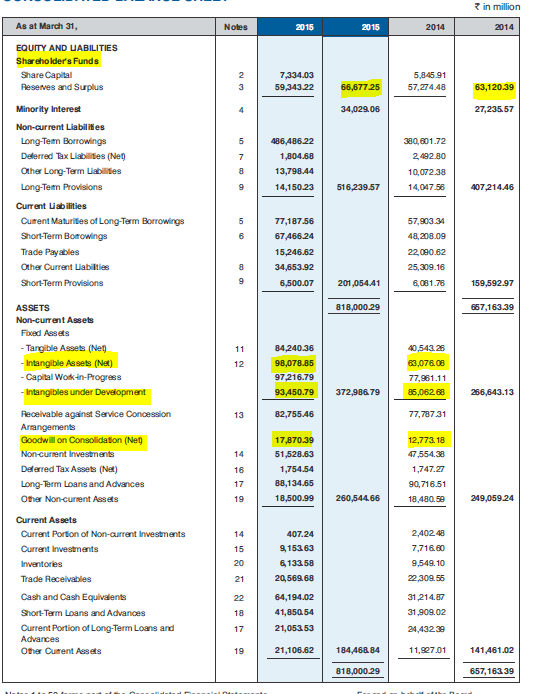

Events during and after demonetisation demonstrated to the public how poorly conceived and disastrously executed was the decision to remove Rs 500 and Rs 1,000 rupee notes from the public. In the case of IL&FS, a cursory glance at the company’s consolidated balance sheet in FY2015 (the first year consolidated accounts were published) would have revealed that the company had negative equity capital, after factoring for intangibles and goodwill (as per RBI norms) from FY2014; this kept getting worse till the company defaulted in mid-2018.

Consolidated Balance Sheet of IL&FS for FY2014 and FY2015

In the case of Yes Bank, the UBS sell-side analyst had highlighted the bank’s high-risk loans in a report in July 2015, and this analyst had regularly highlighted mismanagement in the bank since May 2017; yet the RBI finally acted only in September 2018, when it declined to renew the three-year term of Rana Kapoor (the founder-CEO) from February 1, 2019. In both IL&FS and Yes Bank, the RBI, which had access to non-public information, allowed both institutions to continue to grow their assets (thereby exposing the financial system to more risk), even when there was public information available that the institutions were inadequately capitalised for their high-risk assets. The shock to the financial system of their collapse was immense, yet the RBI maintained a studious silence on its abysmally poor oversight of these institutions.

The RBI regulates the system with little accountability regarding its own shortcomings, and there is a lack of transparency on its own role when financial calamities take place. In the case of demonetisation and the failures of IL&FS and Yes Bank, there is ample evidence that the RBI’s conduct required considerable improvement.

Michael S. Barr, the Vice Chairman of Supervision of the US Fed., concludes the report stating,

This report is a self-assessment, a critical part of prudent risk management, and what we ask the banks we supervise to do when they have a weakness. It is essential for strengthening our own supervision and regulation. We welcome external reviews of SVB’s failure, as well as congressional oversight, and we intend to take these into account as we make changes to our framework of bank supervision and regulation to ensure that the banking system remains strong and resilient.

The RBI and other regulatory agencies in India would do well to pay heed to these words, as for long they have operated in a system and culture where they are unaccountable for any failures. It is through such candid, self-critical reviews that the regulatory systems are strengthened, contributing to financial stability.

The Wire.in published this article which can be read here

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in Yes Bank. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.