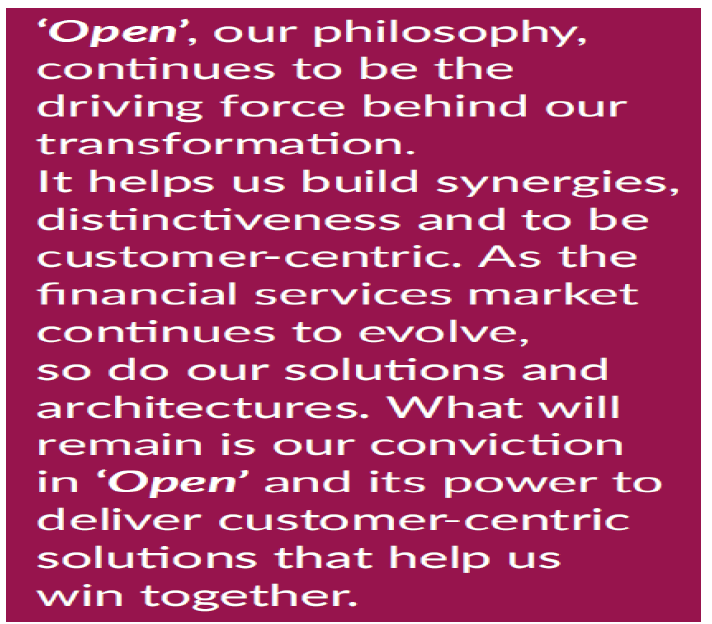

The overriding theme of Axis Bank’s FY2023 annual report (released on June 26, 2023) is “Open, to Win Together”. The catch phrase is reiterated ad nauseam throughout the report. “Open” stands for not only transparency but also inclusiveness: it is “Dil se Open”. “Together” includes its employees: Axis Bank cares for the “rounded wellness” of its employees, including their mental health. It carries out repeated surveys; it has enabled an Artificial Intelligence (AI) bot to have “HR [Human Resources] conversations” with them; and it employs professional counsellors to support them at times of stress (600 have been counselled, and another 1,247 are waiting in queue for counselling).

Extract of ‘Open’ Theme in Axis Bank’s FY2023 Annual Report

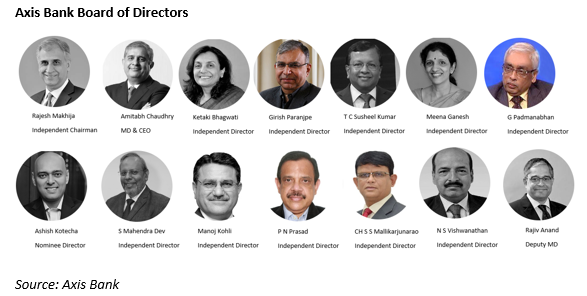

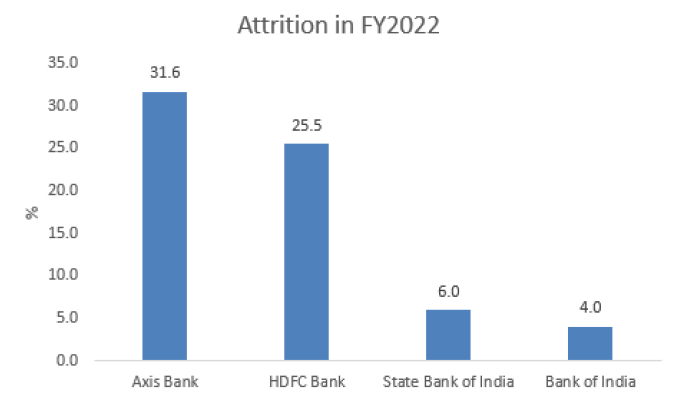

It is a pity, then, that in this year of ‘Openness’, Axis Bank has actually reduced the information it earlier provided regarding employee attrition and declined to respond to queries on the subject. And in this year of ‘Togetherness’, more than a third of its employees have exited, a significant rise over FY2022. The Axis Bank board of directors, boasts of former senior executives of the Reserve Bank of India (RBI) as well as a nominee of Bain Capital; moreover, a majority of board members declare a specialisation precisely in human resources management. Nevertheless, the board hardly mentions this massive annual exodus in its annual report, and chooses to remain silent on it causes.

As for the third element in the new slogan, “Winning”, Axis Bank has no doubt won the prize for customer complaints in banks (as discussed in my article), and perhaps it has done so for staff attrition as well.

The annual report talks of the pivotal role of employees in achieving the bank’s long term goals, and boasts that its policies focus on the “rounded wellness” of its staff.

Given such public displays of devotion to employee welfare, one would expect the 91,898 permanent staff of Axis Bank to display loyalty to their employer. However, similar tall claims regarding customer satisfaction made in the bank’s FY2022 annual report later proved illusory, as Axis Bank emerged the private sector market leader in customer complaints.

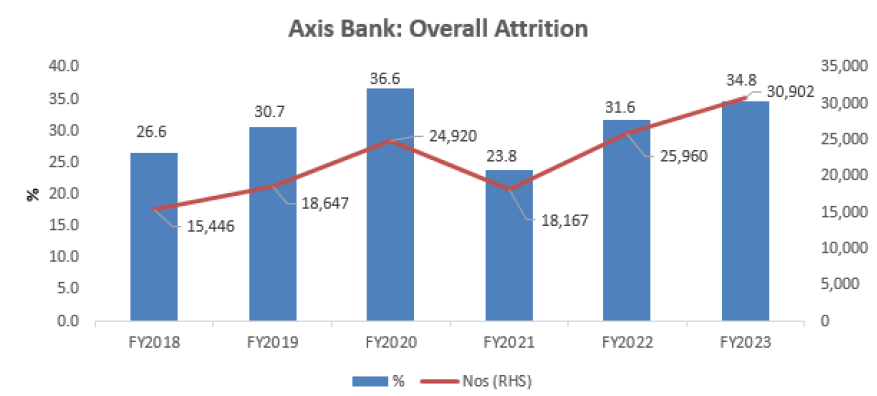

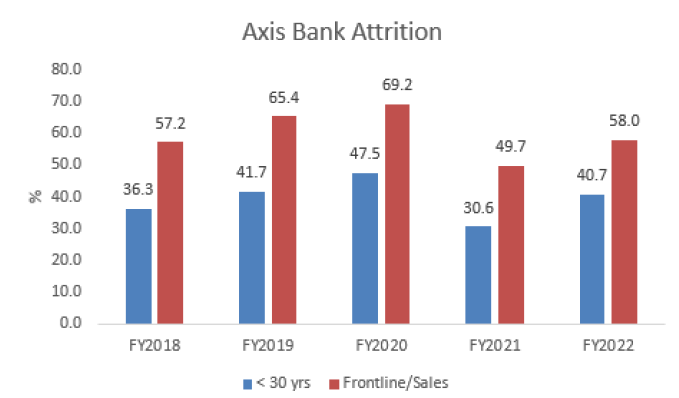

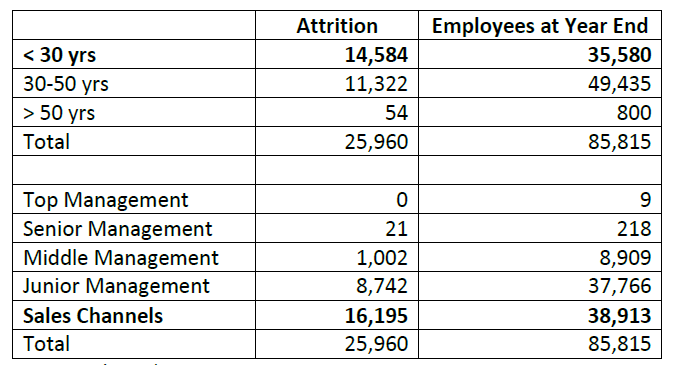

Similarly, data in the bank’s FY2023 annual report disclose that, far from displaying loyalty, Axis staff continued to leave in droves during the year. Indeed, staff attrition increased to 34.8% in FY2023 from 31.6% in FY2022. The fact that more than a third (30,902) of the workforce exited in FY2023, up from 25,960 in FY2022, provides the real picture of the bank’s public commitment to its labour force. This will have an adverse and consequential impact on customer service and banking operations. Collectively, in the last three years, 75,029 staff have exited (voluntarily and involuntarily). That is as much as 81% of its headcount in FY2023 and 96% of its headcount in FY2021. The bank’s attrition percentage in FY2023 is its second highest since FY2018. With record customer complaints in FY2022 and such a high churn in staff, which will be mainly at the entry and mid-management level, the bank’s entire retail strategy maybe in peril.

Source: Axis Bank

In its annual report, the bank also discusses its commitment to its female staff, and how its objective is to reach 30% female representation by FY2027, from 26% in FY2023 and a targeted 27% during FY2024. It is noteworthy that Axis Bank plans to gradually increase female participation in its work force.

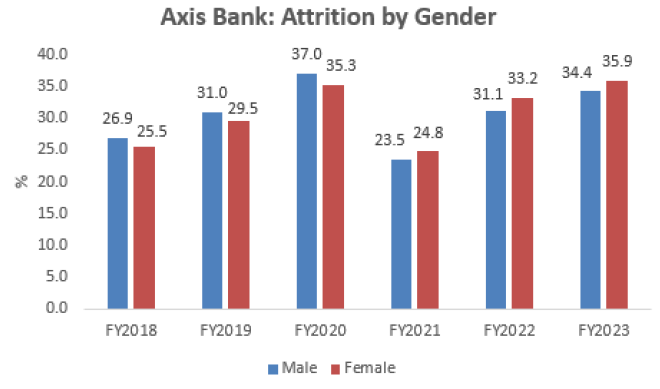

What is less noteworthy is that in the last 3 years, female staff attrition has been higher than male attrition. Apparently, women employees, for whatever reason, do not feel happy at Axis Bank. Female attrition in percentage terms is the highest since FY2018.

Source: Axis Bank

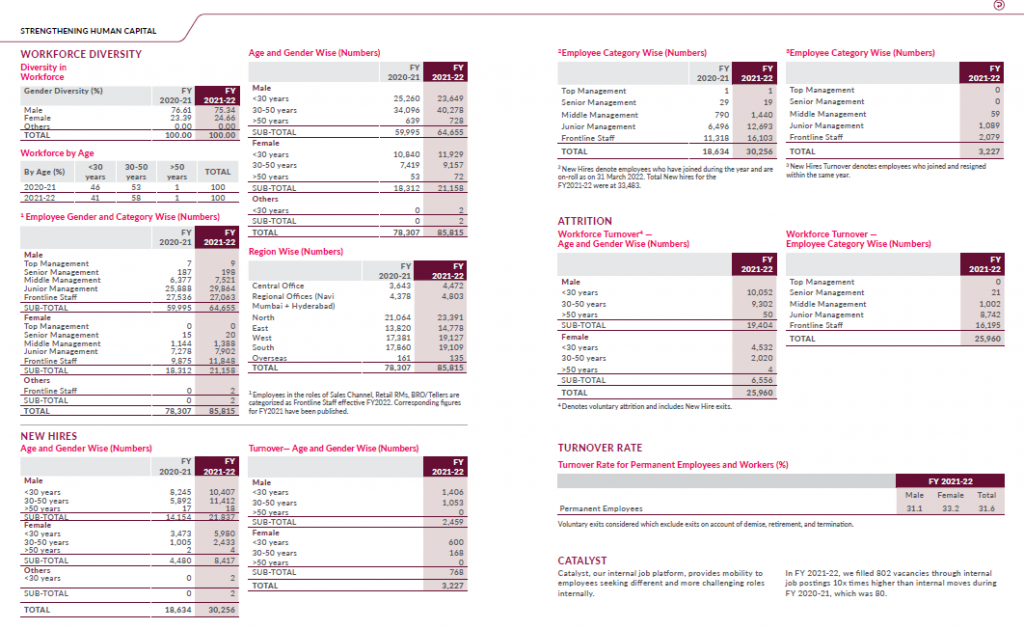

From FY2018 till FY2022, Axis Bank was an industry leader in voluntarily disclosing data on employees and attrition, which was highly commendable. Stakeholders could compute attrition in various categories by age bucket, management cadre, gender and even in new hires. The extensive data provided a comprehensive analysis on employee attrition across various segments in the bank.

Extract on Employees and Attrition in Axis Bank’s FY2022 Sustainability Report

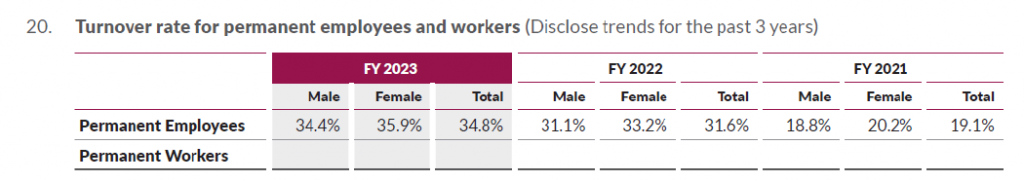

Disclosure on Attrition in Axis Bank’s FY2023 Annual Report

Source: Axis Bank FY2023 Annual Report p. 179

From FY2023, the Securities and Exchange Board of India (SEBI) had made it mandatory for companies to disclose attrition in the annual report, and this analyst had hoped that Axis Bank would continue to furnish such comprehensive information. This would also provide valuable insights into the bank’s attrition. Unfortunately, the Axis Bank board of directors took a decision to conform only to the bare regulatory minimum, and drastically withheld information which was earlier disclosed. As a result, stakeholders are in the dark on attrition in the various categories especially at the lowest age (less than 30 years of age) bracket and in frontline sales, which in FY2022 was an alarming 41% and 58% respectively. It is possible, given the overall rise in attrition in FY2023, that the attrition in these segments was even higher as compared with FY2022.

Source: Axis Bank

Axis Bank Attrition by Age and Management Category in FY2022

Axis Bank’s historically high attrition in the less than 30 years and sales/frontline category indicates a deep-rooted problem. The under-30 years and sales groups form the majority of attrition in their respective age and management categories, and therefore the overall numbers are substantial. As both categories are populated by youngsters, there is a recruitment and training cost for the bank, which becomes an investment if they continue to be in the bank for some years. But when attrition is so high, the costs become an expense, as freshers normally take around 9 months to break even for the bank. The consistently high attrition in these categories indicates a combination of poor selection practices by the bank’s recruitment team, inadequate training and a stressful work culture. When attrition regularly exceeds 30-40% in these categories, the bank has a major human resource management issue which the board of directors has failed to address.

With attrition getting worse in Axis Bank, the lack of data which the bank earlier voluntarily disclosed is worrying. But further, there is also lack of in-depth management discussion on attrition. The only significant reference to attrition is the following:

“In an effort to control attrition at various levels, the Bank introduced a KRA [Key Result/Responsibility Areas] focused on team retention for all AVP [Assistant Vice-President] and above team leaders with a team size of more than 4. So far, the same has been implemented across more than 90% leaders.” (p. 134 Axis Bank FY2023 Annual Report)

Stakeholders are also informed that one of the seven observations and actions taken by the board of the bank’s performance evaluation for FY2022 was “oversight on actionables relating to attrition and customer complaints.” (p. 156 Axis Bank FY2023 Annual Report)

It is heartening to know that this mass exodus has not entirely escaped the board’s notice. However, these statements do not tell us anything about the causes of attrition. They do not acknowledge the fact that attrition has been rising in the last 3 years, or that more than a third of the workforce jumped ship in the year. The board’s remedial measures, such as they are, also do not appear to be working: attrition actually rose during the year.

Axis Bank stakeholders are in the dark on attrition; is it rising because it is an industry phenomenon, or is there something unique to Axis Bank such as poor selection for roles, inadequate resources to meet over ambitious sales targets, long working hours, low remunerations, inappropriate training despite the bank on average providing 87 hours per employee and a toxic work culture? Consequently, what additional steps is the board of directors taking to address this important issue? Recall that M.K. Jain, the then Deputy Governor, RBI addressed the boards of directors of banks on May 31, 2023, pointedly stating,

“… there is operational risk due to various factors such as high attrition, lack of succession planning, skilling of staff, outsourcing, etc.

(i) Attrition and high employee turnover lead to loss of institutional knowledge, disruption in services and increased recruitment costs…”

The Axis Bank board of directors which at present includes a former RBI deputy governor (to be appointed as chairman of the board on October 27, 2023) and an ex-RBI executive director, needs to devote more efforts to addressing the phenomenon of rising attrition. The directors also need to be more transparent in educating stakeholders on why the current measures have proved inadequate, and what further specific measures are being considered to address the issue. The apathy of the 13-member FY2023 board with regard to attrition is particularly surprising, as eight of the directors (an overwhelming majority of the board) declared a specialisation in human resources management (p. 141-142 FY2023 annual report).

One factor that needs exploration is whether the measures on which the Axis Bank management relies – surveys, bots, counselling – provide employees a channel of communication and representation of their grievances. Traditionally, trade unions used to provide such a channel, and they were institutionalised in the public sector banks. While there may have been some negative features to trade unionism, the private sector banks may have thrown the baby out with the bathwater by effectively banning them. In the absence of employee representation, the only way employees can express their grievances is by voting with their feet. This problem afflicts all the private sector banks, even if Axis Bank seems to be the champion in this category.

Source: Banks

The apparent lack of attention by the Axis Bank board to attrition has ominous implications; either they are aware, but despite RBI concerns, they are relatively unworried; or they are fully aware, but are deliberately withholding public discussion to avoid censure and negative publicity.

Sadly, in the recent past, this analyst has had to document major contradictions between Axis Bank’s public commentary and the facts in the public domain. In its FY2022 and FY2023 annual reports, the Bank commented on how it aspires to be “number 1” in customer satisfaction, while withholding the information to stakeholders that Axis Bank was the private sector market leader in customer complaints in FY2022 (latest industry data). In the case of attrition, its FY2023 commentary highlights the importance of employees and their wellbeing, but fails to discuss why attrition has been consistently rising in the last 3 years.

As Axis Bank publicly claims it has impressive tools to monitor employee wellbeing, such as repeated HR surveys, AI bots to engage in HR conversations and professional counsellors to alleviate stress, finding out the causes for rising attrition should not be difficult. As rising attrition results in disruption, customer dissatisfaction and higher staff costs of hiring and training, the causes should be disclosed. At the bank’s annual general meeting scheduled for July 28, 2023, shareholders must demand an explanation from the board of directors.

Even as Axis Bank keeps reaffirming openness in its FY2023 annual report, when this analyst specifically sends queries to the bank on customer complaints and attrition, the bank declines to respond. While the bank publicly claims to welcome one and all, customers are filing record complaints, and staff are rushing to the exit door. When a bank makes tall claims in its annual report which are challenged by data in its own disclosures, it undermines confidence in the bank and its board of directors.

Note: This analyst had emailed Axis Bank with detailed queries on 28th June and also sent a reminder on 3rd July that the queries remain unanswered. The Bank has declined to respond

This article was also published in The Wire and can be read here

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in banks mentioned in this note. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

www.hemindrahazari.com

All rights reserved. No portion of this article may be reproduced in any form without permission from the author. For permissions contact: